If you compared your bank statement today to one five years ago the chances are you would have a lot of direct debits for online subscription platforms and services like Uber, Spotify, iTunes, Sky TV and Netflix. Give it another five years and you will have a lot more retailer subscriptions, including those for beers, wines and spirits, according to Rick Breslin, founder of the Hello Vino wine app.

I know, I know. As a producer or retailer, you’re sick and tired of all the “adapt or die” warnings from biased pundits. Same here.

Instead of fear mongering, I find it more effective to highlight the evolution (I refuse to use the word “disruption”) of other consumer industries impacted by new, digital-first innovators. Since we’re talking about beverages, it’s probably most appropriate to start with the grocery sector.

What’s for dinner?

With meal kits and food subscription services such as Blue Apron and HelloFresh affecting supermarkets by way of lower basket rings and diminishing loyalty, consumers are increasingly choosing these convenient and educational offerings to discover new meals and ingredients to replace their traditional retail food purchases.

The success of new subscription food recipe home delivery meal kits like Hello Fresh are becoming a serious worry to supermarkets and how people shop

Some retailers are adapting to this change. Most notably in the US with Albertsons and its acquisition of meal kit service Plated.

They have every right to be worried. We have seen in the past how digital services and offers can transform our retail landscape. Remember Tower Records? Or Blockbuster Video? If so, you’ve witnessed the nearly complete digital transformation of the music and movie industries, thanks to Apple, Netflix, Spotify et al.

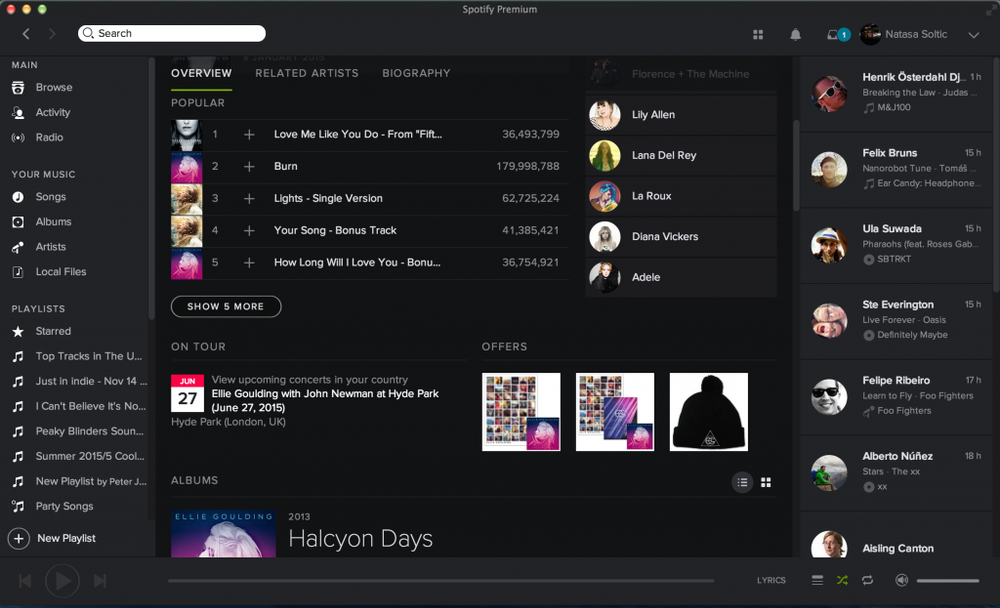

There are already drinks and alcohol apps that are looking to use similar digital models to transform how we shop for alcohol in the same way we listen and purchase music on platforms like Spotify

Aside from the product and supply chain completely changing from a physical to digital medium, the discovery aspects of the music and movie industries have been elevated to a new standard dictated by iTunes’ user-friendly visual interface and product curation, while Netflix focused on the algorithmic personalisation of content.

Speaking of entertainment, it has been interesting to watch how other brands and manufacturers have responded to the threat of platforms like Netflix. Hasbro (which is both a manufacturer and a brand builder) has launched its own Hasbro Gaming Crate in response to the bankruptcy and failure of one of its largest retail accounts in Toys ‘R Us. It is not alone in taking steps to control its own supply chain and not rely entirely on third party retailers.

Hasbro launched a subscription service to send games directly to its customers, bypassing traditional retail outlets.

What do I wear?

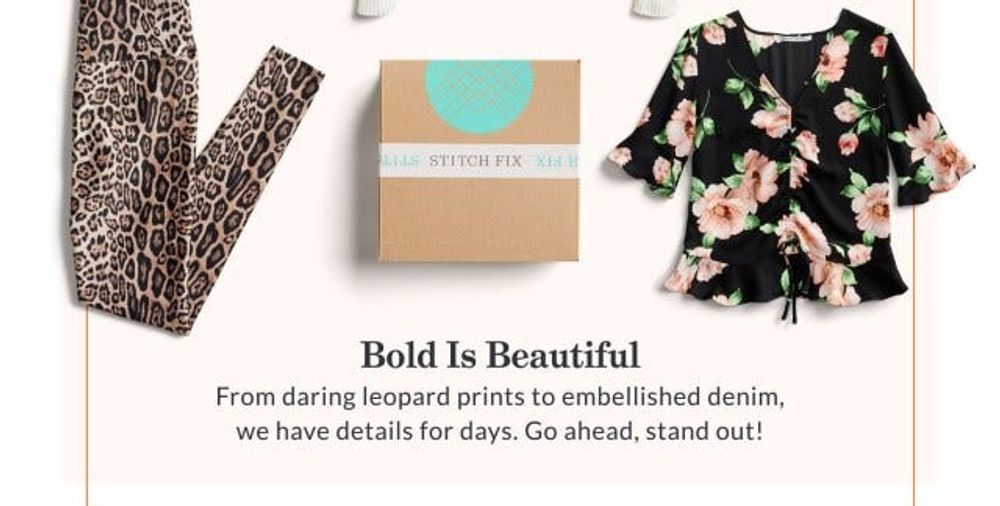

Probably the industry most closely aligned with beverage alcohol as it pertains to purchasing a product based on personal taste would be the the clothing and fashion industries and the fact that new personalised fashion services, such as Stitch Fix in the US, are growing in popularity and reducing visits to physical storefronts. “The current shift in customer behaviour is permanent,” warned Stitch Fix, chief executive, Katrina Lake, recently. (ASOS has a similar impact to the high street clothing sector in the UK- Ed).

Stitch Fix uses a blend of technology and human curation to deliver a personalized fashion experience to consumers

Nordstrom was quick to adapt, acquiring subscription-based men’s fashion service Trunk Club in 2014 after having previously invested in clothing e-tailer Bonobos as early as 2012. And, oh yeah, Amazon is now in the fashion subscription business, too. Of course they are. (Amazon has launched Prime Wardrobe in the US which allows you to be sent clothes to try on before you buy them. With the added catch that you can earn more of a discount, of up to 20%, the more clothes you buy).

Need a taxi? Or a place to stay?

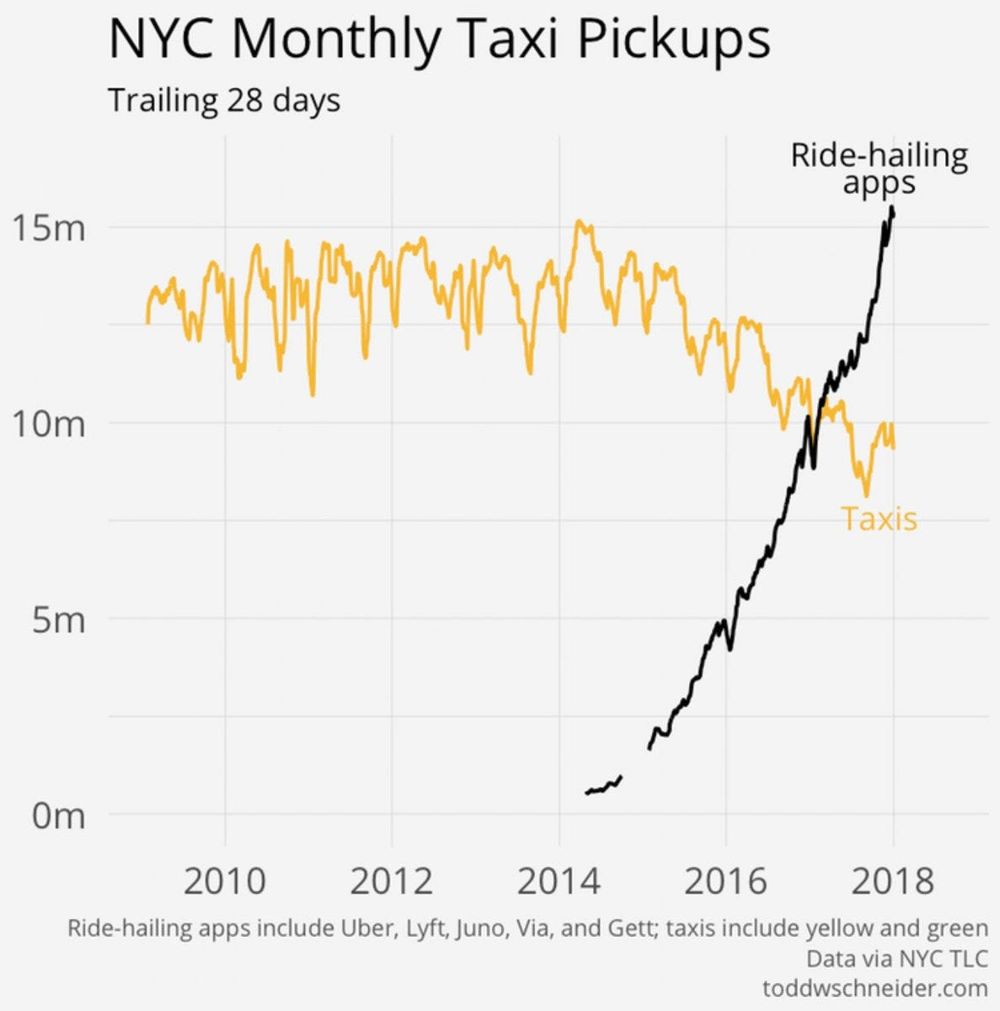

Digital transformation of the transportation and hospitality industries may be the most obvious example, but today’s nascent, digital-first services leading the evolution of consumer retail are reminiscent of the way companies such as Uber, Lyft and Airbnb captured significant market share from their industries’ incumbents reluctant to adapt.

They leveraged technology to prove convenience, customer experience and consistency trump price — all day long.

The data doesn’t lie. Ride-hailing apps have transformed the taxi industry.

Aside from their digital-first approach, there are a few common traits among these change agents transforming traditional retail:

1) They own the relationship with the consumer.

2) They provide a superior customer experience (CX).

3) They deliver value to the consumer.

In other words, these digital-first services have been able to capture market share and lead innovation in their categories by consistently delivering a delightful brand experience rather than focusing solely on branding a product.

Now we ask — what to drink?

Can we expect the same retail innovation in the beverage alcohol industry? The answer is: Yes, so long as the three conditions listed above are met.

However, both DTC and 3-tier alcohol sales have historically poor performance managing relationships with the end consumer.

On the 3-tier side, the point of failure is obvious. The supply chain largely prohibits the opportunity for brands to form consumer-direct relationships, as those are primarily owned/managed by the retailer (loyalty programs, weekly ads, etc.). Sure, big volume producers spend huge amounts of money on brand building, but it’s almost entirely fueled by advertising — if a brand wants to communicate with consumers, but doesn’t own the relationship, they’ll need to buy more ads.

And yes, a few large volume brands have compiled email lists with a few thousand consumers (to whom they may even send an email a couple times every year), but it’s a minuscule fraction of the total customers who have purchased their brand/product. Furthermore, are they really delivering value to the customer by sending the occasional email with a recipe or funny wine meme?

On the DTC side — a segment which, by definition, will soon change — the opportunity to form meaningful relationships between brands and consumers seems more accessible due to the one-to-one communication aspect of direct sales. But the thousands of small producers operating within this segment are unwilling or unable to make investments toward the application of technology (AI, marketing automation, personalisation, digital communication platforms) in order to scale the high-touch experience required to foster customer loyalty, and in turn, brand advocacy.

But, there has been some progress…

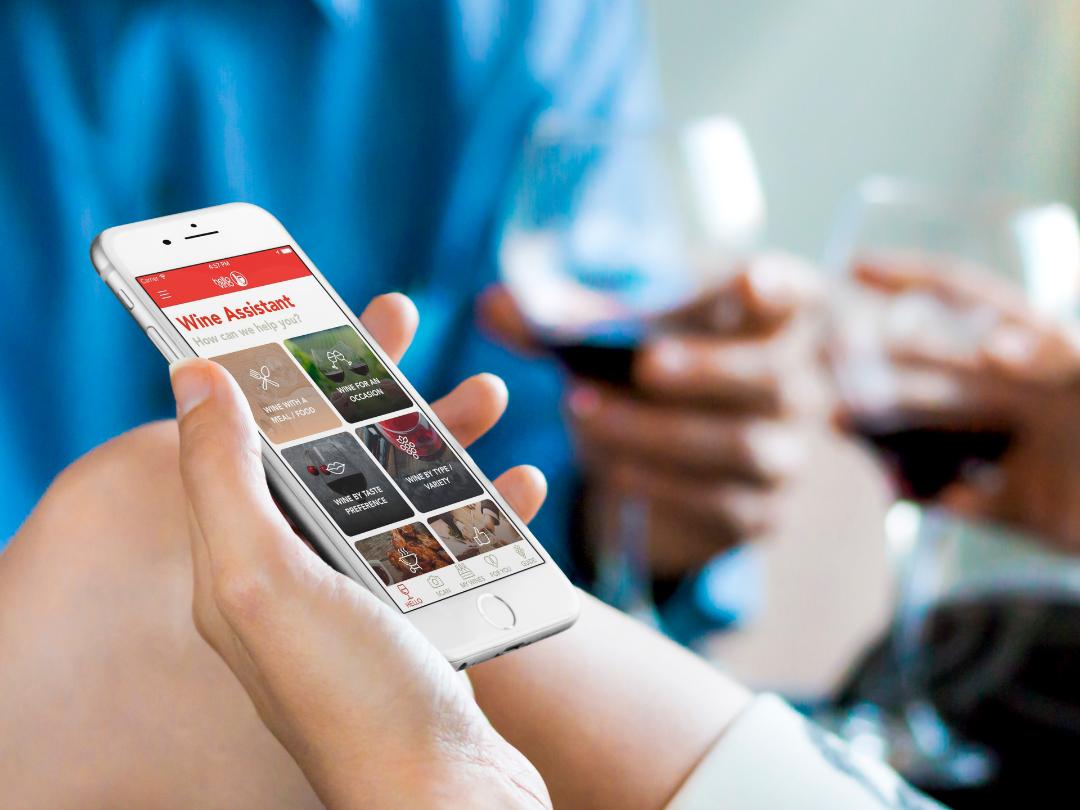

Hello Vino’s mobile wine assistant assists consumers with purchase decisions, while creating a scalable digital communication and sales channel

Enter: The New (Digital) Guard for Beverage Alcohol

Like the other retail categories, beverage alcohol has its list of those that are at the leading edge of adapting the industry more towards the purchasing behaviour of today’s consumers. The space is nascent, but leaders are already emerging. Without naming names, you can see how consumer technology highlighted in the business cases above are being applied to beverage alcohol:

Music & Video Discovery Apps → Alcohol Discovery Apps

Meals / Fashion / Game Kits → Virtual Wine & Beer Clubs

On-Demand Transportation and Hospitality → 1-Hour Alcohol Delivery

And we can’t forget about the Big Data by-product created by the ongoing collection of consumer preferences and purchase behaviour by these digital consumer applications. But, I digress.

Ok, I’ll name one name. Here’s the self promotion bit. Hello Vino is doing some exciting stuff on each of these fronts. I look forward to revealing our industry-first efforts in the coming months, as we continue to collaborate with strategic partners stepping up to take the lead.

In the meantime, please reach out if you’d like a sneak peek or would like to be involved.

- Hello Vino describes itself as a “virtual wine assistant” which “uses artificial intelligence to learn about your wine preferences” so as you tap through the choices, scan wine labels and rate your favourite wines, the app is set up to “make new wine recommendations based on your activity and settings”. Hence its claim to be the “first personalized wine subsciption service”.