Alcohol duty reforms don’t come round very often – in fact every 140 years or so according to the Chancellor Rishi Sunak as he announced his radical plans for a “fairer” system going forward. Here is what we can expect from future alcohol duty rates.

The UK’s alcohol duty system is being ripped up in a bid by the Chancellor Rishi Sunak to make it “simpler, fairer and healthier”. The move comes as he also pledged to freeze all alcohol duties across beers, wines and spirits in the Budget announced in the House of Commons today.

Today’s Chancellor statement, however, was full of headlines and pledges but not exact details of what the reforms will be in actual facts and figure. The Buyer has since been able to access some of the figures and proposals that are laid out in the Treasury’s consultation document that is going out to the drinks industry about what some of these new duty rates will be and just how much they live up to the Chancellor’s pledge to make alcohol duty “simpler, fairer and healthier” in practice.

As the industry begins to unpick the figures there are already suggestions the new reforms are anything but “simpler” or “fairer”. The Wine & Spirit Trade Association has revealed this afternoon that the proposed duty on a still bottle of 750ml wine at 15% will remain at £2.33 until February 2023 but with the new duty regime in place would go up to £2.91 (+68p) (+82p including VAT). See below for its full response.

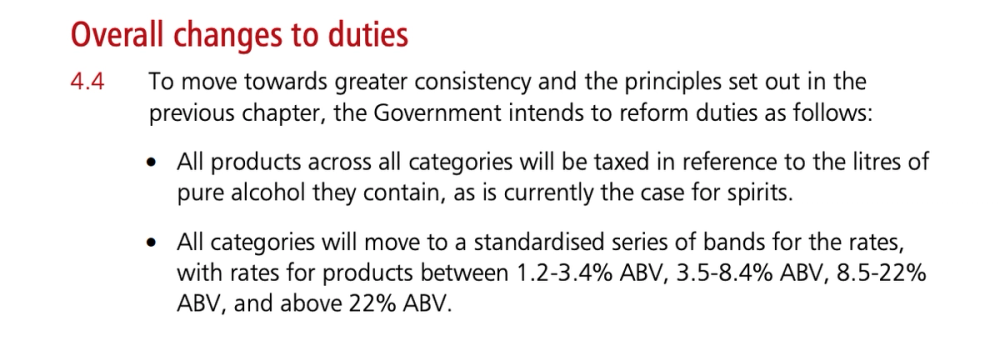

The reason the previous system was so complex was because there are so many different types of alcohol, so ripping it up and starting again requires more than just five minutes of pledges at the Dispatch Box in the House of Commons. What is clear is the number of duty rates are being cut from 15 to six and any changes won’t come into force until February 2023.

Treasury documents explaining the Budget policies suggest the alcohol reforms could see it lose out in revenues of £20m in 2022-23, £115m in 2024, £125m in 2025, £140m in 2026 and £155m in £2027.

Chancellor Rishi Sunak announces the duty freeze in today’s Budget

So what are the headlines in the Chancellor’s new alcohol reform strategy? Here are the key points to know, or at least as much as we know to date. More details to follow:

- New five step alcohol reform strategy to come into force in February 2023.

- New system based on a “fairer” process where a product’s alcohol duty will be based on its alcoholic strength. The higher the ABV, the bigger duty rate charged was the Chancellor’s key message.

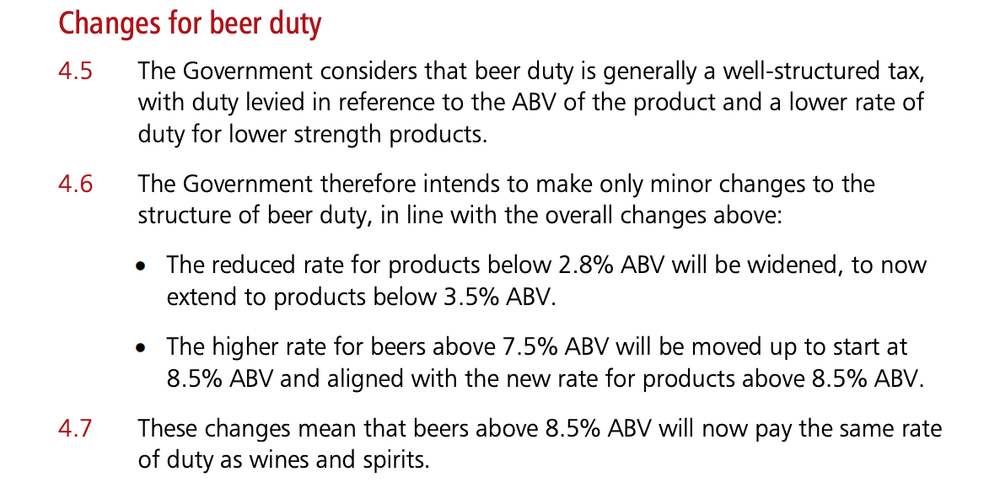

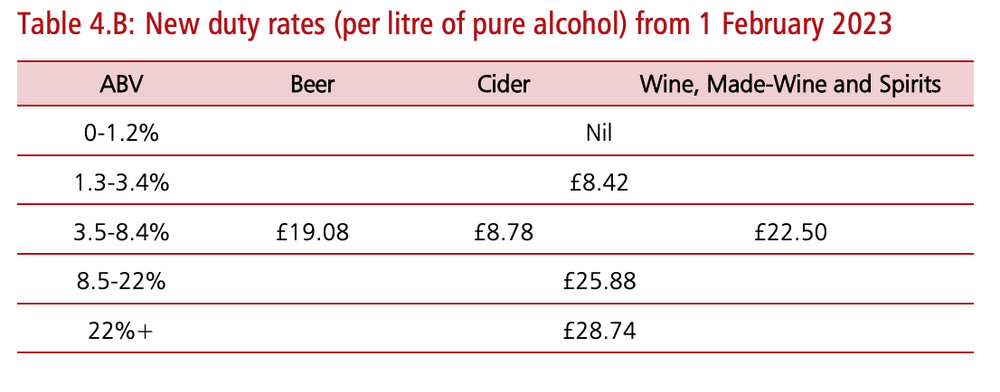

NB: Overall alcohol reforms: From the consultation document The Buyer has seen the Treasury is proposing these rates

NB: IT also includes: “For the 8.5-22% ABV and above 22% ABV bands, all products across all categories will pay the same rate of duty.”

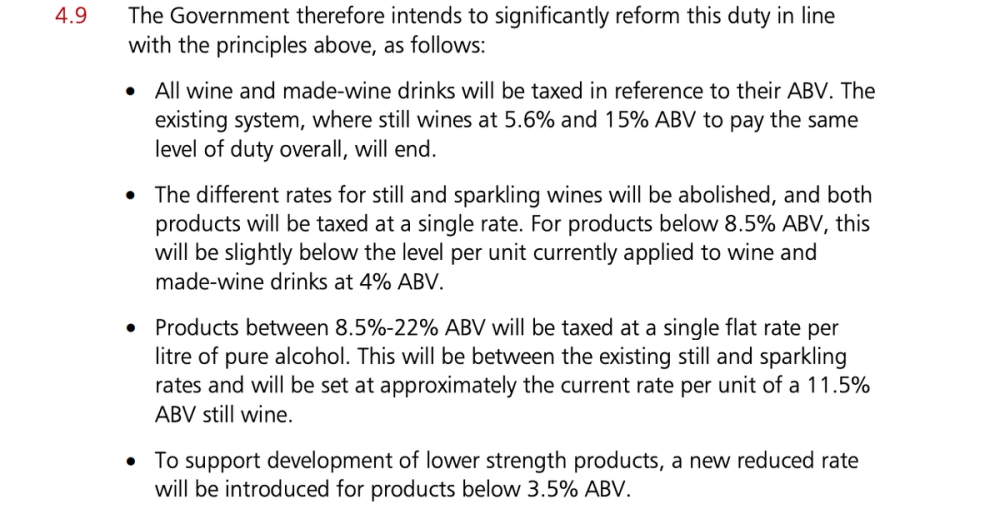

- All sparkling wines to have same the same duty rate as still wines. This is potentially the biggest shake up of them all and removes the so called super tax of 28% duty rates on sparkling wine and is a massive boost to the English and UK wine industry’s growing sparkling wine industry.

- WineGB said it was having a briefing with the Treasury this afternoon to better understand what this might mean in practice.

NB: Future Wine duty rates: From the consultation document The Buyer has seen the Treasury is proposing the below:

Other measures announced in the Budget:

- A new boost to fruit cider sector as its duty rate is to be cut by 5% to bring it in line with apple ciders.

- A relief package will be offered to smaller drinks producers that produce drinks below 8.5% to promote the craft drinks sector.

- A “draught relief”, cutting the tax on drinks served from pumps, such as beer and cider, by 5%. The plan, which is estimated to cost the Treasury £100m a year, will reduce the cost of a pint of beer by 3p.

- Chancellor pledged these cuts were not just for this Budget but part of a long term strategy to make a duty system that was “simpler fairer and healthier”.

NB: The consultation document from the Treasury’s consultation document states this is the proposals for beer:

The Treasury also presents this chart in the consultation document as to what all the duty rates together might look like

Freezing Duty Rates

Of more immediate interest to the drinks industry was the Chancellor’s decision to “cancel” – or in real terms- freeze all duty increases across the board on beers, wines and spirits. Although this was expected the fact it comes alongside such a shake up in duty reforms gives hope about the government’s attitude to duty increases – which is a far cry from when above inflation rises became the norm.

The Chancellor also announced a one year 50% discount for business rates for retail, hospitality and leisure to reflect the hit they have all taken by the pandemic.

Shares prices in pub companies jumped on the back of the Budget with JD Wetherspoons up nearly 6%, Marstons by 6%, Mitchells & Butlers by 3.8% and City Pub Group 2.3%.

Industry Reaction

The WSTA’s Miles Beale said the duty freeze will come as a “huge relief” to both business and consumers.

The drinks industry response to the Chancellor’s announcements is led by the Wine & Spirit Trade Association, Miles Beale, the WSTA’s chief executive, said:

“The decision to freeze wine and spirit duty comes as a huge relief to British businesses, the hospitality sector – including its supply chain – and consumers, giving everyone a much-needed break to help them recover from the pandemic. Chancellor Rishi Sunak should be commended for listening to our calls for support and understanding that punishing tax hikes are not the best way to reinvigorate the sector. By offering continued respite to the UK wine and spirit sector his actions will help save jobs and – in time – replenish revenues to the Treasury through growth in our potential-filled sector.

“We welcome the reduction of the sparkling wine super tax, which is long overdue. However, while simpler the proposals for the overhaul of a new alcohol taxation system does not make the regime fairer, which was a fundamental aim of the review. We are mystified by a proposal that embeds unfairness between products meaning that beer will be taxed between 8p -19p per unit, wine increases to 26p per unit and spirits remains at 29p per unit. We look forward to seeing the detail of a new system which should remove the existing unfairness of how different products are treated.”

The WSTA estimates the following changes to duty under the proposed rates

- Duty on a 750ml bottle of still wine at 12% remains at £2.23 until February 2023, if the new duty rates go ahead duty will go up to £2.33 (+10p) (which goes up to12p on the sales price when you include VAT).

- Duty on a 750ml bottle of still wine at 15% will remain at £2.33 until February 2023 when the duty rate will go up to £2.91 (+68p) (+82p including VAT).

- Duty on a 750ml bottle of sparkling at 12% remains at £2.86 until February 2023 when it will go down to £2.33 (-53p)(-64P inc VAT).

- Duty on a 750ml bottle of fortified wine at 17% remains at £2.98 until February 2023 when it will go up to £3.30 (+32) (+38p inc VAT).

- Duty on a 70cl bottle of vodka at 37.5% remains at £7.54 and will remain unchanged.

- Duty on a 70cl bottle of gin at 40% remains at £8.05 and will remain unchanged.

Kate Nichols, chief executive of the UK Hospitality, said: “We have been lobbying hard for significant reform of the outdated business rates system and therefore very much welcome the Chancellor’s move today to extend the 50% business rates relief for the hospitality and leisure sector for the next financial year. The devil will be in the detail, though, so we look forward to learning to what extent it will benefit businesses.

UK Hospitality’s Kate Nicholls welcomes the business rates move but would still like the government to go further on VAT

“The Chancellor’s announcements simplifying – and in many cases reducing – alcohol duties, are great news for pubs, bars and restaurants, and will benefit all. The Chancellor has shown real innovation and creativity in reforming an archaic system of duty, which we applaud.

“Positive as these announcements are, hospitality remains incredibly fragile, facing myriad critical issues. Rising utility bills, wage bills and food and drink prices have resulted in 13% inflationary costs that businesses are having to absorb at the same time as they navigate severe supply chain issues and chronic staff shortages. Given this toxic cocktail, it is imperative the Government go further to support businesses in our sector.

“The most effective way to achieve this would be to maintain the current lower 12.5% of VAT for the sector. The Chancellor has been bold and radical with alcohol duty – we urge him to adopt the same approach when implementing root and branch reform of business rates, to ensure industries share the burden equally.”

Kingsland Drinks’ Ed Baker welcomed the Chancellor’s duty freeze

Ed Baker, managing director at Kingsland Drinks Group, said: “We wholeheartedly welcome cancelling the predicted rise in alcohol duty rates – it will certainly go some way in boosting the industry’s ability to recover in the toughest trading conditions in recent history. We also welcome the breaks afforded to the hospitality, leisure and retail industries; they have borne the brunt of the pandemic and Brexit in many ways and continue to do so. This decision will prove crucial as the industry recovers. Inflationary pressures relating to supply chains, the price of energy and the cost of living will have to be fed through into the prices that people pay. The Chancellor’s decision to overhaul duty rates addresses a longer-standing need for fairer taxation across the alcohol industry, but the detail as to how this will impact individual sectors in practice remains to be seen.

Simon Thorpe MW, chief executive of WineGB said: “We are delighted by the government’s decision to equalise the duty between sparkling and still wines. This reform will have direct benefit to English and Welsh sparkling wine which accounts for some two-thirds of Britain’s annual production and will undoubtedly help to underpin our ongoing growth as one of the UK’s most exciting ad fast-growing agricultural sectors. It will help us to develop wine tourism, employment and R&D initiatives and build towards a long term economically sustainable industry.We also applaud the decision to freeze duty on wine and other alcoholic drinks – another boost for wine lovers.”

WineGB believes the move to level up sparkling wine and still wine duty rates will save 63p on every bottle of sparkling wine and “provide a direct benefit to English and Welsh sparkling wine which accounts for some two-thirds of Britain’s annual production”. It said it also ends “the irrational duty premium of 28% currently paid” on bubbles over still wine of a similar or equivalent alcohol level.

- More industry reaction to follow.

- Click here to see the full Treasury consultation document on alcohol reform. The consultation is open to January 30 2022.