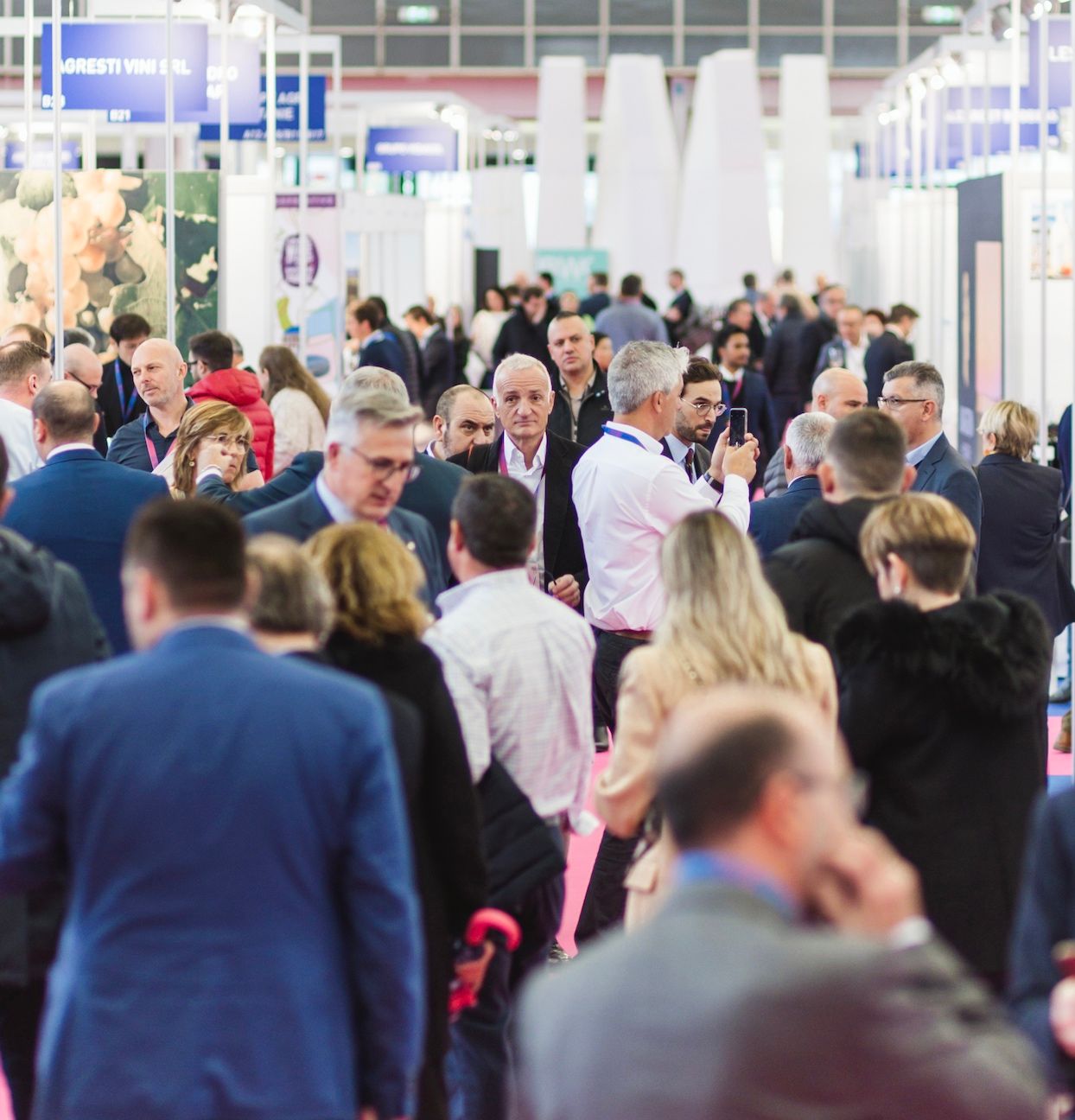

For many producers and buyers last week’s World Bulk Wine Exhibition was the first time they had been in the same room together since 2019. They would have all found it a very different market place to be in, says Richard Siddle.

There was a peculiar atmosphere at this week’s World Bulk Wine Exhibition. It’s as if everyone had walked into the filming of an episode of ‘First Dates’ and did not quite know what to do with themselves.

There were lots of producers and buyers around to do business with each other, it was just they were both waiting for the other to make the first move. For many it was also the first time they had ventured back into the dragon’s den of the WBWE trading floor since before Covid and it was as if they were having to re-learn the rules of engagement. The big stumbling block was where did you start your negotiations when the price of grapes was not the most important factor?

Covid, the subsequent impact on the supply chain, and the knock-on effect of rising dry good costs, soaring inflation, and shortages in glass and packaging meant everyone was having to work out new ways of doing business with each other. Or not doing any business at all.

There was a very different trading atmosphere at WBWE 2022 on the back of all the supply chain issues and increases in costs throughout the wine industry

The fear being if you agreed a deal, a price and contract at the fair just how credible would it be in three to six months time? The worst trading circumstances have come together at a time when the market is full of wine, but buyers are increasingly anxious about buying it.

For years buyers and producers alike have looked to tie each other down to year long commitments on price and the volumes of wine they were buying and selling, explained Jon Woodriffe, sales director at Origin Wine.

Those have been the foundations on which the global wine industry has done business.

Unprecedented market

“We have all become so accustomed to annual deals. That’s what everyone in the trade has grown up on. That’s all been blown out of the water because of the increase in dry goods and packaging costs,” he added.

It’s why the WBWE has become such a critical show. The one time of the year when the majority of bulk wine is is traded in one place. Miss out and you risk not having the volumes of certain varietals and regions of wine for the next 12 months.

Guy Smith, director at Frederick’s Wine Company, a UK wine importer that works with a number of producers, including Winegrapes Australia and Antigua Bodega in Argentina, said it’s an unusual situation to have buyers coming to WBWE looking to get pricing and volume commitments and producers being unwilling to give it to them.

The biggest stumbling block to doing business is the ongoing shortages in glass bottles. Which means in some markets there is currently no glass at all and what there is comes in one size and shape, particularly for those looking to source from France, Italy and Spain. All supplied with a ‘like it or lump it’ attitude from the big glass manufacturers. It means both buyers and sellers are having to negotiate with one arm tied behind their back, not knowing what the costs and terms of that agreement are going to be in a few months time.

There was plenty of wine to taste, but how much of it was being bought at WBWE

Resulting in an awkward and unprecedented stalemate at last week’s WBWE. Where Southern Hemisphere producers, in particular, were desperate to strike deals and clear their tanks ready for the 2023 harvest coming in the first quarter of 2o22, and buyers were prepared to play the long game and “see what happens” down the line.

Ripping up long term contracts

The fact major UK bottling companies are now said to be changing their pricing on a quarterly basis means it is having a direct knock-on impact on producer, supplier, and retailer margins right up and down the supply chain.

“That makes it really hard. How often can I go back to our customers and ask for another price rise,” said Woodriffe.

But in many instances they are. At least for now. Even major retail buyers realise they have to, said bulk wine consultant, Inge Straetmans, who works in the Belgium retail market, during a panel debate analysing the pressure on buyers and what they are looking for.

Torbjorn Rolander, brand manager at Enjoy Wine and Spirits, a Swedish drinks wholesaler, agreed and said buyers now have to be far more flexible than they have in the past. Particularly when working with partners they want to have long term relationships with.

“Talking about changing long term contracts has never been done before,” added Stuart Bowman-Hood, director at Fredericks Wine. “We are having to have those tough conversations. But the retailers understand that.”

Particularly when some glass bottle prices went up some 30% earlier in the year and are going up by another 40% now.

Winegrapes Australia Paula Edwards says buyers are now looking to commit to buying wine “as and when” they need it

Buyers are also “holding back” and looking to see how the market responds to all the outside forces before committing to big volumes, said Paula Edwards, general manager of Winegrapes Australia. “They know they can come back and buy as and when they need and see what they can get if they hold back,” she explained.

She said this was the first time she had been able to get back to WBWE since 2019 when the world was a very different place. It was a good time to be back, she said, and to really re-engage with the market again and in some ways it was like starting again and having a “clean slate” with some customers in how they do business together.

She said “ideally” she could find a way back into the UK retail market. “That’s a big target for us.”

Australian woes

The long faces of the Australian producers and brokers at the World Bulk Wine Exhibition in Amsterdam this week told a story of having large volumes of wine to sell and a worrying lack of buyers willing to take them. Even at knock down prices of A$80 cents a litre and below.

Many brokers had come to the show with one price in mind and had soon realised they would have to knock that down considerably to grab interest.

The fallout from the collapse in the Chinese market was there for all to see as Australian players looked to find ways to sell excess wine and free up space in tanks and cellars for the 2023 harvest.

“It’s a tough place to be at the moment,” said Peter Flewellyn, export sales manager at CW Wines. “We have got pressure on capacity and space.”

Edwards said she was “prepared to discount” if it meant moving wine out of tanks. For example, wines she had thought could sell at A$2.35 a litre were more likely to move closer to A$1.15.

Flewellyn said CW Wines was hoping to pick up business from across Europe, particularly in Sweden and Scandinavia. “We are ready to go and ship our wine. We are here to find out what buyers are looking for. We have got more stock than we are used to having that’s for sure.”

WBWE was the first time many buyers and producers had met in person since 2019

Even the lure of super cheap pricing from Australia is not enough to convince some buyers to switch back some of their supply to Down Under as a lot of those cheaper prices need to be offset against much higher dry good and freight costs and still uncertainty over shipping times and how long it is going to take to get those wines into market.

“The market has certainly slowed down because of Covid, and the supply chain and shipping problems,” said Flewellyn.

Trading tensions

There is clearly also an underlying tension between European and UK buyers, in particular, who feel Australia was too quick to turn its back on markets that had helped make Australia’s name around the world in favour of China. Now the China dream has turned into a nightmare they are not ready just to re-open their markets, particularly as they have spent the last few years sourcing better value wines from other countries.

They also question how serious Australia is about turning back its supply to its traditional markets, for if and when China drops its tariffs and opens up its customs and borders to Australian wine, then so many of its producers will quickly jump back on the Chinese bandwagon again.

The frustration for the bulk Australian players at WBWE is that there are no actual increased tariffs on bulk wine into China, it’s just they can’t get their wines through customs, added Flewellyn. Edwards feared the Chinese market “was not coming back any time soon” despite political moves in Australia to make it happen.

A fact backed up by Frances Adamson, governor of South Australia, who confirmed to The Buyer during a separate trade debate in London last week that any potential change in the Chinese tariff situation was realistically a good five years down the line.

Instead so many more Australian players, including Winegrapes Australia, were doing so much more business at home and in New Zealand and Edwards was hopeful that some of the brands and work being done there could be picked up in other European markets Europe too.

Whatever happens producers are looking to squeeze the 2023 crush as they simply have too much wine still in tanks. She expects Winegrapes Australia to crush around 1,500 tons compared to 3,000 tons in 2016.

Winners and losers

WBWE allows buyers and producers to get right down to the business of trading wine

But in the world of wine where there are losers there are also plenty of winners too.

Woodriffe said South Africa had certainly enjoyed picking up business from the big Sauvignon Blanc shortages in New Zealand over the last couple of years.

What was particularly encouraging, he added, was that a lot of major customers who switched supply to South Africa were now coming back for a second vintage and that it was offering something new to the market that customers and consumers like.

“There is also a good market for red wines from South Africa too. We are seeing good demand and volumes for dry reds,” he added, which has resulted in “fairly stable pricing” for red and white wines across the board.

Guy Smith said another factor to throw into the mix is the change in UK duty rates in the first half of 2023 which means higher rates for higher duty wines, which could potentially see 35 to 45 cents increase on an average litre of Argentine Malbec and further pressure on wines, particularly from the Southern Hemisphere, that are consistently above 13.5.% to 14% abv.

To that end it was noticeable how many more de-alcoholised distributors and operators there were at this year’s WBWE, with dedicated time during its conference for talks, and tastings on what role de-alcoholised wines can play in the future.

WBWE 2022 could go down as a landmark event in the wine industry’s current history. The time when the true picture of what is really taking place in boardrooms and negotiating rooms right around the world was laid bare. It was also when the old rules of trading were being ripped up and new rules were being written before your eyes.

- To find out more about WBWE go to its website here.

- This is an extended and adapted article that was first published on VINEX, the trading platform for bulk and bottled wine.