It’s one thing investing in consumer insights, it’s quite another to know how to use them to power your business forward. Concha y Toro’s strategy to base its wine and brand developments on what its target consumers are looking for appears to be giving them the edge in the highly competitive premium branded wine category.

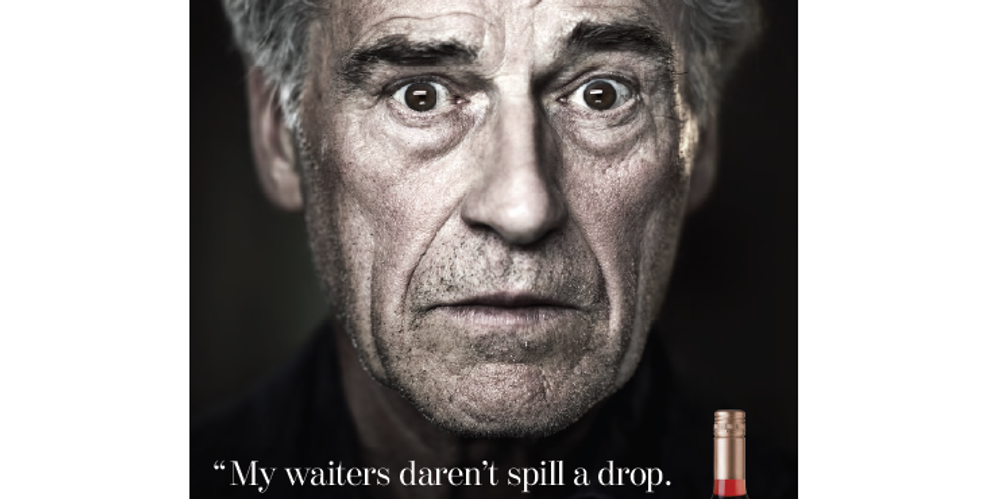

Attention grabbing, high profile, daring advertising has been part of CYT’s strategy to make Casillero del Diablo its leading brand

In just over a decade writing professionally about wine I can genuinely think on (a very small) handful of times that I have attended an industry event hosted by a major wine company that was genuinely focused on looking primarily at changing shopper behaviour and its likely impact on the future of the overall wine category.

In the vast majority of cases the theme of the event starts and stops with the wine in question. Where it has been made, the soils, the terroir and the unique growing and climate conditions that makes this wine so different from the rest. Then there is the who factor. Who has the wine been made by, the winemaker and their esteemed credentials.

What’s more it is not always obvious what the actual reason for holding the event is. Other than to celebrate a new vintage, a change in the label design, a different font size perhaps based on new regulation changes in the region where the wine comes from. It might be the fact that the wine producer in question has just invested a huge amount in a new winery, or brought another big name producer into their fold.

The words “consumer” or “shopper” or “insights” or even “behaviour” are as rare as the humility on show.

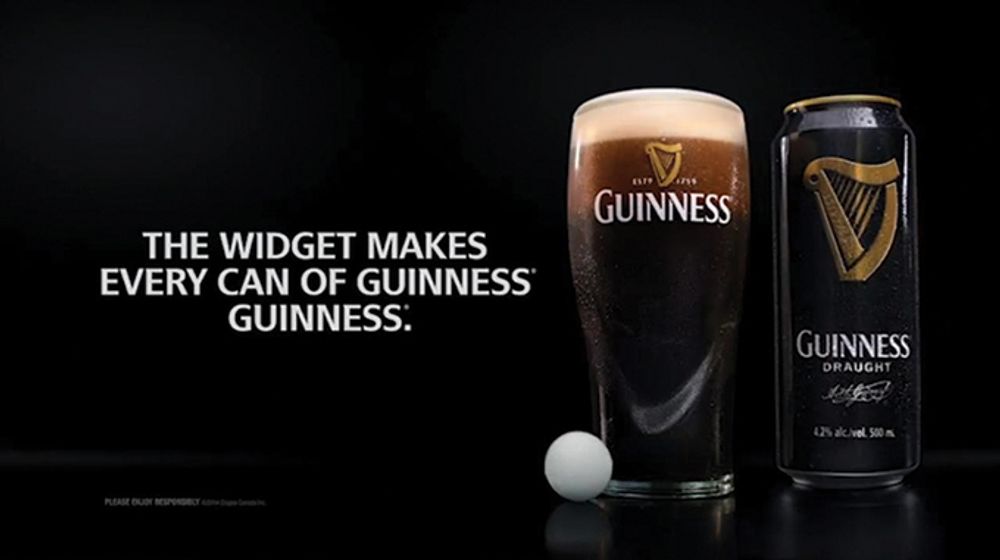

Now compare that to the average launch event of a major FMCG, household grocery brand. In my former life, before wine, I also had the privilege of sitting through many presentations for all sorts of new products be it the first chilled ready meal, twin pack Mars bar, the upside down ketchup bottle or the gas widget in a beer can.

Big grocery brand launches are usually about serving a consumer need but how often are they in wine?

Those launches also followed the same pattern. Half an hour of mind blowing facts about how shoppers are changing, how we’re all living our lives faster, the advent of dashboard dining, the need to satisfy the cash rich, time poor consumer. All leading inevitably to the great reveal. Whatever new product it was it’s goal was to meet the needs of this new demanding changing shopper.

Category leading insights

These sorts of events in the wine industry come along as rarely as a declared Port vintage. Probably because there are only a tiny handful of global wine companies seemingly capable, or willing, to hold such an event. We’re talking your Constellations, your Accolade Wines, Treasury Wine Estates or Gallos. Then there is Concha y Toro.

It’s not just leading Chile’s wine sector, it’s driving a path for the rest of the global wine industry when it comes to consumer insights. Earlier this month it hosted the latest in its series of agenda setting wine insight events –albeit over two years since it held its last one.

Concha y Toro is not only wiling to invest in a wide range of shopper and consumer insights, from both within the wine category and outside, but is willing to share it too. Or at least part of it.

It’s the fact that CYT wants to understand the shopper as a whole that make its research so potentially valuable for the wider wine industry.

Rather than only look through the prism of a wine glass for its answers, CYT is willing to invest in data from as range a field as possible, covering, in particular, all alcohol categories. It’s the only wine company I know that compares the size of the UK wine category to that of bagged snacks – £5.6bn to £2.6bn if you want to know.

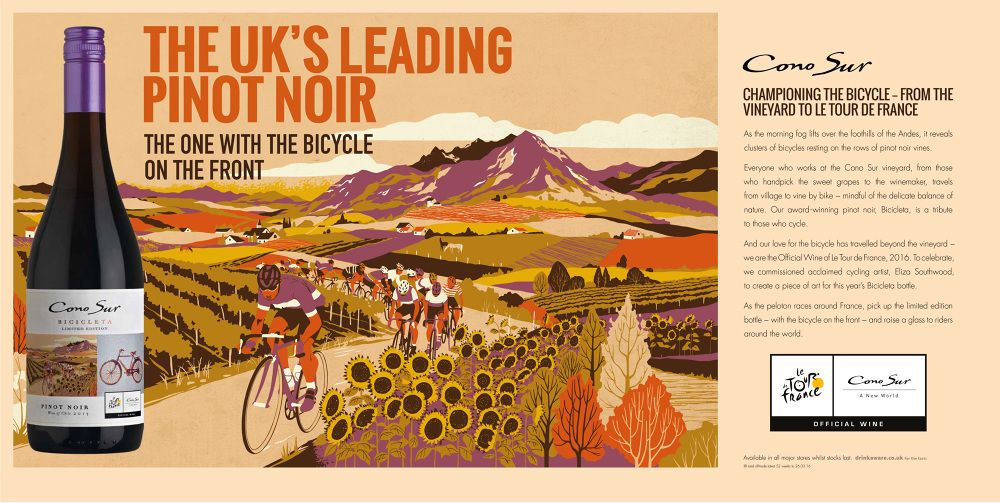

Aligning its brands to key events like the Tour de France helps CYT take its brands to new consumers

What do we need to address?

Here are some of the top line takeaways from CYT’s own research, based primarily on shopper behaviour and changes in consumer attitudes in the UK and the US.

- wine is losing share specifically to what are seen as more refreshing, longer glass alcohol alternatives. Be it a glass of cider, a cocktail.

- consumers are looking for excitement, experiences they can enjoy and share on social media, and switching to drinks and outlets that allow them to do that.

- they’re looking for ever more convenient ways to drink, and new formats that allow them to access their favourite drink wherever they are, be it canned pre-mixed cocktails and gin and tonics.

- they also don’t just want the choice of a bottle to open – hence the arrival of so many more half bottle sizes now in the market.

- they’re more concerned about their health and ability to cut down on how much they drink and how often, with fewer overall drinking occasions

- there’s been a marked shift in the social norms around drinking, it’s more acceptable and understandable to not drink on a night out and excessive drinking is increasingly frowned upon.

- consumers are still ever searching for the next thing, and for craft and artisan products they can engage with and feel like they own. Hence the rise, in particular, of craft gins.

- the search for new flavours and points of difference are also helping the rise in dark and spiced rums.

Drill down behind those trends and you start to see why wine is having its problems and with which age groups it needs to do a better job to engage with potential drinkers.

Future target audience

Affluent 25-45 year-olds are the key category for the wider premium wine industry to capture

The sweet spot, for example, of a group of consumers that wine is struggling to really connect with is the affluent segment of the 25-45 age group. Above that and you have good, long-standing, loyal wine drinkers that can help carry the category into its future.

But 25-45 year-olds are less convinced. For example, if you look at the total BWS fixture in the UK then nearly a quarter (23.5%) is made up of under 45 year-olds. But that still slips back to 17.6% when looking just at still wine.

All of which has helped CYT develop a very clear strategy, and concise category profile for each of its major power brands; Casillero del Diablo; Trivento and Cono Sur.

Casillero del Diablo is the wine to share whilst watching a great movie; Trivento is all about discovery and taking risks; whilst Cono Sur is the wine to enjoy with food.

FMCG-style investments

Cono Sur’s link up with the Food Network is part of the targeted consumer strategy for each of its major power brands

Now CYT is in a position of strength and influence to invest huge sums of money in above the line activity. Be it sponsoring Sky Cinema (Casillero del Diablo), the Food Network channel (Cono Sur) or the Discovery channel (Trivento).

But by following an FMCG strategy it has become a virtuous circle of high top line investment, followed by on large on the ground sales increases, which allows it to re-invest with more ambitious above the line activity.

You only have to look at the success it has had with its three power brands in the UK to see its FMCG approach is working.

Whilst the total still wine market in the UK grew in value by 2.9% in the year to March, 2018, (Nielsen) CYT’s leading brands were up by 8.1%. Its volume figures are even more impressive, for whilst overall wine off-trade volumes were down 0.8%, CYT’s brands were up a collective 4%.

This breaks down as a 7.4% value and 3.5% volume increase for Casillero del Diablo, 10.4% value sales and 4.3% volume growth for Trivento, whilst Cono Sur saw value sales up 9.2% and volumes 6.4%.

High brand advertising appears to be working too. Casillero del Diablo’s platform sponsorship of Sky Cinema in the UK has seen it sales fly from £70.4m in 2014 to £126.3m in 2018.

Its overall strategy, however, is one that any off-trade focused wine business can follow. It has identified three key pillars for growth:

- to have a wine for every potential wine drinking occasion in the off-trade, which can help current light and medium category shoppers to buy wine more often. Here wine brands have to play a bigger, more active role.

- do what it can to create genuine excitement in the wine category through its FMCG branded approach that will help increase penetration of wine drinkers particularly in the under 45s.

- both of which should then deliver genuine consumer engagement with the right target drinker, and encourage those engaged drinkers, particularly the over-45s, to trade up more.

Category disruption

Outside of those key pillars the wine market is still very much ripe for genuine category disruption. It’s not uncommon in such a mature market as wine for innovation to have tailed off. It’s what we have seen in other grocery areas, until a spark of innovation helps kick-start the whole way we shop that particular sector.

Take detergents. There was little to excite or engage the shopper with one soap powder being just like any other. That is until the tablet and the capsule popped up. Now there are so many different ways to wash our clothes.

Or the mobile phone? We’ve gone from a wall of faceless, grey handsets, to a market where it has become a status symbol and mark of who you are as a person what sort of smartphone you have in your pocket.

CYT believes the branded wine category is ripe for disruption similar to what we have seen in flat categories like detergents and the arrival of NPD like capsules

What that genuine, category disruption looks like in wine CYT is unable to say – at least not for the moment.But what it is doing, behind the scenes, is using all this data, and analysis, and no doubt a whole lot more to boot, to promise a series of new products that it claims will disrupt the market at different times over the next three to four years.

Having painted such a pretty picture, it has a lot to live up to. But we can expect its new product launches to be very focused on the key customer and age groups it has identified. So something, potentially, for the affluent 25-45s, something else for the engaged over 45s and something particularly left-field for the 18-25 year-olds?

What it does come up with remains to be seen, but the industry as a whole should be thankful for the category driven insights that CYT has already laid out.

* This is an adapted article that first appeared on VINEX, the global trading site for bulk and bottled wine.