With such an enormous breadth in wines, styles and price points it is vital Australia is able to find markets for all its wines. Which for a country that still relies so much on its bulk and commercial wines is how it needs to progress if it is also going to find an increasing number of export markets for its premium wines, says Wine Australia’s Andreas Clark.

Looking bak on the recent history of the major wine producing countries around the world is like comparing the fortunes of the Top Four or Top Six teams in the Premier League. Whilst their wines are always going to be the biggest sellers, the ones that demand the most attention of wine buyers, the way they are made, sold and marketed, means their fortunes are constantly bobbing up and down. Particularly when the size of their annual harvest has such a significant impact on the global wine supply chain.

If a wine producing country the size of Australia starts to get a runny nose, the rest of the world needs to get a fu jab.

So it was encouraging to hear last month, straight from the horse’s mouth as it were, that things Down Under are in a lot finer fettle than they were four to six years ago. Then, if our football analogy still works, it had a lot of average players, running down contracts, on huge wage bills that were dragging down the rest of the team.

Australia’s performance around 2010-2013 was similar to what Louis Van Gaal experienced during his time at Manchester United

Now it seems Australia has gone out to the market and invested in lots of new, young, dynamic talent with the skillsets and imagination to take them to the next level. Whilst still relying on good, solid, trusted professionals you need to build a successful team. You still with me, Brian?

On the up…

The results out on the international wine arena speak for themselves. All price points for Australian wine are mainly on the increase in all its key markets, but particularly so for wines above $10. Its long held desire to move the whole Australian wine category up a rudder or two on the pricing ladder appears to be working. Its biggest rises, admittedly from lower bases, are for wines between A$20 to A$29 up 60% and A$30 to A$49 up 52%.

At the commercial end total sales are up 18% for wines up to A$2.49, and 15% between A$5 and A$7.50. Bulk wine exports also up in value by 10% to A$440m and had an average value per litre in 2017 of A$1.03, up 6% The first time it has been over A$1 since 2012. The UK remains the number one bulk wine market worth A$169m in 2017.

The overall value of Australian wine exports grew 15% to A$2.56 billion, with volumes up 8% to 811 million litres. The average price per litre FOB is also up 7% to A$3.16, the highest since 2009.

All of this is a very different story to where the Australian wine industry was between 2007 and 2013. With so many commercial wines and brands all vying for attention on overseas supermarket shelves Australia was particularly badly hit by the global economic recession of 2008 onwards.

It was suddenly faced with mass over capacity, and a rise in the Australian dollar making its wines less attractive in all its key overseas markets. What was being exported was increasingly in the bulk and low priced categories. As a result export volumes fell 100 million litres to 686 million litresbetween 2007 and 2013. Value sales also fell by A$1.2 billion from A$3bn to A$1.8bn.

The sun is shining brightly on all premium parts of Australian wine

Troubles behind

So Australia has come a long way in a relatively short period of time, with its best years potentially just around the corner. Particularly so if Andreas Clark, chief executive of Wine Australia, gets his way and lifts sales in China and the US as much as it hopes.

He is quite open about the fact Australia has had “its challenges” but he firmly believes it has now “come out the other side” stronger, leaner and fit for purpose.

It’s also been treated to an extra A$50m in extra funding from the government to invest in expanding its exports in key countries.

Wine Australia’s Andreas Clark

He speaks a lot, in particular, about the “strong bedrocks” that are now the foundations of an industry that has the image as a reliable, credible wine producing country around the world. One that is heavily supported by its government and has some of the strictest and safest regulations to govern how it is developed. Combined with an extensive R&D budget focused on how to make its vines, grapes and wines even more reliable and relevant in the future.

Strong government backing

The Australians might moan about not getting enough support from their government, but compared to the rest of the world, the amount of money available to Wine Australia and its main R&D and development associations really puts it at a strong competitive advantage.

News that Wine Australia has an extra A$50m to invest in its key export markets and R&D brought a strong reaction from producers in other parts of the world, noticeably South Africa.

It means Australia can look even more closely at what viticulture advances need to be made to make vines even more resistant to pests, but also the changes in climate. It’s not just Australian winemakers that are experimenting with different grape varieties, particularly Mediterranean and Italian grapes, to see what can work best in different regions.

Grape variety research is a key part of the official R&D investments taking place. Particularly around which grapes produce the best quality and yields and what sort of rootstocks provide the most resilient vines.Developing the right grape varieties that are disease resistant and hardy to Australia’s climate is where the future of Australian wine has to go.

“”R&D is funded and matched by the government and has been for a long time,” confirms Clark.

Take advantage of wine shortages

Australia, said Clark, was “very well placed” to take advantage of the huge wine shortages on the back of the poor global 2017 vintage considering it enjoyed its best harvest in 10 years in 2017. Particularly when you consider Australia’s total yearly production was 1.3 billion litres, compared to the 2 billion drop in global production to 24.6 bn litres, a shortfall of some 222m cases of wine (OIV).

With less need to discount and keep prices strong, then 2018 could be a great launch pad for many more Australian wines, added Clark. Particularly as the national average purchase price for grapes increased by 7% in 2017 to A$565 per tonne, the highest since 2008. The third year in a row where average wine grape price have increased.

Shiraz and Colombard saw the greatest price increases followed by Muscat Gordo Blanco, Pinot Gris/Grigio and Chardonnay.

Significantly the proportion of A and B grade grapes (A$1,500 and above per tonnne) were up to 7.4% from 6.4% reflecting the growth in premium Australian wines. Shiraz purchased at A and B grades increased to 15.5% from 13.3%, double the proportion from five years ago.

UK strengths

The buzz at the recent Australia Day tastings shows there is still huge interest in what Australia has to offer in the UK

For all Wine Australia’s love affair with China and the US, it is the UK that is still paying a large chunk of its bills. It remains its number one country by volume and in 2017, 223m litres were exported to the UK compared to 172m litres to the US and 153m litres to China.

The bulk of that wine, however, is, well, in bulk. At 80%. That figuremight be edging down (8% in 2017), but it still dominates its position in the UK and is also driving much of the growth in the bottled in UK market.

Australia is still also number one in the UK off-trade, and now third in the on-trade by France and Italy. So quite easily holding down those Champions League places.

But there is a shift happening. Total UK exports were down 2% to A$348m in value and 5% in volume. But that decline in bulk sales offset what was a 5% increase in bottled exports to A$179m.

Being the dominant player in the UK it is not surprising its sales trends reflect the market as a whole with a 40% plus drop in wines sales below £4 (compared to nearer 15% for the market as a whole).

Its sales in price points above £7 are all up, reflecting the market as a whole. With close to 30% increase for wines between £7 and £8, over 40% between £8 to £9, 35-40% growth between £9 and £10 and close to 50% increase in sales between £10 to £20. But note these are all from very small bases.

With so much to play for it is surprising that Wine Australia is working very closely to be as well placed as it can be post-Brexit.

In particular it is working with the Wine & Spirit Trade Association to ensure its voice is heard in the lobbying work it is doing both to the UK government, but also trade ministers in the Australian government.

Clark said its priority is to ensure it can operate in the UK with the “same level of certainty” as it does now with the EU. It was also a good time to “tighten up anomalies” around key technical areas that currently, for example, do not allow for its wines to be carbonated in Europe, or for the addition of sweetness or musts to bulk wine.

Chinese success

Any analysis of Australia’s export performance has to start with China where it saw a hugely impressive 63% increase in sales in 2017, up to A$848m sales and close to A$1bn when you look at overall China. Volume exports were also up 54% to 153m litres.

Its average price per litre FOB is now A$5.55 (+6%) and China now accounts for more than half of Australia’s wine shipments of A$10 plus wines per litre.

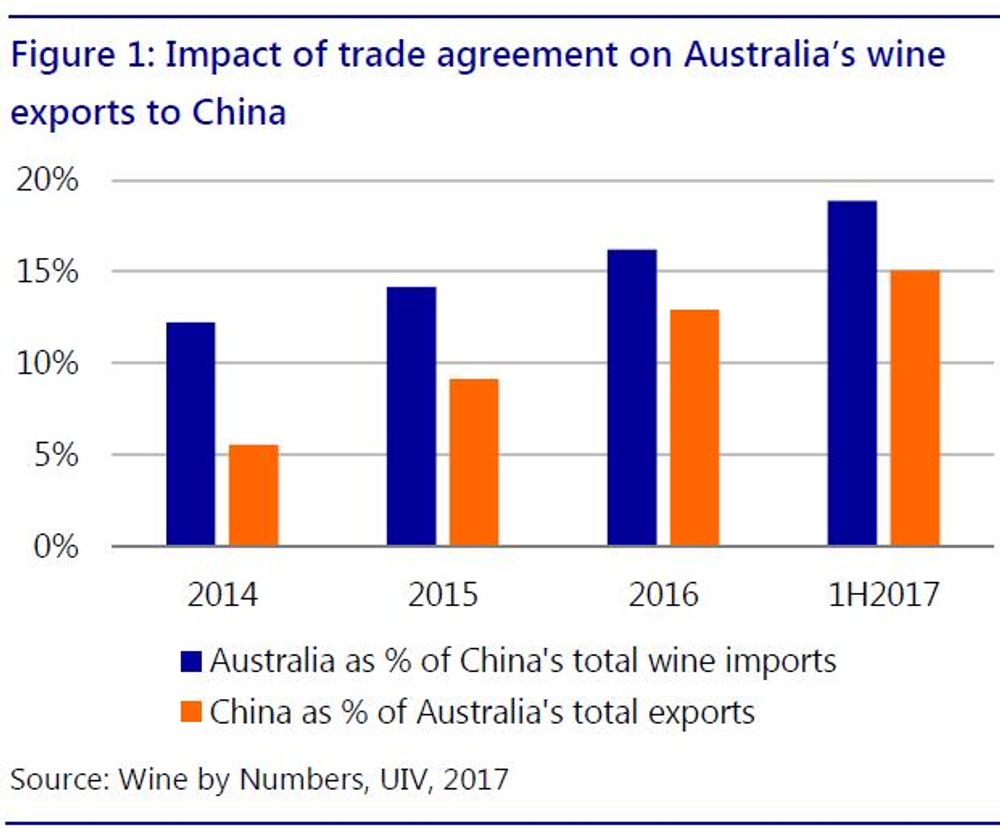

Clark stresses, however, that this has not just happened overnight or completely as a direct consequence of the Free Trade Agreement. Instead it is the result of a long, sustained period of quite lobbying, promoting and educating what he describes as still a “nascent” wine consumer. It’s certainly enormous growth compared to the A$25m of sales it had 10 years.

“People have been working in the Chinese market for years, and it is now starting to pay dividends,” he explained. “We want to be keep funding that growth.”

Which means more work looking to help educate the trade as well as consumers. “Anything that helps them understand Australia more,” says Clark. “It’s collective hard work pushing those stories.”

Australia’s FTA doe not put it in a strong place to grow even quicker. Whilst its tariffs to export wine will be 0% come next January, France, Italy, the US, Argentina and South Africa will all have to pay a 14% tariff on bottled wine and 20% on bulk wine.

The Free Trade Agreement between China and Australia has been a massive boost to its wine industry

It is looking to take full advantage of that position at this May’s VInexpo Hong Kong where it has been awarded the country of honour. It is also working hard to penetrate in to what Clark refers to China’s second and third tier cities which are less saturated in wine. It will be hosting a producer roadshow to key cities during the year.

“What’s particularly pleasing is we are getting cut through or our premium wines as well,” he adds, in a market that is notoriously price sensitive.

Bulk wine is also becoming a bigger sector in China, with Australia enjoying a 100% increase in sales at A$58m.

Red wine dominates Australia’s Chinese exports, accounting for 90% of sales, and “has been a key factor in our growth,” adds Clark.

Australia also now has a zero tariff FTA with South Korea whilst its exports to Japan are also benefiting from a deal that has removed tariffs on bulk wine already and will see the 15% placed on bottled and sparkling wine reduced to zero by 2022.

US challenges

The US is proving to be a harder market for Australia to crack

He concedes it has a tougher battle on its hands in the US. Not helped by the three tier system which makes it hard to create a national message for its wines.

In many ways it faces similar challenges and issues in the US as it has in the UK trying to move consumers away from just considering it as a commercial wine producing country.

Not helped, some would say, by the extraordinary on-going success of Yellow Tail, which was back with another Super Bowl TV ad this week. A wine that has become almost the flag bearer for Australia in the US.

Yellow Tail’s critics would, no doubt, point to the fact 93% of Australia’s wines in the US are currently sold in the $4 to $8 price bracket.

For many this is the image of Australian wine in the US that is holding back more premium sales.

But again, Clark stresses, it is “over indexing in the $10 plus price categories”. Exports at A$10 or more were up 8% to A$45m in 2017, and off-trade sales above US$11 were up 32%, compared to 7% across all wines.

This, though, is being achieved with only 1% of the US$11-plus market. It currently sits seventh amongst countries selling wines in the on-trade, but again that only equates to a 1.7% market share.

It is looking to target up to seven key US states where it can work to widen its message and push its more premium message. Whether the likes of US, New Jersey, Illinois, Florida, Texas fall in love with McLaren Vale Shiraz over their own US counterparts remains to be the seen, but at least it has some money to try and make it happen. Some of which it is spending on taking producers on a US city roadshow across those states during 2018.

The bulk sector is also proving an important route in to the US with more businesses looking to ship and bottle in different states. It shipped A$79m of bulk wine in 2017, up 24%.