Whatever the Covid-19 virus might be up to, we all need to eat and drink and find the most effective and convenient way of doing so, which is all summed up in this new IGD report.

You must have real technophobe issues if you have not turned to online shopping at some stage of the Covid-19 lockdown – unless you some how liked standing 2 metres apart in a very long queues to run the gauntlet of a mass supermarket shop.

Not surprisingly one of the headline figures to come out of the IGD’s new UK Channel Opportunities report is just how much the average British shopper has switched to online during 2020 and the Covid-19 outbreak.

The report is one of the first to be released by the major grocery analysts and gives a fresh perspective on just how quickly the retail landscape is changing.

Although online continuers to grab the headlines, it would be dangerous to over state its position when you consider that even with the unprecedented levels of growth in 2020 it will still only represent less than 10% of all grocery sales in 2022. Leaving over 90% to still be split between the high street spends of the major supermarkets, discounters and convenience sector.

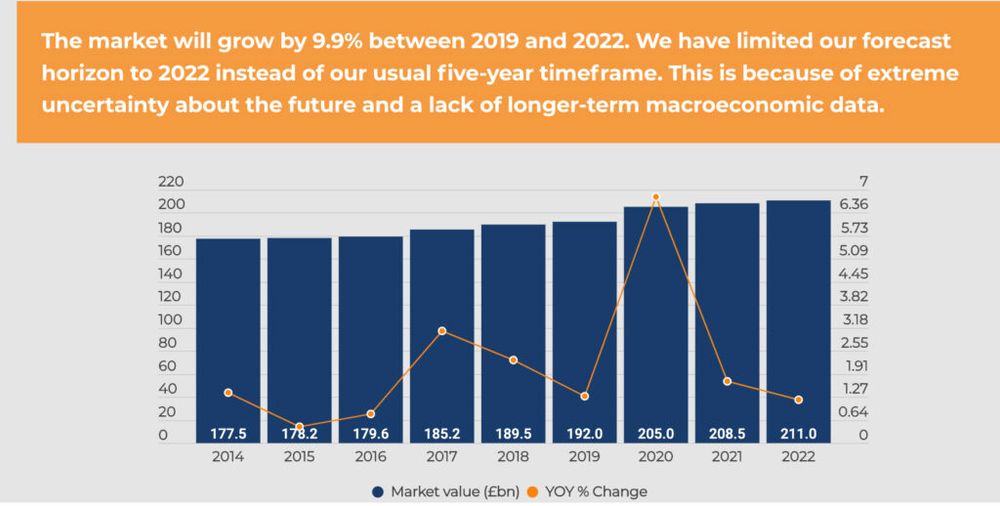

The IGD predicts the overall UK food and grocery market will grow by 10%, or £19.1bn, between 2019 and 2022. The major trends that were present in the market going into Covid-19 are still there, and, if anything have accelerated during the pandemic.

Online growth is here to stay

What is particularly striking, though, is its assessment that online players are now in a position to “mostly retain the loyalty of new shoppers gained during the pandemic”.

So, yes, whilst we might have had no choice to fight for a delivery slot during the months of lockdown it appears our shopping habits have also now changed and people like the convenience and reliability of online shopping.

So much so that previous forecasts around e-commerce growth in the years to come have had to be ripped up. Particularly in terms of the market share it is going to take off the overall grocery pie in the years to come – with online accounting for £1 of every £11 spent on grocery in 2022.

The IGD forecasts online spend will increase by 59.2%, or £7bn, between 2019 to 2022 – jumping from £11.8bn in 2019 to £18.9bn in 2022.

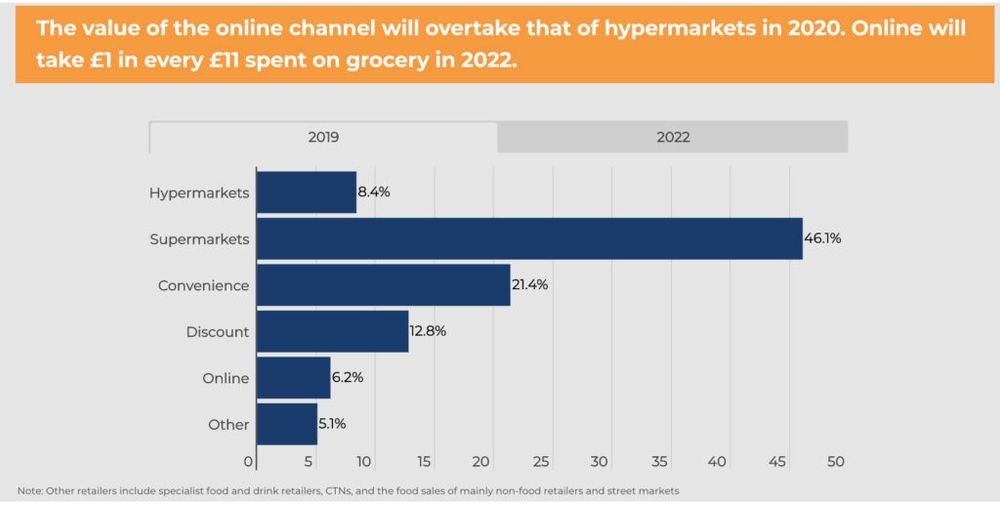

(Market share by channel in 2019: IGD)

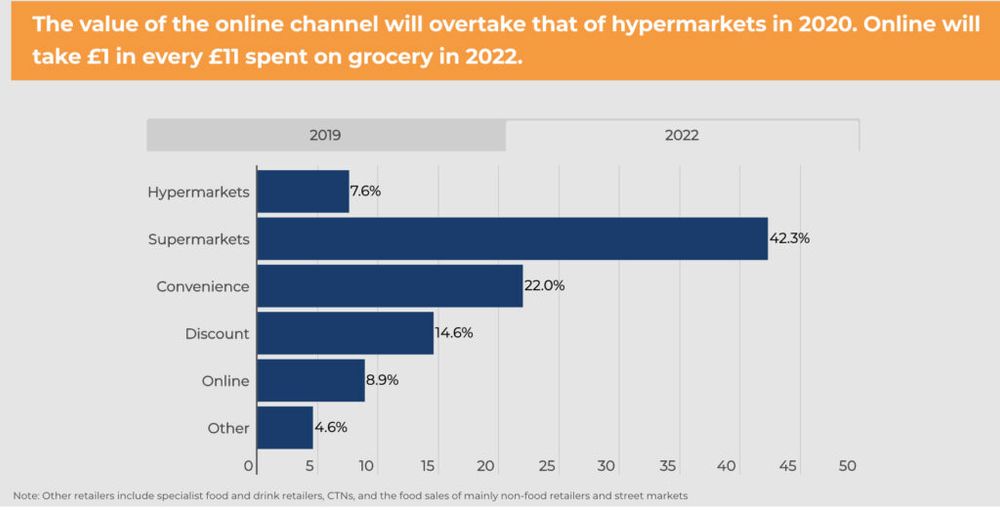

(Market share by channel in 2022: IGD)

Interestingly it actually predicts the pace of growth will “pause” during 2021, no doubt as the sector recalibrate itself in the months to come, but will then “resume” growth levels as more of the bigger grocery, and online players come to grips with getting their online offer right.

In particular, it points to the likely expansion we are going to see through Amazon in grocery sales, and what impact we will see when Marks & Spencer finally gets its e-commerce model working through Ocado. Which combined with further developments amongst the Big Four supermarkets will help give e-commerce a second wave of growth post 2021.

The IGD is therefore predicting:

- Online market share of the grocery sector will increase from 6.2% in 2019 to 8.9% in 2022.

- Online will be the fastest-growing channel in 2020, following dramatic increases in shopper numbers and bigger order sizes.

- The value of the online channel will overtake that of hypermarkets in 2020.

Discounters to get stronger

As the UK teeters on falling into a full on recession, with thousands of job losses being announced by the week, and the real possibility of even more once furlough payments are withdrawn in the autumn, it means the average UK shopper is going to be more cash strapped than pre-Covid-19.

Which will see an even bigger swing towards the discount retailers, says IGD – with a further increase of £6.3bn, up 25.4%, between 2019-2022 to an overall market size of £30.9bn in 2022 versus £24.6bn in 2019.

It predicts the discount channel will the “fastest-growing channel in 2021 and 2022, driven by a rise in unemployment and shoppers looking to economise”.

Aldi and Lidl’s decision pre-Covid-19 to embark on major store network expansions plans could not have been better timed to take advantage of the momentum swing in shopper needs. Smaller store formats will also enable Aldi and Lidl to “boost their reach into urban areas” and we can also expect to see “rapid growth” by some of the other “variety discounters” – such as B&M and Home Bargains – as they look to “scale up their grocery operations”.

All of which will see discount market share increase from 12.8% in 2019 to 14.6% in 2022.

Convenience challenge

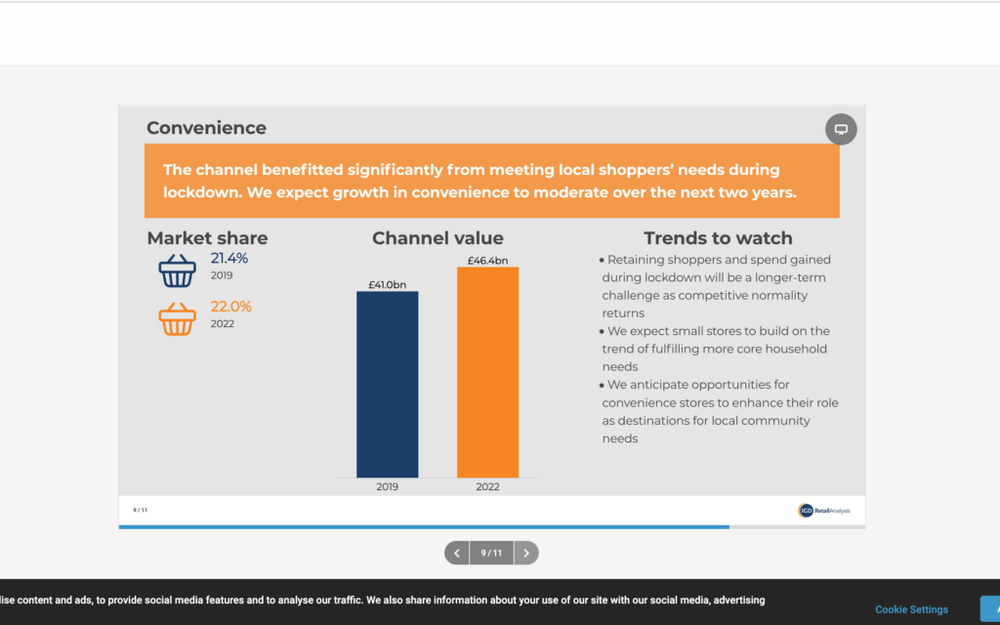

The other big winner during the Covid-19 lockdown has been the resurgence of the local independent and convenience store sector as we all looked to shop more often in our local areas.

The big challenge now for the c-store sector is holding on to that new business, and the IGD is predicting a slowdown in growth in 2021 and 2022.

That said it is still forecasting the channel as a whole to grow by 13.2% with an additional £5.4bn in sales between 2019 and 2022 – taking its overall grocery market share up to 22% in 2022 from 21.4% in 2019, worth £41bn in 2019 to £46.4bn in 2022.

The opportunity is clearly there for those “stores that develop their role as destinations for local community needs”. The big issue will be how quickly city centres come back and whether the daily commute and office life returns to anything like normal over the next year.

Supermarkets set for decline

The picture is not so good for the larger, traditional supermarket sector. For whilst the major grocers have enjoyed strong growth during the pandemic, particularly at the start of lockdown, that is starting to slow as embedded grocery trends start to bubble back to the surface.

The IGD only sees a growth in sales of £0.7bn, or 0.8% in supermarkets through to 2022, with hypermarkets performing even worse, with only £0.1bn and 0.3% growth over the three year period as “shoppers migrate to other channels” particularly online and the discounters. So much so that the big boost in profits in 2020 will “turn” to “negative” performances by 2022.

The larger store sector will be worth £89.3bn in 2022 versus £88.6bn in 2019.

It explains: “Retaining the loyalty of shoppers who switched to them at the start of the pandemic will be the priority for operators of large stores. Making stores easier to shop while also differentiating through their range and emphasising value will be vital as stores pivot towards more functional retailing.

It says the winners in multiple retailing will be the ones that can make that more “functional” shop as interesting and different as possible, without losing the efficiency. We can “expect to see more focus on packaging reduction, and health and wellness, to appeal to shoppers’ changing priorities,” it adds.

Supermarkets are also likely to invest more in “labour-saving technologies” to free up more investment to cut prices.

Having learnt the lessons from the 2008 recession the supermarkets will be primed and ready to take on the discounters as best they can and there will once again be a battleground over who is the “best value” retailer on the high street.

“Supporting e-commerce will be a more significant function of larger stores,” it says, but it also questions whether they “have enough space to improve the experience?”

The IGD predicts:

- Hypermarket market share will decrease from 8.4% in 2019 to 7.6% in 2022.

- Supermarket market share will decrease from 46.1% in 2019 to 42.3% in 2022.

- After a boost to sales in 2020 from the pandemic, supermarket growth will turn negative by 2022.

This, combined with the growth in discounting and online, will see a major realignment of where we choose to shop. With traditional supermarket sized “large stores” losing market share “faster than previously expected” to an extend that they will only “account for half of grocery sales by 2022”.

- The full report is available to IGD subscribers here.