If wine brands, producers and retailers want to hit key sub £10 commercial price points after the new duty reforms come into place on August 1 they are going to have to make, source, buy and sell wine in a very different way. The situation for mainstream spirits brands, fortified wines and port is even worse. Richard Siddle on what we can expect…

So what is going on? Why is the drinks industry so fixated on this August 1 date and what are these changes in alcohol duty?

The drinks industry is going to have move fast to keep ahead of and on top of the alcohol duty reforms coming its way on August 1

That’s a lot of questions to answer in one go, so let’s break this down into its various component parts.

The UK wine and drinks industry – and all those that supply and work in it – is rightly concerned about what is going to happen come August 1 and the government’s new alcohol duty reforms come into place. A highly controversial policy that has the government claiming, on the one hand, it has made “the biggest reforms to alcohol duty in 140 years” and in so doing replacing what it describes as an “outdated and impractical system” based on “obsolete rules” it says were handed down by the EU. A new policy it claims introduces “new freedoms” and the chance to radically simplify the entire system” and “slash red tape” along the way. A new “common-sense approach” to tackle duty “whereby the higher a drink’s strength, the higher the duty”.

Which is a pretty interesting spin on a policy that has been universally derided by those tasked with implementing it. The last few months has seen wine producers, distillers, major brand owners, importers, merchants, and retailers alike all queuing up to denounce what the collective drinks industry sees as taking a hammer to crack a nut. The biggest single alcohol duty increase in 50 years that could result in losses in wine and spirit sales and a massive administrative burden on already troubled businesses across the on and off-trades and up and down the wine and spirits supply chain.

That’s quite the difference in opinion. So in a nutshell what are these new reforms all about?

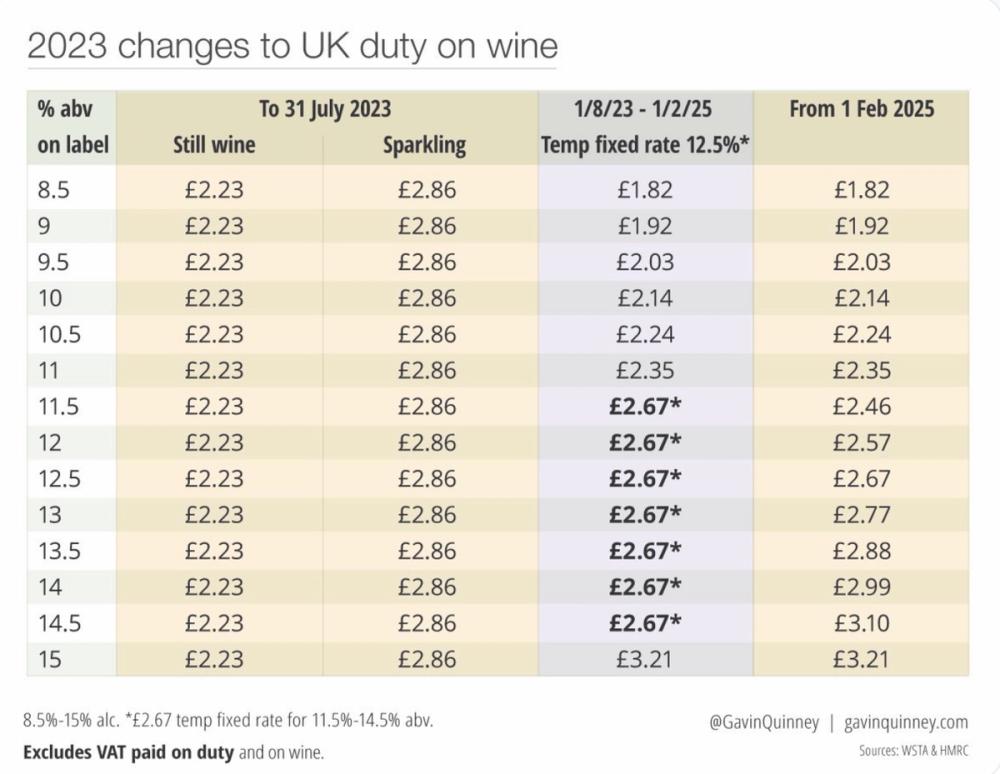

The government’s new alcohol duty reforms will effectively split the still wine market into three categories from August 1:

- The low alcohol category between 8.5% abv and 11.5% abv suddenly becomes far more attractive due to favourable duty rates that work out, compared to the current £2.23 duty rate, at: £1.82 for 8.5% abv; £1.92 for 9%; £2.03 for 9.5%; 2.14 for 10%; £2.24 for 10.5%; and £2.35 for 11% wine.

- The mainstream market where most wines are sold between 11.5% and 14.5% will all now be taxed at £2.67 compared to the current rate of £2.23.

- The 15% and fortified wine market from 15% to 18.5% – covering fortified, port and sherry – will see duty rates between £3.21 (15%) and £3.95 for 18.5%. Fortified wines, including sherry and port, which will see a duty rise of 44% (+VAT) adding around £1.50 to a bottle (Steve Moody exec chairman of Fells via WSTA).

What’s more:

- The average bottle of vodka with an abv of 37.5% is faced with a 76p increase in duty.

- Beer is the only category to fair better with only a 0.04% increase for a 4.5% beer.

- The new duty reforms will also place a heavy burden on smaller, craft producers, particularly craft distillers.

- Smaller suppliers and wine merchants will face increased costs having to deal with all the added administrative costs in calculating and implementing the full duty reforms.

Even the government’s own senior MPs are against are the changes. Sir Graham Brady, the influential chair of the 1992 Committee, and also chair of the All-Party group for wines and spirits, says the government has to “stop making things more difficult for the sector” and concedes the new duty reforms are a “huge bureaucratic challenge, especially for smaller businesses”.

Miles Beale, chief executive of the Wine & Spirit Trade Association, says these duty reforms are the icing on a cake of duty increases that have since 2010 seen:

- 21% increase in beer duty

- 32% on spirits

- 58% on wine

- 90% on Port.

He took to Twitter last week to say the “government’s aim for a simpler, fairer, less bureaucratic system [has] failed UK #wine #spirit #business and #SMEs on EVERY count”.

What does that mean to the average bottle of wine and spirits on sale in the UK?

Shoppers are going to notice some big changes down their local supermarket wine aisle over the coming months

It effectively means an on shelf 20% increase in price – 44p – for wines between 11.5% and 14.5% from August 1 – 90% of all wines sold in the UK – based on duty going from £2.23 to £2.67. Throw in VAT at 20% that increase goes to 53p per bottle (Source: Gavin Quinney). The Wine & Spirit Trade Association claims the increases could amount to over £1 a bottle once all the administrative costs are included.

But that’s not even half the story. This is only a temporary move to get us all used to thinking about taxing alcohol, and wine in particular, on percentages of alcohol. The real ‘fun’ starts on February 1 2025 when the government unveils the full ramifications of its ‘simpler, fairer’ duty regime with what will be 27+ new duty bands for wine.

This will include different duty rates for every 0.5% increase in alcohol in wine from 11.5% upwards – the same system that is being applied to wines between 8.5% to 11.5% and 15% to 22% abv from August 1. Meaning from February 1 2025 a 11.5% wine will have £2.46 duty per bottle, rising in stages to £3.21 for a 15% bottle.

Perhaps not quite as ‘simple’ as the UK government and Treasury officials would have us believe.

It’s all a bit confusing isn’t it?

It most certainly is. To help the trade – and wine drinkers – pick their way through the maze of duty regulations Gavin Quinney, owner of Chateau Bauduc in Bordeaux, whose business model relies on selling a large proportion of its wine direct to consumers in the UK, has pulled together a brilliantly comprehensive analysis of what the duty changes are and the potential impact on wine bottle pricing in the UK. If you are involved in buying and selling wine in the UK it really is a must read – and you can access the full thread here.

https://twitter.com/GavinQuinney/status/1678981369005744128?s=20

Here are two charts that set out what to expect for still, sparkling and fortified wine.

So what can we expect to happen come August 1?

All will be revealed shortly, but it is likely to polarise the UK wine and spirits market and on and off-trades even more.

If major retailers and supermarkets want to keep on hitting the key consumer price points for wine below £8 they are going to radically have to change where they are sourcing their wine from, and switch their focus to producers, brand owners and suppliers that can provide them with quality, value for money wine that either come in at below 11.5%, or sit just a little higher on the alcohol duty accelerator.

Major brand owners who have comfortably sat in the Top 10 or 20 best selling wines in the UK off-trade will be scrambling behind the scenes to see what they can do to get their alcohol levels down without damaging the quality and reputation of their wines. An extremely difficult and potentially dangerous balancing act to get right.

If you look at a lot of the major brands currently on supermarket shelves – like McGuigan, Campo Viejo, Yellow Tail, Casillero del Diablo, Dark Horse, Hardys – and many sit at 13.5% to 14% abv. All of which are facing duty hikes of £2.88 to over £3 come February 2025.

Its not surprising then if you look at the portfolios of most of those major wine brand owners and they have been quietly testing and trialling lower alcohol wines for some time – at least those that can legally do so. Some brands are already in market, others are waiting in the wings to launch when the time is right. Which is very much now.

The new Belight range from Casillero del Diablo comes in at a duty busting 8.5% abv

Concha y Toro, for example, has just revealed details of a lower alcohol style for its mammoth Casillero del Diablo brand. Its Belight Sauvignon Blanc Casillero del Diablo wine comes in at a duty busting 8.5%.

But whilst producers across the southern hemisphere and north America are free to do pretty much what they like to their wines to hit commercial price points, wineries in Europe are going to be completely disadvantaged as strict appellation rules across France, Italy, Spain, and others, do not allow them to change the wines they make, and certainly do not allow them to install a spinning cone machine to reduce the alcohol level.

What happens to all their sub £10 wines now? Will major buyers simply stop stocking what have been mainstays in their ranges for decades? How will supermarket customers react if the choice of wines they can buy between £5 and £10 is restricted to those that can supply high volume, low alcohol wine?

What are the big supermarkets and major wine buyers doing to prepare?

You only have to go back to this year’s ProWein in March to see the real impact in the trade. That was when the major UK supermarket buyers were falling over each other to scour the halls looking for producers that can supply them with large volumes of lower abv wine.

It is highly unlikely they were able to fill their order books in time for all those wines to be on shelf come August 1, but the ground work is being done right now with their major suppliers and the producers they work with to look at their 2022 and 2023 harvests and see what can be done to bring alcohol levels down to the required amount to hit key sub £8 price points.

UK wine buyers will be out in force at WBWE this year looking for high volumes of low alcohol wines to keep up with alcohol duty reforms

The World Bulk Wine Exhibition in Amsterdam in November is already gearing itself for big demand for lower alcohol wines and all the supporting cast of de-alcoholising companies and related service providers. What was a niche part of the show is expected to be the main draw – at least for major UK buyers booking planes for Schipol.

The big problem will be supply and demand. There are simply not enough de-alcoholising machines out there and waiting lists to get them on stream are growing by the day. Plus you have to factor in how good and reliable they are in the first place. Spinning cones and reverse osmosis technology have been in the trade for years, but have not taken off in the way the manufacturers would have hoped as buyers – and ultimately consumers – have simply not been consistently happy with the results.

The worry is that for some price dominated retailers it is now a case of needs must – regardless of how good the quality of the wine in the bottle. Pressure is being applied to suppliers to get them wines they can continue to sell at £5, £6, £7, £8 a bottle. But it is a difficult and potentially dangerous road for distributors, producers and retailers, alike, to go down and all eyes are on the de-alcoholising sector to really step up to the mark.

It is also, frankly, pretty depressing if the major multiples and the hard discounters continue their race to the bottom and don’t see that as – finally – a reason to push up the bottom tier of pricing to a level that all in the supply chain can make a profit from.

But don’t hold your breath. The pressure on suppliers to absorb increases in supply chain costs are as acute as ever. The Sunday Times reports this weekend that Tesco made it quite clear to suppliers at its latest grocery summit that it sees the market moving from “inflation to deflation” and expects them to pass on savings and help them offer reduced prices to their customers – pointing to charts that show a 50% drop in wholesale electricity prices, a 22% reduction in plastic PET packaging prices and an 84% fall in the cost of freight over the past year.

Are we likely to see different brands and wines on sale?

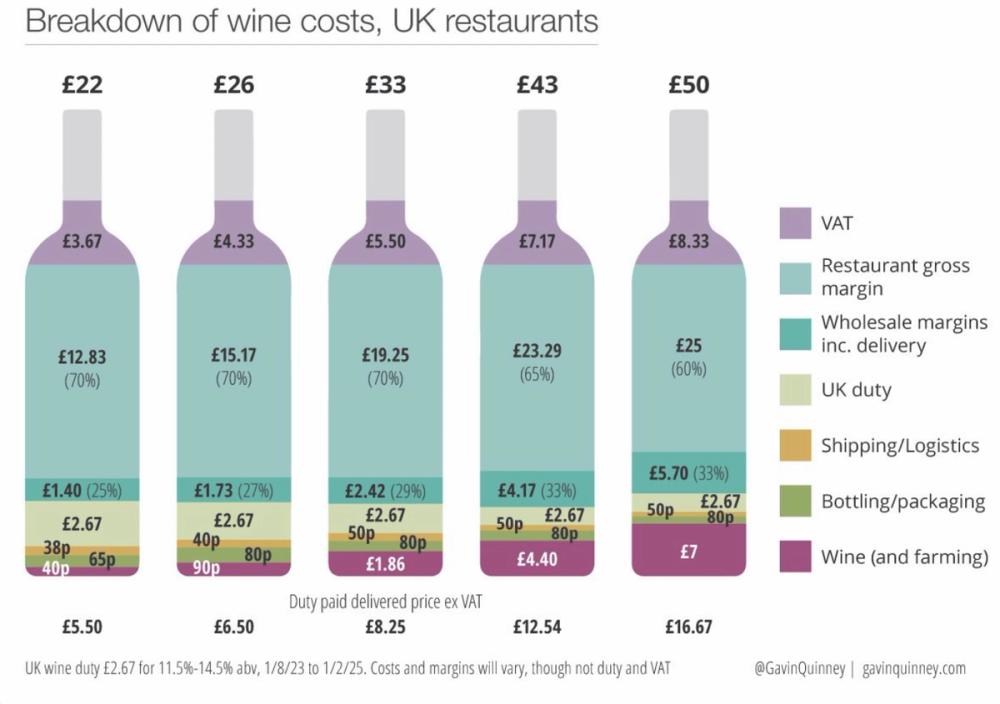

Gavin Quinney of Chateau Bauduc has broken down the costs involved that make up the average bottle of wine on sale in major retail stores

It’s clear if we fast forward to February 1 2025 the average supermarket wine ranges are going to look very different to how they are now. But will the brand names have changed much? It is certainly not in the retailers interest to suddenly swap the Top 10 or 20 wine brands with a raft of new names that consumers don’t know or trust.

But it will be up to the likes of Concha y Toro, Gallo, Treasury Wine Estates, Accolade Wines and Freixenet Copestick, and others, to come up with new solutions, making and sourcing wines below or around 11.5% that still stand up to scrutiny and are good quality. Chances are some of our biggest wine brands will exit certain parts of the market, leaving the £5 to £8 category to those who can, somehow, still effectively compete at that level.

As to the quality of those sub £8 wines, and just how much appeal they have to wine drinkers once they realise the alcohol levels in so many of them are far lower remains to be seen. Yes, there are many natural ways to lower alcohol levels, be it picking grapes earlier, canopy management and the rest, that arguably does not lower the overall wine quality, that is not going to be possible for all the millions of litres of wine, particularly from hot, dry southern hemisphere wine producing countries that will have to rely, at least in part, on alcohol reducing techniques to hit the alcohol levels they require.

But it again totally alienates those major European wine producing countries that are not allowed to alter their wines.

And where does it leave the average wine drinker. Yes, the major beer brands have shown the success they have had with 0% alcohol versions that have worked well with consumers, but the processes required are more complex and less successful when reducingalcohol in wine.

Interestingly research released last week by Proof Insight, part of C&C Group, shows 62% of off-trade wine shoppers would be willing to spend 44p more to get their favourite wine at its current alcoholic content. Up to 50% of spirits drinkers are also prepared to pay the extra price per bottle post duty rises too. Whether they do or not remains to be seen.

It says: “While there is a risk of losing a small percentage of category shoppers if retailers are to pass on price rises as a result of the change in alcohol duty, this is unlikely to have a significant impact on consumer behaviour in the on- and off-trade, outside of the continued pressure on volumes as a result of inflation.”

How about wines above £10?

Gavin Quinney’s breakdown of costs for wines on sale in restaurants and the on-trade

These duty reforms could well convince more producers, brands and retailers to compete at higher price points and collectively raise the bar for both branded and own label wines in the UK. The race to the bottom has never made commercial sense for anyone in the wine supply chain, but such is the lure of a listing by a major retailer that suppliers, producers and brand owners have long been willing to make uneconomic decisions for their businesses if it means getting their wines on a supermarket shelf – usually with the caveat they will list some of their more premium wines.

Will this finally be the time when retailers and suppliers, alike, realise they have to think differently and push more £10 to £15 wines and above? Price points where the increases in duty are less of a factor and you are getting far more wine for your buck. As Gavin Quinney’s chart shows above the jump in margins for wines being sold above £10 (£2.50 to £4.13 for a £15 wine) in retail compared to wines below £10 are considerable – £1.50 for an £8 wine, just £1.35 for a £6 wine.

Then there are the opportunities to be had if you switch your wines and brands into the on-trade where margins at higher price points are least affected by the duty changes and margins go up as a result. Will we see more of our major household retail brands – particularly from those southern hemisphere countries producing higher alcohol levels – switch tack and look to get listings with the major pub groups and casual dining chains? The likes of Villa Maria, Jacobs Creek have tried to straddle the two sectors before, but you can see a case being made for a brand like Trivento from Concha y Toro, amongst others, that look to push more of their supply into the on-trade.

There is also a big question to be asked of all those wine businesses, retailers, distributors and producers who are proudly following – and promoting – a sustainability strategy. How true to those principles can you be if you don’t raise your wine prices in face of these duty reforms in order to build a sustainable future for your company, your staff and your suppliers? Can you really be following a B Corp strategy and continue to scrap around for wine listings at £8 and below?

What is happening with sparkling wine with all these duty changes?

Good question. Where the government can claim its duty regime is ‘fairer’ is how sparkling wines are going to be taxed come August 1. Duty levels on sparkling wine will come down from £2.86 a 75cl bottle now to the same level as most still wine – £2.67. A mighty 19p which as Gavin Quinney says “might make a difference to some Proseccos, Cavas and Crémants – much more so if 11% abv – but hardly significant to English sparkling wine (or Champagne) at £25+”.

It does mean, though, we can expect to see even more focus being placed on the sparkling category with more space and opportunities for major brand owners in the big supermarkets. Or at least for those branded players with the vision to make the most of the opportunity.

There a big opportunities for major sparkling brands on the back of a drop in duty for sparkling wine

One of the big things to come out of Concha y Toro’s recent UK press event was the fact it is now quite happy to diversify out of Chile and seek out new growth opportunities in other countries. As Marcelo Papa, CYT’s technical director, said: “I imagine a Prosecco Casillero del Diablo why not? We have a Tempranillo from Spain why not a Prosecco from Italy?”

Freixenet has already had a great success by being willing to expand out of its traditional home as one of Spain’s biggest Cava players, to now being one of the UK’s top selling Prosecco brands too.

We can expect to see other major global wine brands and their suppliers competing in the price sensitive sparkling categories to do the same and look at how they can add more sparkling producers and brands to their mix – the lower the alcohol – and price point – the better.

But will major global brands really go to all this trouble just for the UK market?

That is the big unknown. We would do well to remember the UK is no longer the most important wine market in the world for many international wine producers. Particularly when there are bigger margins and markets to go for in the United States, Canada, South America and across Asia and potentially still China.

Yes, the UK is still commercially important, but many producers also talk about the UK’s strategic influence, particularly when trying to get into new markets around the world, and you have to question how strong that ‘strategic’ element will be in the future if the cost of doing business in the UK goes beyond hitting price points – which is hard enough in any case – but dramatically changes the way you make wine too.

Are you really going to fundamentally change the way you make wine to lower alcohol levels by two to three percent to hit better duty rates in a market that is not giving you the margins you can get elsewhere?

Can the major Port houses that have relied so much on the UK market continue to do so if the average bottle is going to be £1.50 more?

Will the big spirits brands continue to invest in the UK when they are facing huge duty and price increases?

The WSTA’s Miles Beale has been highly critical of the government’s new so called fairer, simpler duty reforms

This is why the WSTA argues the government’s “new duty regime discriminates against premium spirits and wine more than other products”. Chief executive, Miles Beale, explains: “Wine from hotter countries – like new trade deal partner Australia – will be penalised most of all, because the grapes grown in hotter climates naturally produce higher alcohol wines.”

The much heralded new free trade deals with the likes of Australia and New Zealand don’t mean much in practice if their relatively higher alcohol wines are not competitive in the UK market.

Beale says the new Australian free trade agreement brings up front benefits to consumers of over £30m per year, but the new duty systems engulfs and overwhelms that benefit with a “MASSIVE -£140m p.a. hit”.

So what’s going to happen in the medium to long term?

You save the hardest questions to last! No doubt the wine and drinks industry will find a way to take these reforms on the chin and make them work. It has little choice, no matter how hard the pain is going to be. Ironically those who have long championed for average wine prices to go up will finally get their wish – but for all the wrong reasons. Consumers are going to have to spend a whole lot more if the actual cost of the wine in a bottle is proportionality more than the duty and VAT being charged for that bottle.

It is up to the industry as a whole to break these figures down and make the public aware just what they mean for their average bottle of wine and what a big difference it will make spending £1 or £2 a bottle more.

There is also a big opportunity here to draw a line in the sand and break the cycle of constant discounting to hit £5 to £7 price points in major supermarkets. The new duty reforms makes them even less tenable.

It’s time for the big supermarkets to take a deep breath and actually talk to their customers about why they are putting up average wine prices up and respect them to make their own choice about whether they are willing to trade up to them or not. They can’t just rely on their suppliers to do all that hard work for them.

They have the power and influence to change shopping behaviour and now is the time for them to really step up and make a difference. Sacrifice some lost sales between £5 and £8, but make more margin by pushing more consumers over that £8 price barrier.

Only then can the rest of the industry get on with making these duty reforms work in their own businesses.

- To find out more about the what the duty reforms are and what you can do to talk to your MP and customers about them and what impact they will have on your business you can access the WSTA’s special alcohol duty campaign hub here.