Daniel Lambert has been quietly running his own successful wine importer business in Wales since 1992. Not that things are quiet any more…

It was a couple of months ago when we first talked about having a chat with Daniel Lambert and his wine wholesale business that he has built from scratch to become a multi-million turnover business over nearly the last 20 years. But when we finally found the time to do so, in mid January, the world had moved on at a pace. Particularly Daniel Lambert’s.

In fact even during the hour or so of our conversation he was constantly being phoned and contacted by officials in the House of Commons who were preparing MPs for a select committee hearing with Defra’s Parliamentary Under Secretary of State, Victoria Prentice, on the so called “teething problems” of dealing with Brexit.

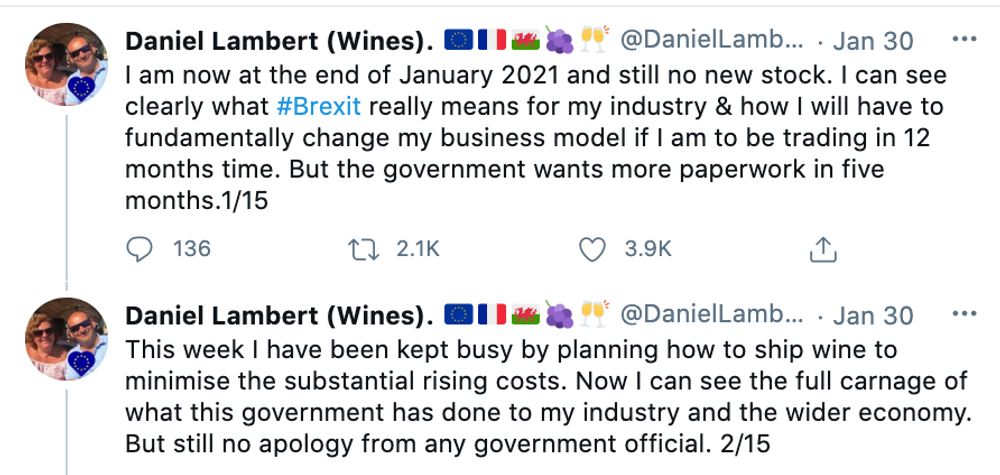

Daniel Lambert has become the voice of the wine industry – at least the wine importer side of it – with his social and national media coverage on the implications of Brexit

The issue has become Lambert’s specialist subject ever since the Brexit deal was finally announced on Christmas Eve. Not that he has gone out seeking any publicity or a media spotlight. It has simply been the consequence of working extremely hard on the detail of how he can now trade with the EU, and then very eloquently presenting those facts in a series of Twitter threads that took on a life of their own when they were picked up by national political journalists and the Westminster village.

It sparked, amongst others, a full blown analysis in the Financial Times, a follow up in the Daily and a major interview with LBC radio host James O’Brien, who was taken aback when Lambert told him it had taken him 21 days just to get the paperwork ready for him to place his first delivery with an EU producer last month.

“I have had an unbelievable response. I have had people in Texas, New Zealand, South Africa and many others contact me. It went properly viral [reaching some 5.4m people via Twitter],” he says.

Daniel Lambert was a special guest on James O’Brien’s LBC radio programme to explain the new Brexit trading rules

Needs must…

But behind all the headlines and media appearances, Lambert needs to be completely on top of what is now required to import wine from the EU, as that is what his business is dependent on. The success he has had, since 1992, has been based on his ability to seek out and import a constant flow of exciting, different wines from producers that have appealed to the growing network of specialist independent wine merchants.

A way of doing business he now says is impossible for him, and hundreds of others, because of the way the Brexit deal has been negotiated. A situation that he says is so dire and desperate it staggers him there are not more people, like himself, doing all they can to batter down the airwaves and tell their stories to their local paper or TV and radio stations.

He’s angry, pissed off, frustrated, and anxious all at the same time. The more of the Brexit conundrum he unravels, the angrier he gets.

It was only in the middle of January, for example, that he found out any producer wanting to export their wine out of the EU had to raise an EX1 form if it was to pass through any port. “No producer knew they needed it, and no importer here had probably heard of it,” he claims.

“The government is getting away all with sorts of things at the moment and it’s just not good enough,” he says. “I find it depressing the wine trade is passive about what is going on. Lots of small importers are going through the same thing as me, but are too scared to put their heads above the parapet. We really need some of the big boys in the industry to stand up and stay something.”

Daniel Lambert’s series of Twitter threads went viral and resulted in him becoming the focus of attention for the national media on Brexit and its impact on the wine industry

Sharing the knowledge

The reason why he took to Twitter to share his frustrations, and what he experienced in dealing with the new regulations was more to help his independent customers “understand what was going on” than it was to talk to the media or the public. It has, though, succeeded in doing all three.

The complexities of how a wine supplier can now bring wine into the UK from the EU takes some explaining. But here goes.

- For every order (EAD) of wine the producer in that country will need to create an EMCS form that allows that wine to transition through the EU to a port.

- They will need to transport the wine on special ISPM 15 fumigated pallets that are said to cost more and are harder to find.

- To export that wine out of the EU you will need an EX1 (that can only be produced by a specialist broker costing around £75) and EAD document from the producer in the country that the wine came from.

- To get the wine into the UK means going through the Chief system, which was previously only used for wines from non-EU countries, and have a C88 document – if you are bringing wine in duty deferred or duty paid. It makes sense, says Lambert, to send the C88 document to the producer you are buying wine from so that they can include it in all their paperwork for the port. A C88 also requires a broker to process costing a further £50 to £75.

- If you are importing the wine bonded then you need a movement guarantee (that costs around £50) and put it on a UK EMCS movement document. Or pay for a haulier’s movement guarantee, adds Lambert.

- It means every shipment of wine now incurs a fixed cost of at around least £125 to £150 in customs fees.

- If you do manage to get all your paper work right it is currently taking around six to eight weeks shipped from the EU, four weeks longer than before.

It’s the cumulative costs that are potentially crippling, says Lambert. Before January 1 it cost on average around £180 to ship one pallet of wine, that has now gone up to £400, he adds.

It’s a “catastrophe”

(Click here for Daniel Lambert on the catastrophe of Brexit trading rules for independent wine merchants and small importers dealing direct with the EU)

It effectively means, claims Lambert, that any discerning independent wine merchant, or small wine producer in the EU wanting to sell their wine in the UK, will no longer be able to operate as they have before. It’s simply uneconomic to be spending hundreds of pounds more to selling or buying a pallet or two of wine, unless you are prepared to put all that extra cost on to the average price of a bottle of wine.

It’s where he gets the now much quoted figure of up to £1.50 extra going on to a bottle of wine for a wine brought in from the EU.

“It’s got to be all aspects of the trade saying this is catastrophic of what is going on. Groupage is now dead…unless you want to pay quite a lot of money for it. That is catastrophic for independents,” he says. “Small growers are just not going to do it, it’s as simple as that,” he adds.

Which ultimately means all the “niche” wines from the EU, that make independent wine merchants stand out, is “all going to get annihilated”. It’s simply not going to be possible to mix all those wines from a number of producers together on one pallet and bring it over, he explains.

“We’re in a pretty shitty place now, as an industry,” he adds. Not only does he see ranges being dramatically cut, but there will be a knock on effect in the wine regions as suppliers won’t be able to stock numerous versions of classic styles such as Sancerre and Chablis.

(Daniel Lambert on why he fears wine ranges will be cut back & choice of EU wine in UK will decrease)

Economies of scale

The only way forward is for importers like him to only ship wine when they have enough volume and customers that can justify an order of at least nine pallets of wine. That’s the amount needed to “negate” the extra costs needed. “It’s about economies of scale.”

“This is why you have to get to that critical mass of about 9 pallets to negate that extra cost as it has to go into every extra bottle to bring that cost right back down again.”

Which for his business model will probably mean switching from bringing wine in from Europe once every two weeks, to once a quarter. But that will place enormous pressure, he adds, on being absolutely spot on in terms of planning and making sure you have the right volumes in the market at the right time to meet all your customers needs. Which becomes even more difficult when you factor in the uncertainty in the on-trade as to when and how far it can re-open in between any of those quarterly shipments.

(Daniel Lambert on why new EU trading rules means end of groupage and having to ship more less often)

It’s what Lambert has done in order to get his first shipment, post Brexit, from Burgundy. He clubbed together with a couple of his bigger independent customers, who were able to commit to buying a certain amount of stock to make the shipment viable, enabling him to bring in enough wine to service the rest of his customer base. He says other wholesalers and independents will have to do the same.

“I have thought long and hard how to circumnavigate all this. At least by doing this it gives independents a fighting chance.”

It does, though, open the way, he thinks, for some of the larger independents potentially opening up their own bonded warehouses and managing their supply chain and cash flow in that way and bringing in wine more on a consignment basis – which is how he works already with some of his New World partners. That way you pay for your wine, and your duty, when you sell it, he stresses.

Fundamental change

(Daniel Lambert on how Brexit now means a fundamental change in the way the wine industry works)

“The UK isn’t having teething problems. This is a fundamental shift in how all the UK agents are going to be trading in the future. You have got to think outside the box now.”

It will potentially mean a different kind of relationship between an importer and an independent, based much more on a mutual partnership than just being a supplier of wine. Lambert will certainly be looking to prioritise working with independents who can give him the buying assurances he needs to get the right wines for them.

It will then, he says, be up to the switched on independent merchants to see this opportunity for what it is and why they will have to rip up their traditional trading models if they are going to prosper in the future.

“I can’t see how you can continue to trade with the EU, trying to do what you used to do without it incurring costs.”

For some particularly niche, premium and must have wines in his range then, he says, he will have to trade as he used to do and bring in a pallet or two at at time. But when he does he will have to pass a surcharge of 30p to 45p per bottle.

(Daniel Lambert on a very different way of working for independents and their importers)

“If there is one positive from all this, then the role of the agent is more important that it’s ever been before. Without question,” he says. “But it’s not a positive that I happily grasp, or have sought to gain from.”

In fact, importers, he adds, now have a role to play in helping independents explain to their customers quite why the price of so many of their favourite wines have suddenly gone up.

But equally independents now have to “adapt their business” models in order to be able to work with importers in the most mutually beneficial way. “You have got to adapt your business and work with the agent to make it as most cost effective for them and for you – and that’s a very different way of working.”

All change for supermarkets too

The new trading regulations will also mean the bigger distributors, and the major supermarkets, who are buying £8, £9, £10 wines, and above, will potentially have to change the way they work. Before Brexit they would usually only be importing three to four pallets of those wines at any one time, claims Lambert. Now they too will have to ship in much bigger quantities, but “they just don’t physically have the warehouse space” to do so. “This is what people are not grasping.”

Particularly as most supermarkets work on a three to four week replenishment cycle, he adds. How are they going to cope with all this extra wine in their supply chain and continue to maintain the same pricing on their wines?

The answer is they won’t, says Lambert. Apart from the mass volume branded and bulk wines that work on a different trading model. For the majority of European wines prices will have to go up, he says. “Nobody is going to go unscathed.”

Switching supply to the New World is not going to solve the problem either as there is simply not the volumes available from the likes of Chile and Australia to plug a potential gap from the EU, he stresses. “You can’t expect to get another 20 million bottles from Chile – where are you going to get it from?”

There is also potentially more trouble ahead, he warns. Yes, it was a relief the much dreaded VI-1 forms, that would have involved getting an expensive laboratory test for each consignment of wine, were removed, but it is only a reprieve until July when the government and the EU will reveal details of whatever compromise plan for VI-1 forms, and its alternative, they have come up with.

“It’s absolute political bullshit that is going on. The wine trade is being used as a bargaining chip for these VI-1s,” he says.

* In Part 2 of our in-depth interview with Daniel Lambert we talk to him about his trading strategy and how he has set out to offer niche and interesting wines to what has become a growing but crucial independent merchant customer base and how he hopes to do more with the on-trade once it reopens.