Cava has a crucial role to play in the ever growing sparkling wine category, particularly as it has the support of major brands, like Raventós Codorníu, to help drive the sector forward. But where does Cava sit in the priorities of UK buyers looking to make the most of their sparkling wines sales? The latest The Buyer Debate looked to find out…

(Click here to watch the full Cava Debate)

In many ways Cava is a victim of its own success. So well known and established around the world as a sparkling wine category in its own right, it is usually referred to as one big mass of wines, rather than divided up into all its respective parts. But then it’s the same for Champagne and you don’t get to hear too many grumbles coming down the tracks from Reims to being thrown under one big (branded) umbrella.

But, like Champagne, there is so much more to discover once you draw back the curtain and start to explore the different styles, regions, and ageing potential the vast array of Cavas have to offer.

Zoom might lack its own “open curtain” function, but it provides a great platform for buyers, producers and wines to come together for healthy debate – and Cava offers plenty of that.

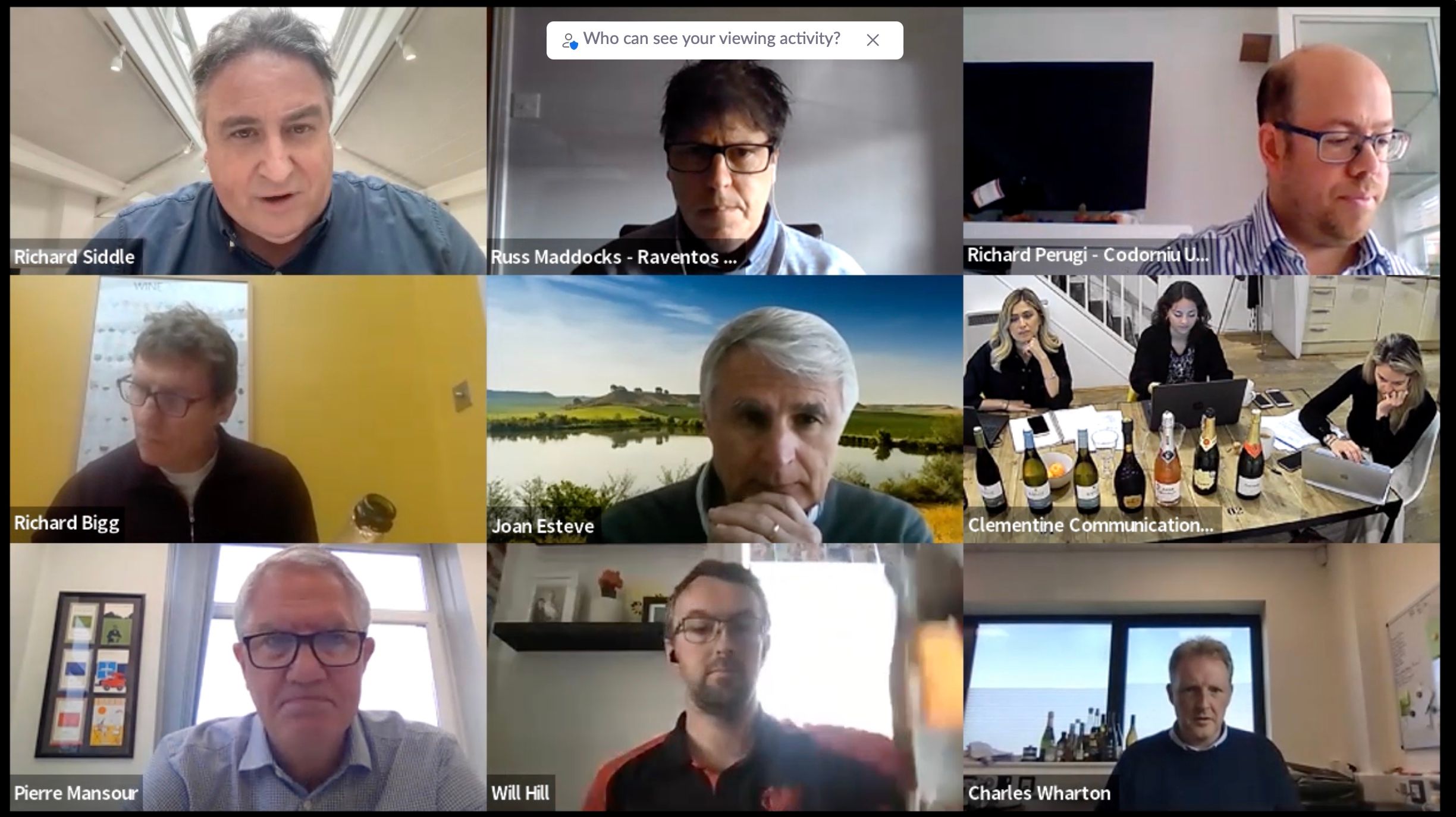

Our thanks go to our panel of buyers that included:

- Richard Bigg, founder of Camino, the specialist Spanish restaurant and tapas group

- Pierre Mansour, wine director, The Wine Society

- Harry Crowther, UK wine buyer for Good Pair Days

- Will Hill, head wine buyer at Humble Grape

- Charles Wharton, managing director, Ellis Wharton Wines

They were joined from Raventós Codorníu and Raimat by:

- Richard Peruji, Codorniu’s key account manager for UK and Ireland looking after its off-trade sales

- Russ Maddocks, Codorniu’s national account manager looking after the on-trade

- Joan Esteve, general manager Raimat winery

“I have been a big fan for a long time,” is how Richard Bigg at Camino kicked off the debate. He was quick to praise Codorniu not only for the quality of its wines, but how innovative it has been over the years introducing new styles. “I am particularly impressed for such a huge producer.”

Cava is a “huge” category for Camino as it is the only sparkling wine it sells, says Bigg. So it has to be right. “Cava can provide all the quality you need, and whilst it uses the same method as Champagne, I really like how it has its own identity and Mediterranean style.”

He particularly admires how producers are using indigenous grape varieties in their Cava blends as it helps give it a “strong identity” to the wines they are producing. “We sell a lot of it and it is very popular.”

(Video extract: Camino’s Richard Bigg on why he is such a big fan of Cava)

Camino sells three types of Cava: its house Brut style; a rosé; and a Gramona for more premium and Reserva sales.

“I think a lot of people get that it’s a lot of bang for your buck. It’s extraordinarily good value. I just don’t understand how a wine made in the traditional method can be so affordable. People really enjoy it. It’s easy drinking, but there’s more to it as well. There’s substance to it.”

It is also, crucially for a restaurateur a great wine to serve with food. “It’s a big deal for us.”

Huge potential

Pierre Mansour at the Wine Society is in total agreement with Bigg about what he calls his “confidence and support” for Cava that he thinks is “without doubt one of the best quality traditionally made sparkling wines that’s outside of Champagne”.

He also likes the fact that Cava has created its own “individuality” thanks to the local grapes that are used in its blends.

The Wine Society currently has around 90 sparkling wines out of its 1,500 wine range, of which four are Cavas, including its own Society Cava. But those four Cavas accounted for 28% of the volume sales of all its sparkling wines in 2020, with prices ranging from £8.95 for its Society reserve level Cava through to £20 to £23 a bottle.

“We certainly have demand for Cava,” says Mansour. “But there is a but. There is definitely a gap in perception between what I believe in the quality that Cava offers, and what the British consumer’s perception of Cava is.”

He adds: “If we were a Spanish specialists we would work with many more Cavas. The quality to price ratio is extremely good, but Cava has a branding image issue which makes things quite difficult.”

(Click below for Wine Society’s Pierre Mansour on the potential of premium Cava with its customers

That said he was extremely impressed by the range of Cavas put forward by Codorniu for this debate. “The quality of Cava is incredibly consistent, but not in a simple bland way. You can taste the difference between a house style.”

He says what The Wine Society and other major retailers need Is to see more work done to “embellish” the overall Cava image “in a way that enhances Cava and and does not put it out of the reach of most wine drinkers”.

Work on branding

Will Hill at Humble Grape was in complete agreement over the “quality and consistency” you get from Cava.

The big issue it has is its image and branding and in its own Humble Grape sites Cava is often seen by its customers as “old fashioned” and “not as trendy” as the sparkling wines you can get from other regions and countries where it is doing particularly well with Pet Nat styles and Crémants. He says there is more of a nostalgia attached to Cava and “work needs to be done” to modernise its image, particularly amongst younger wine drinkers.

“But then proof is in the bottle once people taste it there is not one complaint,” he adds.

Charles Wharton says it has three Cavas on its list and four Proseccos and for every six bottles of Prosecco they sell a bottle of Cava, but he wishes it was the other way round. “The trouble is getting people to trade up to more premium Cavas. That’s our biggest problem. But there are some amazing Cavas out there, it’s just getting people putting them in the same price category as Champagne. With some of the good ones there is definitely the quality there.”

That said Ellis Wharton is selling more Cavas than it used to, the key is to move people up the pricing ladder, he adds. “We can trade people up to Crémant, Champagne and English sparkling wine, but can you get people to trade up from £10 to £15 [with Cava]. That’s what we struggle with.”

Harry Crowther at Good Pair Days, the new online wine site that uses machine learning algorithms to assess people’s general tastes likes and dislikes to pair the right selection of wines for them from its list, says it has successfully listed five Cavas between £12 and £17 and managed to sell 1,000 bottles since it launched in December 2021. Customers are asked to rate the wines they taste and Cavas come in at around 3.9 to four out of five so they definitely appreciate the value and quality, he adds.

“Cava has been in a no man’s land for a while in terms of its price point. People will either jump to Prosecco, or if they want to trade up they will jump straight to Champagne and Cava has been left in that no man’s land price position. But we don’t struggle to sell it,” says Crowther.

He believes there is potentially much to be gained from the “Corpinnat movement” and how that is encouraging producers to make sparkling in a slightly different way, which he believes might “have inadvertently done some good for brand Cava” and helped put some more spotlight back on the category. “I think it is important to consider what is happening with Corpinnat.”

(Click here for Codorniu’s Richard Peruji on challenges and opportunities for Cava in the UK)

Richard Perugi says it is important for a brand like Codorniu to also be able to put its consumer hat on and look at the category from their side of the fence and put it in context with other sparkling wines, particularly the huge growth in Prosecco, which “has helped put sparking wine back on the map” – and had a knock-on effect on the Cava category too. Global Cava sales across all styles are up around 17% in the last year.

“The biggest challenge for Cava is to upgrade customers away from the no man’s land it has been in for the last decade and the fact it is undervalued and underpriced. So you have a lot of volume of Cava going out at entry level price Prosecco, in that £6 to £10 bracket. which is doing a disservice to the quality and workmanship that goes into a traditionally method sparkling wine from a great region such as Catalunya.”

He sees the £10 to £20 price bracket is they key target area for premium Cavas and where it can hopefullybring younger consumers into drinking Cavas and upgrade from the more easy drinking styles of Prosecco.The success that English sparkling wines and more recently Crémant have had in that key price bracket shows the opportunity is there for Cava to do the same, he adds.

Cava now “has a great opportunity to really emphasise its quality level” and emphasise the USPs it has, like the use of indigenous varieties in its blend. “There is a lot to be done and we feel like we are at the start of that journey,” says Peruji and Codorniu clearly has the scale and marketing budget to make sure it is not losing any more “head way” to other major sparkling wine categories. But it has to get the image right in order to justify the higher prices.

“All about education”

For Codorniu’s Russ Maddocks “it’s all about education” at the front end of the on-trade where often you will see three sparkling wine choices: an entry level Prosecco; a house style Champagne; and then a premium Champagne. Leaving a big hold in the middle for a premium Cava. “They are going from £20 to £25, straight up to £30 and then straight to £60. There is no tierage,” he says which you would get in the still wine category.

It’s Codorniu, and the other major branded players, job to get out and help work with bigger operators to see the opportunities there are at all these different premium price points, he says. If they can he thinks there are “massive opportunities” to move the trade and consumer alike away from the “80s and 90s stuffy Cava image”.

“There is so much growth, anticipation and expectation out there it is massive.”

Perugi says Cava only has to look at the English sparkling wine category for its inspiration and how it has been able to drive its premium image. Their goal has to be getting the drinker who is regularly looking for sparkling wine in the £12 to £20 price range.

“Anything above the £10 is our holy grail. Get people above that £9.99 mark and you can really add value to the category and the image.”

He adds: “It’s about getting the image of Cava right so that we can justify that shift from £7 to £9 to the £12 to £14 bracket where you get an even better price to quality ratio.”

It is a similar situation in Spain says, Joan Esteve, where all the good work being done in the vineyards and cellars “is not being communicated well to the consumer”. He says the number of cheap Cavas in its domestic market has also “damaged the image of the category as a whole”.

(Click below for Codorniu’s Russ Maddocks on educating the trade & consumer alike about potential of premium Cavas)

Pushing prices

Mansour says it really comes down to quality first and then reflect what its Wine Society customers are expecting. “We don’t really put a price threshold on it,” he stresses.

He would, for example, most certainly consider a Cava costing £20 to £25 if it had the right “quality and finesse” the issue it is has is the “status” factor that has also become part of the sparkling category. Where does Cava sit as a potential gift for someone to take to a dinner party or celebration if it costs more than £20 compared to a Champagne?

“I think there is this sort of tension between not wanting to lose that value for money message that Cava does so bloody well, in terms of price versus quality ratio, and getting too luxurious. I think that would also be a mistake. Cava has an opportunity to cut through that snobbery,” he adds.

The thinks the best way for Cava brands to do that is to “tell the story about what makes Cava different” and put the focus on the local grapes that are used and its unique climate and soils.

Richard Bigg says the quality of Spanish and tapas bars and restaurants around the UK can also really help, providing they promote premium Cava. He is also encouraged by the number of £10, £12 and £15 single variety Cavas he sees in the major supermarkets that must be doing well for them to get more listings.

As for helping out with the image he urges the Cava authorities to team up with big Spanish personalities like Rafa Nadal, Penelope Cruz or Fernando Alonso and help bring some glamour and excitement to the category as well.

Charles Wharton says that through its retail business it does not have any real issues selling Cava at £20 to £25 a bottle. In the same way it does not have a problem selling £30+ bottles of English sparkling wine. The issue is getting people to come in asking for Cava specifically and not just a “bottle of Prosecco” where the Prosecco is just the generic name that people now use for any sparkling wine.

Will Hill says the £25 to £30 price category remains an easy selling point for the customer coming into Humble Grape to buy wine to take away. “It’s a sweet price point where you can recommend a lot of things,” he says.

Where Cava has a balancing act to address is the quality and image of its bottles and how premium they look against other sparkling wines, yet the price tag does not reflect that premium look, he adds.

Harry Crowther says Good Pair Days would struggle to sell Cava at above £20 – its bigger volumes are sold more at £15 to £17, but he can see the potential to “pull people” through the price points in the on-trade. Particularly if staff can focus in on the traditional method and the fact Cava uses so many of the same varieties as Champagne and yet it is half the price.

- If you want to find out more you can go to Raventos Codorniu website here.

- Part two of the debate write up will be published later in the week.