We have never had more data at our finger tips to help us in whatever part of the drinks industry we are in. But do you know where to look and how to analyse it to help you make better decisions about how to run your business? Enolytics, and other data analyst services, believe they can help you.

No matter how sophisticated a restaurant or pub group’s back office systems are they are mostly operating blind when it comes to knowing exactly who is buying their wine and why in any of their outlets. They will know how much of a particular wine they are selling and at what price, but beyond that the data trail runs cold.

Even if they have set up sophisticated registration and guest monitoring services it is not always easy to unravel the information to make any sort of conclusions about the wine styles and regions that individual customers want to buy other than their purchase history.

But we also know how strategically important data analysis now is for any business to really maximise their success. The difficulty is knowing what sort of data to collect and then how to interpret it.

Cathy Huyghe hopes to provide part of the answer with her new Enolytics service, that basically does what it says – analyse wine statistics and data.

Visualising data

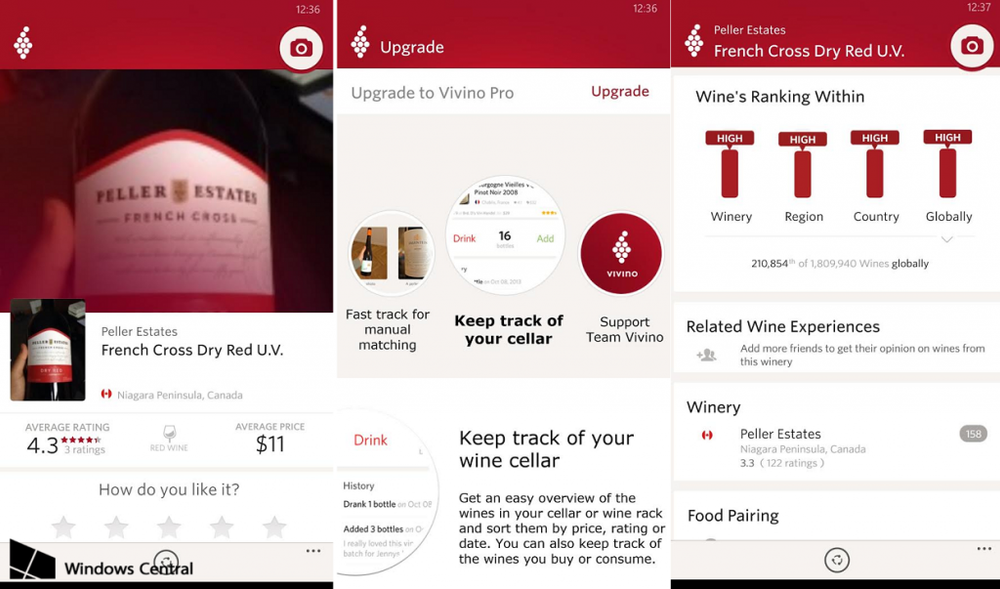

New consumer apps like Vivino have masses of valuable consumer data if you know what to look for

Huyghe, a highly respected US wine writer in her own right and regular contributor to leading titles such as Forbes, admits she is not a data scientist per se, but is, through Enolytics, able to bring together data analysts and scientists to decipher data of wine consumers, producers and suppliers to look at wine in a completely different way.

Her initial strategy is to work with the various wine platforms and app providers that are now handling millions of searches and transactions a day around the world.

As she explains: “It is essentially making the most of analysing data in the B2C wine market. We are working with major consumer wine platforms, like Vivino, and using their data to help understand how consumers are engaging with wine online. We are using metrics that allow us to visualise big wine data in real time.”

For now Huyghe and Enolytics is concentrating on interpreting and analysing how consumer are engaging with the new wine apps to see what they are searching for and why. These businesses are sitting on masses of data just waiting to be sliced and diced.

Challenging wine perceptions

Wine producers might think their closest competition is wine from the same country or region when, in fact, analysis of which other wines consumers are searching for at the same time could come from the other side of the world

But, in time, the same process and data mining could be done for restaurant data. Providing there is enough information to be accessed.

Huyghe adds: “A wine producer will have its own perception about why their wine is being preferred over another. They might base that on looking at Nielsen or IRI data, or information from their importers and accounts. But it is not telling them how consumers are behaving around their wine online.”

It is still relatively early days for Enolytics and it is to a degree reliant on building working relationships with the likes of Vivino so that it can access their data. “We are knocking on the doors of these consumer platforms that have all the data we need to give a more comprehensive analysis of what consumers are thinking when they are searching and buying wine.”

Crunching data

Enolytics is also able to work with individual wine businesses or producers to look at the data it already has so that it can be used to help them make better decisions about what their customers ultimately want.

Huyghe points to a recent report it did for a big European wine producer to see which other wines consumers were searching for online at the same time as they were looking for their wines. It made for a fascinating results. For whilst this specific producer had thought its direct competition was other producers from the same region, or country, the consumer data showed it wasn’t.

“It was, in fact, producers making wines with different grape varieties from other countries on the other side of the world. This was a major lightbulb moment, for them and for us,” she says.

Enolytics will work with a data provider to buy a set amount of information to help them analyse consumer behaviour within certain parameters. “So it could be wines bought between $90 and $120, or it could be by grape variety or country at a particular price,” explains Huyghe. “The results are surprising. What a producers’ real competitive set of wines are based on their searches are not always what you would think. We can also help producers use this data to see how well they are performing versus other players in terms of the number of searches they are getting for wines at certain prices or vintages or availability over time.”

Pinpoint data

Enolytics can work with wine distributors to analyse what type of wines and at what prices are being bought right down to post code level in different districts of say a major city like New York or London

But it is how far the data can be analysed that is so interesting and potentially so useful and exciting or producers, suppliers and operators alike. “We can drill right down to the individual wine and price,” says Huyghe. “Even down to what time it was bought.”

Whilst most of its work to date has been interpreting consumer app data, there are aspects of that which would be very useful to wine distributors looking to work in specific cities, or even districts and regions within a city.

“We can take this down to postcode level,” says Huyghe. “Vivino searches, for example, are accurate to within 100 feet from where it was made. So we know what sort of wines people are looking at in specific areas of a city like New York or London, and at what particular time. Which, as you can imagine, would be very valuable to wine distributors and producers looking to sell their wine there. We can truly create a comprehensive picture of consumer sentiment in any major wine market.”

The beauty of data is that you really don’t know what it is going to be found until you do the analysis. “Our analysts look at the data in many ways and can find correlations that are not obvious, yet very insightful when creating sales and marketing strategies. We can start as general as a particular country, then we can keep narrowing to region, then to a brand and then down to an individual wine label.

“Remember that in some cases people are scanning wine labels on these apps, which creates very discrete data, so we can drill right down to that level.”

In context…

It is important not to generalise wine data, says Huyghe, for how people shop say in London would be different to the choices they are making around the UK or in other European cities never mind the US

It is important, however, stresses Huyghe not to make too many generalisations about the results. For its analysis is based on a set of specific searches. “Doing a search of consumers say in the US would produce a very different set of results from in the UK. The markets are different, and consumers behave differently. That information is very important for a brand to know.”

Collaboration not competition

Huyghe understands the whole area of Big Data and data mining is pretty new to most wine businesses and it will take time for the industry to really see the benefits that can be made. Which is why she welcomes the fact that major wine sites such as Wine-Searcher.com and Drizly, the US home alcohol delivery service, are both now looking to offer new data analysis as part of their added value services.

Drizly opens up a new data channel for Enolytics – food and drink choices whilst dining at home

Wine-Searcher.com data, she says, will be key to understanding country-specific trends and what is dictating purchase decisions. It is already an important tool for wine merchants and buyers to compare prices and analyse consumer demand for wine on daily basis (some 210m consumer searches a year) and from price lists of stores and producers around the world – currently sitting at around 87,000 different businesses. It is now turning that data to build bespoke reports that help producers, retailers, suppliers and operators better understand changing consumer behaviour and how product pricing might be impacting on their businesses (see here for more details).

Whilst Drizly, which now operates in 70 US cities, will through its new Data Distillery, be able to provide aggregated e-commerce data from the past four years. It homes in on consumer preferences and buying patterns, based on price sensitivity and actual sales data.

As Huyghe says: “What’s incredibly important about these two announcements: it makes consumer data all that more accessible. They shine a spotlight on the inherent potential of consumer-driven platforms. Consumers are talking about their preferences for wine and spirits every hour of every day. We just have to know how to listen. Wine-Searcher and Drizly just made that a lot easier.”

The more data sources there are across multiple platforms then the more effective businesses like Enolytics will be, says Huyghe. “If we don’t collaborate, Enolytics wouldn’t have a reason to exist,” she adds.

Data – it can’t be ignored

The challenge, she believes, for wine – and all drinks businesses – going forward is how skilled they are at “being able to integrate different sources of data, including their own, so that they’re working with the most complete picture of the wine consumer puzzle”.

The ultimate prize being able to understand the wine consumer better and what they’re thinking.

If they’re being positive or negative about your wine, which words are they using to describe it? Is it about the flavour, how well it goes with food, is it the country, the winemaker story?

“The data will help wine businesses really identify who their competition is. Because it won’t always be who they think it is.”

She is hopeful that more consumer apps will be willing to collaborate and share data. After all data mining is not what they set themselves up to be. “Vivino sees itself as the Amazon of wine,” says Huyghe, and their new Market functionality lets users browse and shop wine from hundreds of retailers, all from within the app.

For now consumer data and information remains the wine industry’s “blind spot,” says Huyghe.

But with Enolytics and new data services from long established, respected sites such as WineSearcher.com, our ability to see what that data means about consumers is very exciting indeed.

* If you want to find out more about Enolytics you can contact Cathy at cathy@enolytics.com