After the difficult global harvest in 2017, buyers and producers will be relieved the world of wine has largely re-calibrated itself in 2018. So far at least. But what sort of trading conditions can we expect at this November’s World Bulk Wine Exhibition.

The World Bulk Wine Exhibition being held in Amsterdam on November 26 and 27 is an unmissable event in the global wine calendar for those that need to get their hands on large volumes of wine. The biggest fair in the world devoted to the global bulk wine business, it attracts international visitors from around the world and producers from an increasing number of countries – both traditional suppliers and emerging nations.

The bulk wine industry has developed in to a major global wine business in its own right with its own dedicated shows requiring specialist businesses and skills

Ten years ago when the fledgling exhibition first opened its doors, the bulk wine sector was a very different beast to the sprawling industry it has since become, shifting from a sector solely for brokers and large producers to now also being an efficient business strategy employed by small and medium sized wineries, enabling them to fulfil their crops and annual commitments. The sector has seen the emergence of new countries and producers supplying the market, swelling the ranks of the traditional suppliers such as Spain and Italy.

Not only have the number of players in the market surged, but quality, too, has undergone a “revolution” in terms of quality over the past decade, according to the chief executive of the World Bulk Wine Exhibition (WBWE), Otilia Romero de Condés.

“Wine has ceased to be produced thinking whether it is going to be bottled on site or in destination. The quality of wines which are commercialised in bulk – both if their destiny is a blending of the bottling – is astonishing, and the best thing is that it continues to grow each year.”

Otilia Romero de Condes, heads up the World Bulk Wine Exhibition

“We would say that all wine, including bottled wine, has been at some point bulk wine,” she continued. “Bulk wine is every wine, and a great deal of it will also, for example, be bottled in destination, which is a paramount for the environment and the minimisation of carbon footprints. What wouldn’t make sense and it would be tragic for the environment, would be to export, for example to China or the US, everything in bottles; whilst that very same wine with the very same quality can be shipped under the best conditions thanks to the breakthroughs in bulk wine transportation.

Bulk wine now accounts for 40% of all wine exported globally, and is worth more than €3,000 million overall. Global bulk wine shipments increased by 9.4% in value and 4.5% in volume in the year to March 2018 as leading suppliers increased across the board, according to the most recent figures from the Bulk Wine Club, part of WBWE.

Spain led the way in terms of growth, posting a 27% increase in the value of its exports to €660 million, pulling ahead of Italy to become the key supplier of bulk wine in the world. The value of Italy’s bulk wine exports, by comparison amounted to €407 million, a 5.2% increase on the previous year.

However, both countries saw a drop in volumes, with Spain dipping by 0.3% weighing in at 12.2 million hectolites, while Italy saw its volumes drop 7.5% to five million hectolitres. Spain remains the most affordable supplier at 54 cents per liter (+27.4%), whilst Italy registered over 80 cents/litre, increasing by almost 15%.

Top 10 trends

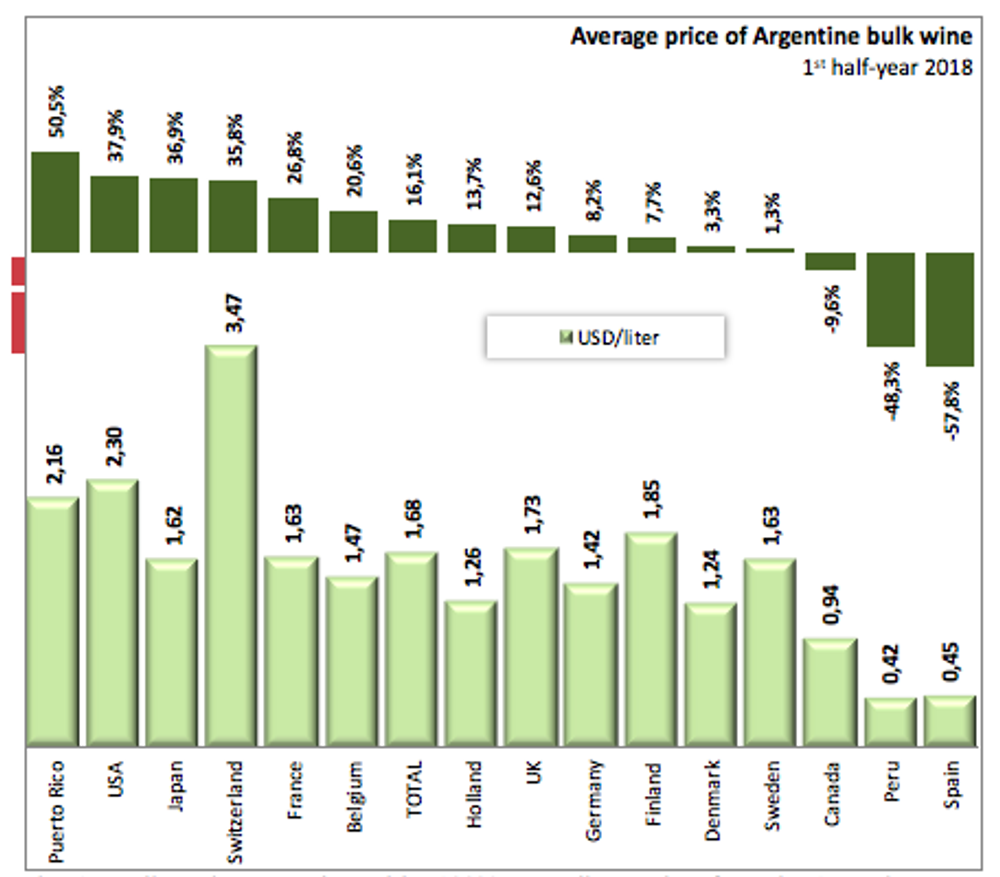

Among the top 10 supplying countries only New Zealand and Argentina saw their turnovers decreased, by 9.5% and 26.4% respectively. New Zealand’s volumes remained stable, at +0.6%, while Argentina’s plunged by 34%, due to the impact of low yields in South America, with a resultant 23.4% nosedive in value, leaving the price close to $1.70 a litre.

Shipments to 14 out of 15 of Argentina’s top markets dropped, from over 17 million litres to barely 11.3 million litres according to Argentinian customs figures. Over the same period, Argentina’s bulk wine imports crashed by 96%, from 52 million litres to a mere two litres due to the decline of Chile, the sole supplier during the first half-year of 2018. Spain was the only country to see its imports of Argentinian wine increase, up to one million litres, making it the third largest designation for the South American country.

All eyes on Australia

Australia is another key player in the bulk wine sector, contributing towards the global growth in bulk wine, and gaining significant share as the third largest global exporter. It accounted for approximately 4.7 million hl, an 11.5% increase, amounting to 360 million euros (+18.5%). However, Australia’s 2018 crush will not fulfil existing demand for the country’s wine, which will push prices upwards, according to a report from bulk wine specialists Austwine.

Jim Mouladerellis chief executive of Austwine

Despite the harvest being described as “high quality”, the company said that the crop would be “unable to fulfil current demand.” Jim Moularadellis, Austwine’s chief executive, and the report’s author, confirmed the industry has “continued to witness increasing supply and pricing pressures” as rival brand owners and bottlers compete for limited supplies of 2018 wines.

This comes ahead of the official yield figures which will be released later this month, but would appear to confirm early reports that the total Australian crush for 2018 will be down between 5-10% on the previous year, which was a record harvest of 1.93 million tonnes.

Australia’s traditional markets such as the UK, where as much as 80% of Australian wine by volume is shipped in bulk, will have to fight that bit harder for their share, with stiff competition and demand from China, where Australian exports have soared by 32% in volume and 34% in value in compound annual growth rate in the five years to the end of June 2018.

And in the past year, that rate has accelerated even further, with growth rocketing by 66% in value and 50% in volume. China now imports more bulk Australian wine than the US, the UK and Canada combined, with 20 litres of red Australian consumed for every litre of white.

“Three years ago most domestic wineries were happy to sell to their competitor wineries almost any inventory item,” Moularadellis said. “But today most domestic wineries are buying from their competitors (assuming the price is right). The item in most demand is entry-level varietal red wine, often to satisfy Chinese demand, or opportunities in other markets arising from China’s demand impact.”

Short supply

Those varietals which are “critically short” include commercial/entry level Shiraz, Cabernet Sauvignon and Merlot, while commercial/entry Sauvignon Blanc, Chardonnay and Pinot Gris are described as “short”. Meanwhile, dry land and premium reds are described as “in balance”, while dry land/premium Chardonnay and Sauvignon Blanc are “long”.

Mouladarellis said that he didn’t see an end to the pressures on pricing, as supplies are likely to remain “muted” over the next three to five years. “There are only modest levels of planting activity, and China will drive much of the demand for Australia’s wine during this time,” he said. “Should Chinese demand for Australian wine continue unabated then bulk wine prices will rise in the absence of any significant new supply from Australia or alternative supply from other producing countries.

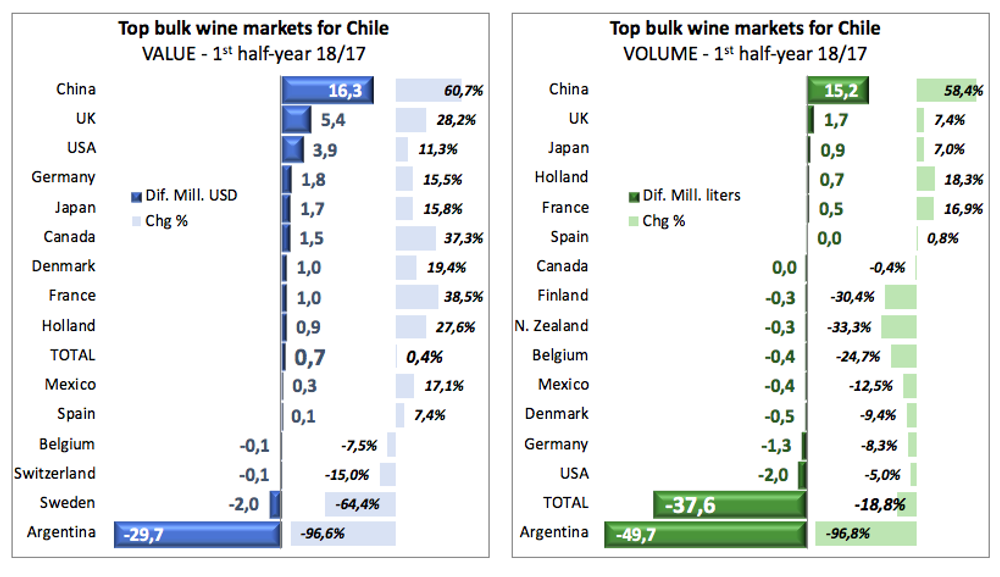

Chile, another big player in the global bulk wine trade, saw its volumes drop by 5%, while its value crept up by 4.2%. While Argentina used to be the key destination for Chilean bulk wine, Chile has seen shipments to its South American neighbour slump by 97% over the past year, pushing it into 13th place, and shifting from exporting more than 50 million litres to Argentina in the first half of 2017 to less than 1.7 million during the same period this year.

The value, however remained stable above $160m, a 0.4% increase, pushing the average price up by 24% and going from 81 cents to $1 per litre.

Chile’s biggest customer for its bulk wine production is now China, with exports to the Asian nation soaring by 60%, to reach 40 million litres with a value of $40m.

France and the United States both posted a bigger rise in value than in volume for their bulk shipments. Though far from the top positions of the world’s ranking, Portugal grew more than any other supplier in relative terms, jumping by 31% in volume and 35% in value.

Top importers of bulk wine

Meanwhile the three main bulk wine importers were Germany, which increased by 16.5% to €570 million, the UK, up 17.8% to €555 million, and France which recorded the biggest increase of 28% taking it’s total bulk wine imports to €335 million. In volume terms Germany also led the pack, importing just over 8.8 million hl, a 3.3% year on year increase, followed by France which shipped in 6 million hl, a 3.8% decline on the previous year, and the UK taking up third place with 5.2 million hl, up by a healthy 11.2%.

All three countries saw their average prices increase, particularly France which shot up by 33%, to 56 cents per litre, though this is still considerably lower than the global average of 78 cents a litre, as cheap Spanish wine dominates the French market.

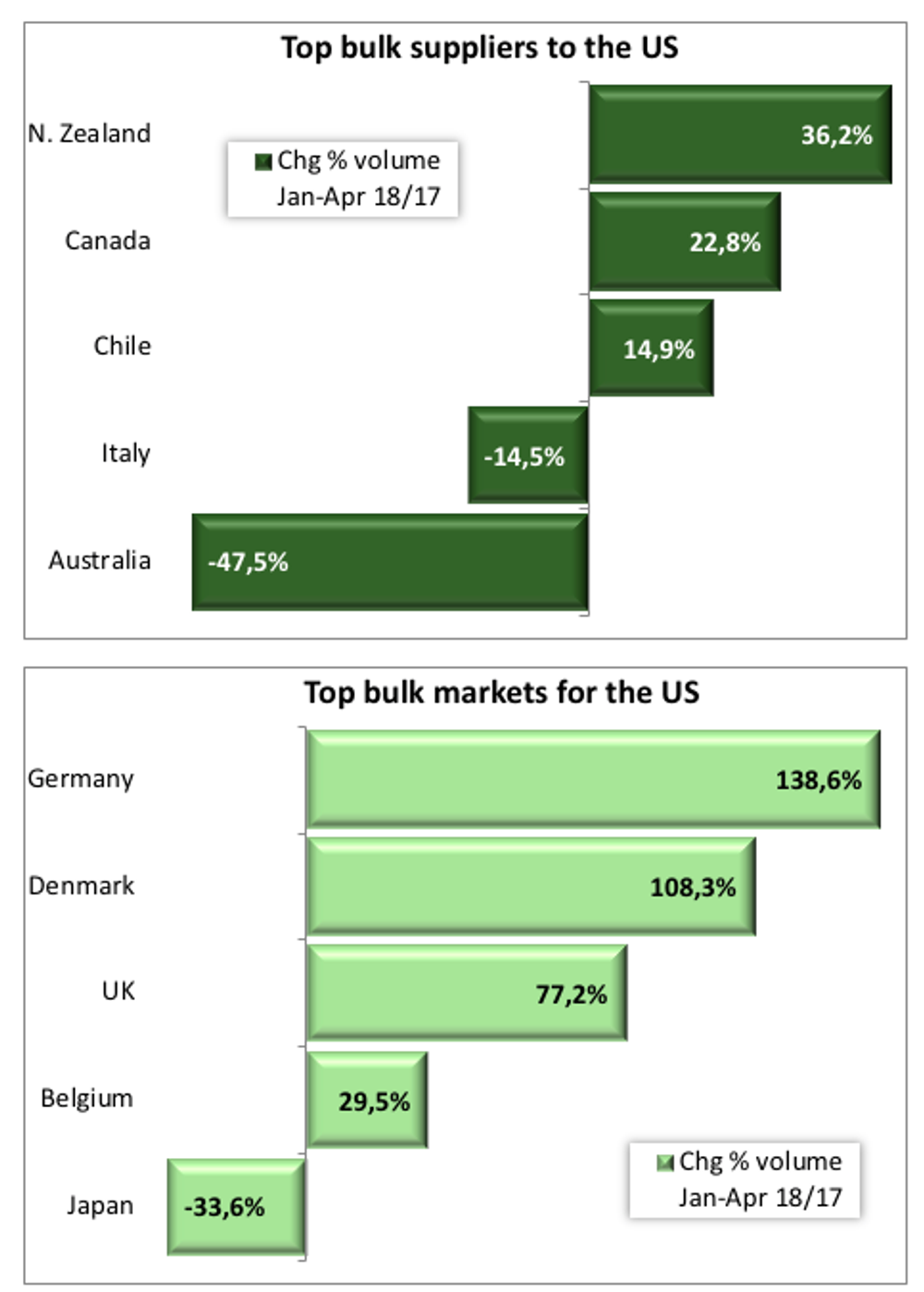

The US remains the fourth largest importer of bulk wine, though it recorded a 5.6% drop in volume and a 10% drop in value in the past year. However, Argentina, previously a big supplier to the US, saw its exports to the US slump by 50% in the past year while imports of bulk wine from Chile were up by 15% and Canada by 23% in value, leapfrogging Australia which saw its shipments to the US plummet by almost half (48%).

New Zealand was the supplier which saw its exports increase to the US by the largest amount, up by over 36%, while Canadian exports to its neighbour also jumped by nearly a quarter (22.8%).

At the same the US saw its bulk wine exports jump by 17%, an 8.6 million litres increase in the first four months of 2018, with a huge increase of sales to the UK, up by 77% in volume and 90% in volume.

This vast leap coincides with a substantial slump in exports of bottled wine, which was down by 69% to the UK, indicating that the US is bottling a significant proportion of its wines in the British market.

Overall, the US exported bulk wine to 27 different countries, but only imported from 14 suppliers.

China takes up fifth position in the world rankings with its purchases soaring ahead of the other countries analysed, up by 35% in terms of volume and 49% in value. The country increased its purchases of Australian and Chilean bulk wine, while halving its imports of product from Spain and France. During the first quarter of 2018, China saw its sales of bulk wine surge by over half (53.6%) in volume and by over 62% in value to 54 million litres with a value of 46 million euros.

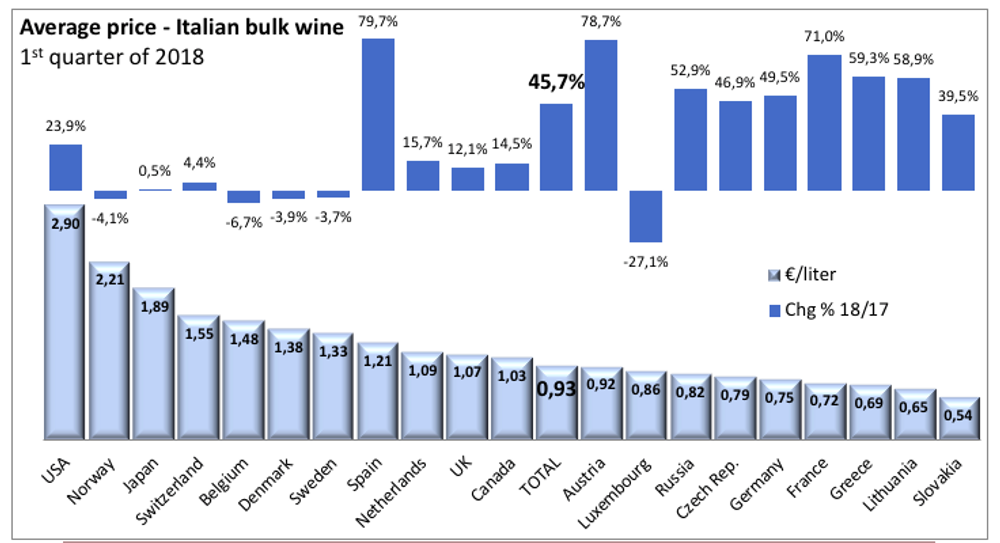

Italy, one of the world’s largest producers, has been hit by last year’s short harvest, and as a result imported 21% more bulk wine although it decreased its expenditure by 7.6%, by dropping its purchase price by approximately 25%. At the same time its bulk wine exports dropped by 30%, less than one million hectolitres during the first four months of 2018, far from the 1.4 million hectolitres it shipped over the same period of 2017. Nonetheless it invoiced €90.4 million, €1.5 million, since the average price has jumped by 46%, shifting from 64 cents to 93 cents.

Italy saw its shipments to the Czech Republic plummet by 76% to Slovakia, to Canada by 61%, and Australia down by 60%. However, it increased its volumes shipped to Switzerland, Sweden, Russia, Luxembourg and Spain.

Bulk wine imports into Sweden —a much more established market— dropped, while Switzerland gained considerable share. Canada bought a little less in terms of litres yet invested almost 10% more, doubling the global average price. Belgium increased its volume of bulk wine purchased by 9% but barely spent 1% more, due to lower prices.

Heading to WBWE

The WBWE promises visitors a host of workshops, masterclasses and activities

So what can visitors to the exhibition expect? “The WBWE will once again be ready to provide the best business platform, whatever the needs of the more than 6,000 professionals who are expected to attend this edition,” explained Romero de Condés.

“Our main challenge is to preserve the fair as the best platform for business, but around the exhibition a series of activities, seminars and competitions have been established; and all of them have made this event a not-to-be-missed date, not only for professionals and for the industry, but also for journalists, students, wine lovers and trend hunters.

“Workshops such as The Art of Blending Wine, which we launched last year and that is the only seminar worldwide devoted to the art of blending, will gather once again this year a myriad of professionals from all over the world focused on sharing their knowledge and talking about this skill and occupation, which is essential for a lot of brands’ success.”

Private label will also be a topic which will come under scrutiny at the fair, focusing on how brands are created and emerging trends in the new markets.

“These two days of expanding business networks are enriching for everyone interested in the wine industry, whatever their occupation might be.”

- If you would like more information about the World Bulk Wine Exhibition you can go to our partner page here or to the official website here.