The Buyer’s latest Digital Hub reflects just how fast the digital world is changing and why there is so much for drinks brands and retailers to learn from what is happening in other sectors.

Now developing a new app is hardly breakthrough technology, but Apple’s announcement this month it is launching its own Fitness apps and range of services is worth all our attention.

For at a stroke Apple has taken a giant step towards really fulfilling its goal of “empowering us all” and using technology to make our lives easier – and in this case healthier.

Our smartphones may already be full of health and fitness apps, but even if we use them every day, they don’t go much beyond just telling us what our step count and heart rate is. They certainly then don’t come back and develop a new smartphone or iPad that is built on the behavioural understanding of tracking millions of people fitness habits and routines.

Apple Fitness+ allows users to download and watch 100s of different workouts, all personalised to your own fitness level, that you can watch on any smart device you have. You can even link it up to Apple Music and listen to specially curated playlists, or create one of your own, to go with the fitness routine you have chosen. Or download a show from Apple TV to watch whilst you build up a sweat.

Whole new level

In so doing it is taking Apple into a whole new area of our lives and giving it the ability to understand – through the emotional connection of fitness – so much more about how we behave and what drives and motivates us.

Knowledge that will no doubt help it in its other mission of “bringing the best user experience to its customers through its innovative hardware, software, and services”.

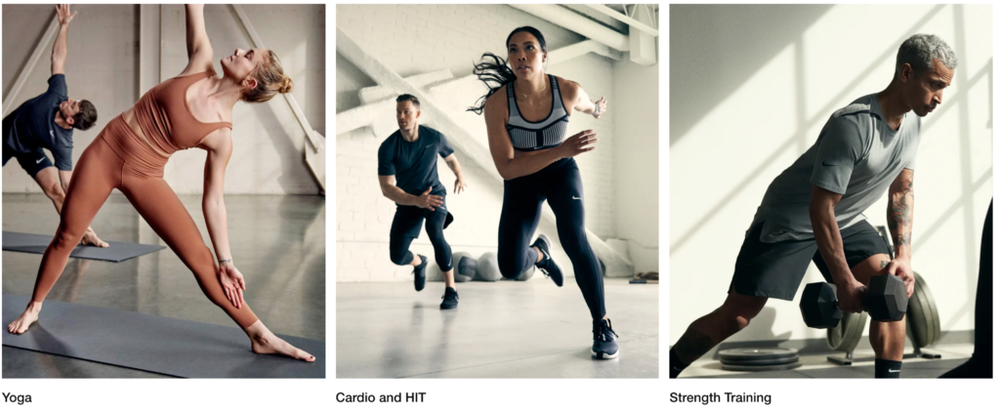

It’s also playing catching up with major sports and fitness brands like Nike. It has quietly during lockdown, when there are a lot less people going into its stores, being pushing as many of its customers as it can over to downloading specially created apps that help it better understand the way they shop and the kinds of products, services and activities they are interested in.

As well as its main Nike shopping app, it has also developed the Nike Train Club and Nike Run Club that allow it to build a much closer relationship with their customers than simply selling them a pair of training shoes.

It allows it to both collect data on what types of activities its customers are most interested in and then use that data to promote the most relevant products to them.

Nike wants to become part of your fitness regime and help you get to the goals you set…which is all part of its “brand deep connection to its consumers”

It’s all part of what Nike’s chief executive calls its mission to have a “brand deep connection to its consumers”.

The granular data it can get from customers downloading a variety of different health and fitness apps will help Nike take that “brand deep connection” to another level.

“What we are doing is obsessing over the consumer journey across the board,” is what Heidi O’Neill, Nike’s president of consumer and marketplace told Modern Retail this summer. “We are creating connected experiences and journeys when we see a consumer interested in yoga, and connecting them to our yoga apparel.”

Focused marketing

Its targeted apps strategy also means it can save itself a lot of money on digital advertising. Analysts were told as part of its latest investor briefing that it is now able to spend far less on digital ads trying to attract new customers, by using its app data to get existing customers to spend more.

By “lowering its customer acquisition costs” it can drive up its bottom line through increasing “return on spend of existing customers”. ,

Certainly lessons for anyone in the drinks industry who has taken the trouble to develop an app. What value is it bringing you outside of driving sales or customers to your main sales platform? What data are you able to take from it and what does it show you?

The likes of Apple and Nike effectively see apps as owning their own TV media channels or film companies where they can broadcast direct to an engaged consumer, and then assess analyse and learn from how they respond to that content.

The drinks industry can learn a lot from how Apple and other big retail brands are using different lifestyle platforms to understand their customers better as well as expand their brands

Personal services

We hear a lot about personalisation, but now much about how you actually achieve it? Using apps in this way to segment and separate different consumers through the services and content they choose to download and look at can go a long way to achieving that.

Yes we know different customers and age groups have different ‘needs’ and ‘wants’ from the products they buy, but it is so hard to really get your hands on hard data and research that shows you want those ‘needs’ and ‘wants’ are. The likes of Nike and Apple clearly see carefully designed and curated apps as being fundamental to not just their digital strategy, but then how it then informs and educates them about the kind of products, services and experience they need to be offering those customers when they come into their stores.

Online and high street retailing really working together in ways we have not seen to this level before.

Nike is already using augmented reality and other ‘smart’ interactive tools to give its customers virtual experiences when they come to its stores. From virtually trying on shoes and going for runs through virtual reality landscapes. Its whole store strategy is based around on the customer – or user – experience and finding ever more innovative ways to make going to a shop an exciting thing to do in itself.

Oh, and if you did not know Apple’s chief executive, Tim Cook also happens to sit on Nike’s board. It hardly seems fair does it?

Why DTC is such an opportunity for brands – providing they invest in getting it right

Week by week we see more wine and spirit brands open up their own direct to consumer websites. Some are more subtle about it than others.

For whilst there are wine businesses like Gigglewater and MindMap Wines that are proud and bullish about why they are going DTC, there are arguably far more that are, shall we say, a bit more circumspect about it. Happy to talk about what they are doing with the trade partners, but strangely quiet about the fact they have a full blown DTC sites working away quietly behind the scenes for that that find it.

Often with new drinks launches these days it’s what they don’t tell you about their distribution and sales strategy that’s often the interesting bit.

Try it out. Go to a top selling drinks brand website and search around down at the button of the home page and often you will come across a ‘Shop’ section which reveals a fully functioning DTC platform quietly running away.

New research from Astound Commerce explains why brands are increasingly going DTC, whether they want to tell us about it or not. It has found that 55% of shoppers prefer to shop directly on a brand’s site over a retailer’s. It also reveals 54% of shoppers will go direct to a brand or producer’s site for more comprehensive product information, and to find other services, like gift and personalisation options.

This also plays into research that shows up to 75% of online shoppers will go online to do research about products and services they want to buy and that given the choice 90% would actually like to do it on the same site as they then go on to make a purchase.

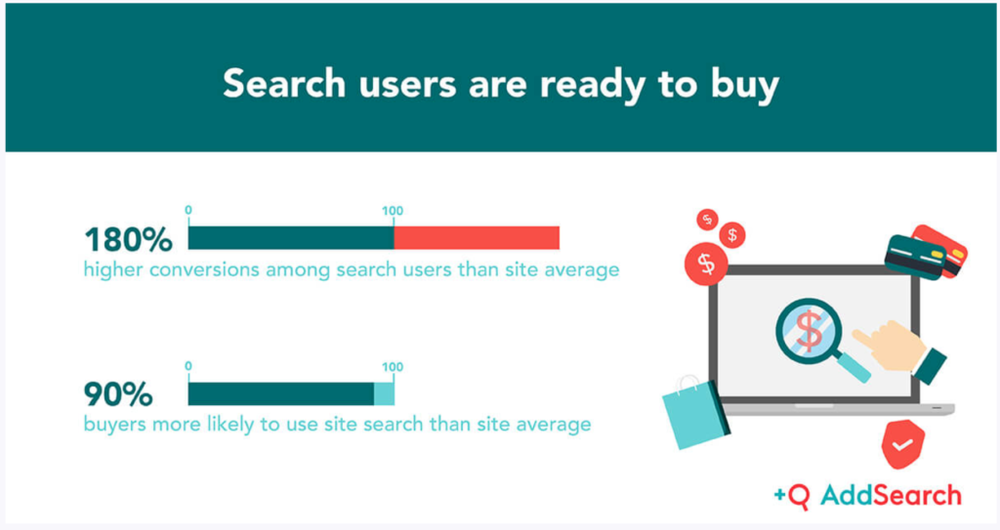

EConsultancy says those who come to your site following an online product search are amongst the best customers to have as they have “buying intent” and are in the “late stages” of pressing the ‘Buy’ button.

Forrester claims 15% people who use site search account for 45% of your e-commerce revenue and result in 180% more conversions among ‘search users’ than average.

Which is good news for those online players that have good enough content and search functionality to make them a one stop stop shop for a shopper looking to buy a specific type of item online. Less so if you run a purely transactional site and are not on top of your SEO. Forrester also says 68% of users will not go back to a site that has bad search capability.

Astound Commerce also claims 73% of consumers prefer to use a brand or producer’s site for on-going support and added information rather than have to go to other channels like social media, SMS and live chat.

All about search and support

All of which means the best DTC and brand sites now, and in the future, are the ones that not only make it easier for people to buy what they want through a quick one effective user journey experience, but also have the right content and support to keep them there for as long as they want.

So rather than have to call up a support centre, 84% of people, according to Parature would rather the site they bought the product from could provide it with the answers through their own internal search function. As soon as they have to ring up and ask for help, the likelihood of them having a bad experience rises enormously.

Can anyone help me? Best DTC sites are brilliant at support as much as they are selling products

So if you are investing in DTC, make sure you also invest in the support services you will need to keep customers happy. Which means gong a bit further than having a FAQ section.

So work through the problems that customers might have on your site and then provide practical ‘How To’ guides for them to follow. Anything that helps them not to have to pick up the phone. The trick is here to use examples that your customers are likely to use, their natural language, rather than trade jargon or wine terms. If you are going to use focus groups then use them to work out the search terms that customers use to buy wine or spirits.

It’s also worth noting evidence from Statista that says more than 97% of consumers will bounce from a website without making a purchase, however, often because they can’t get answers to basic questions — not because a competitive ad distracted them.