Castelnau Wine Agencies, which is part of the wider French Castelnau Group, has been working and supplying wines from all over the world to the UK on-trade for the last 30 years. But with an ever changing portfolio it saw the Buyer’s Case project as an ideal opportunity to showcase their depth and diversity of its range.

Click here to read the full report downloadable PDF report.

The challenge for all wine agencies is arguably threefold: to firstly build up an exciting, different, and interesting range of suppliers and wines to offer to the trade; to then work out how best to market and promote them to the right buyers; and then thirdly build awareness of them and put them in front of the right buyers and hopefully build distribution in the right channels of the trade.

All three routes to market are arguably the bread and butter of how the UK wine trade works. But knowing what you have to do is one thing, achieving the right results is another. There is always going to be a natural churn of producers in and out of leading wine agencies and distributors, as well as wineries moving from one to the other.

Making buyers aware of those changes and helping them keep on top of your portfolio is an increasingly difficult challenge for drinks suppliers. There is not only so much competition to go up against, but buyers can be inundated with requests and it is not always easy to get your fair share of voice.

Case by case

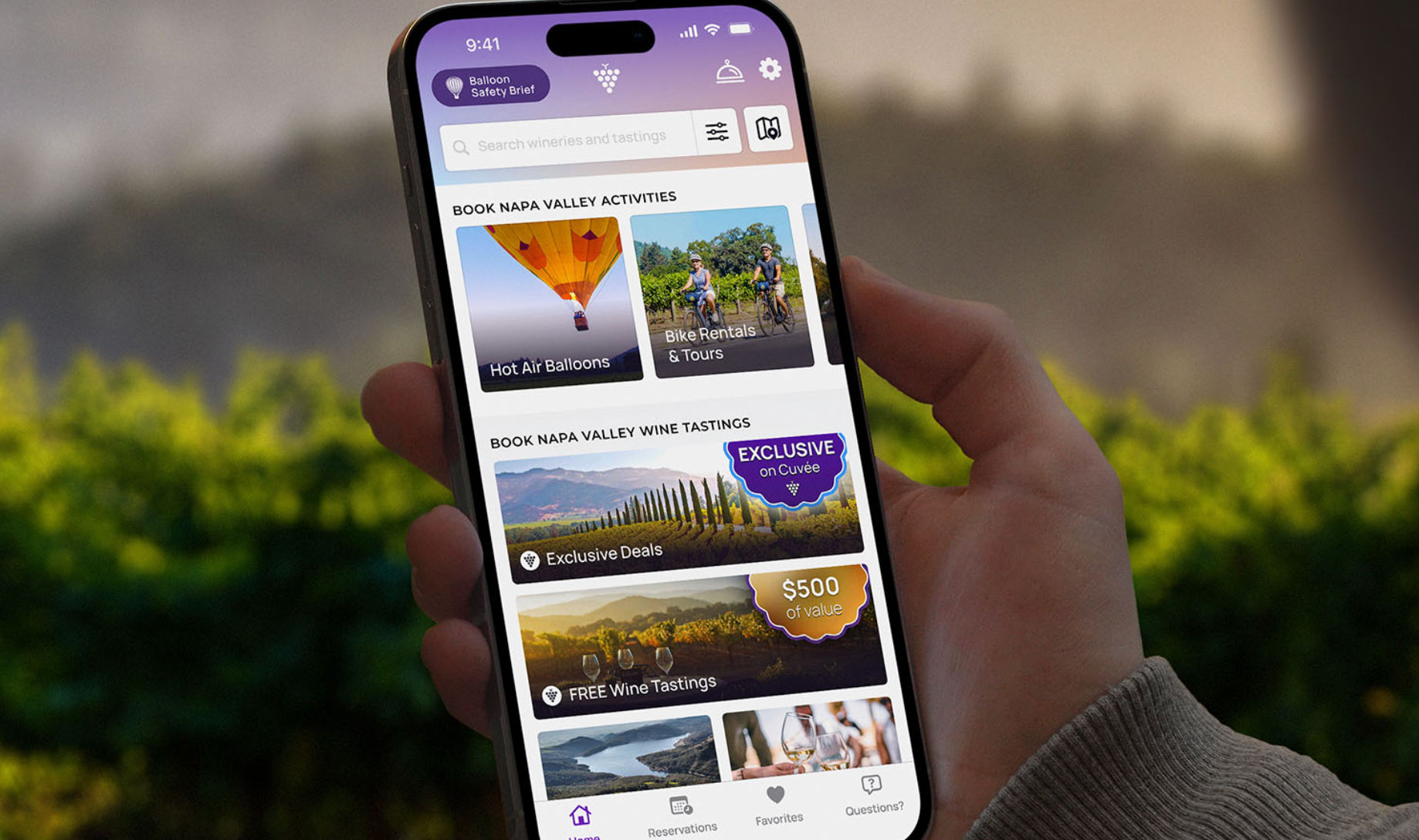

It is why The Buyer has looked to develop The Buyer’s Case project whereby we give suppliers, and wine and spirits producers the chance to put their drinks in front of key influential buyers, giving them the chance to see what sort of products they have in their range.

For busy buyers it has proved to be a useful and effective way for them to not only benchmark their current range against some alternatives, but to find some new wines and drinks in a relaxed, independent way.

To date we have worked with two major French wine producers to help them showcase and present their range of wines to key buyers across the UK, with our previous Buyer Case projects with Les Vignerons Foncalieu and Les Cave de Vignerons de Saint-Chinian. Both resulted in a number of the participating buyers agreeing to take on some of the wines tasted.

For our latest Buyer’s Case project we have had the opportunity to work with a wine agency, and more traditional supplier model with Castelnau Wine Agencies, part of the wider Castelnau Group,which has a number of producers as part of its range from both the Old and New Worlds.

Together we were able to identify the right buyers in the right channels of the premium on-trade and then cherry pick the six most appropriate wines from the Castelnau portfolio to send to each of them.

The selected buyers were identified to cover the following channels of the premium on-trade:

- London wine bar chain

- Gastro and premium pub group

- Premium restaurant group

- Prestige hotel and restaurant operation

And the buyers that agreed to take part in the project were:

Vittorio Gentile, head sommelier, Theo Randall at the InterContinental Hotel.

Fleur Gomez at Drake & Morgan

Fleur Gomez, wine manager at Drake & Morgan.

Tom Hunt, general manager, Hawksmoor Air Street.

Guillaume Mauhut, group wine buyer, ETM Group.

Wines tasted as part of the project

Each were then sent a selection of wines from the following range:

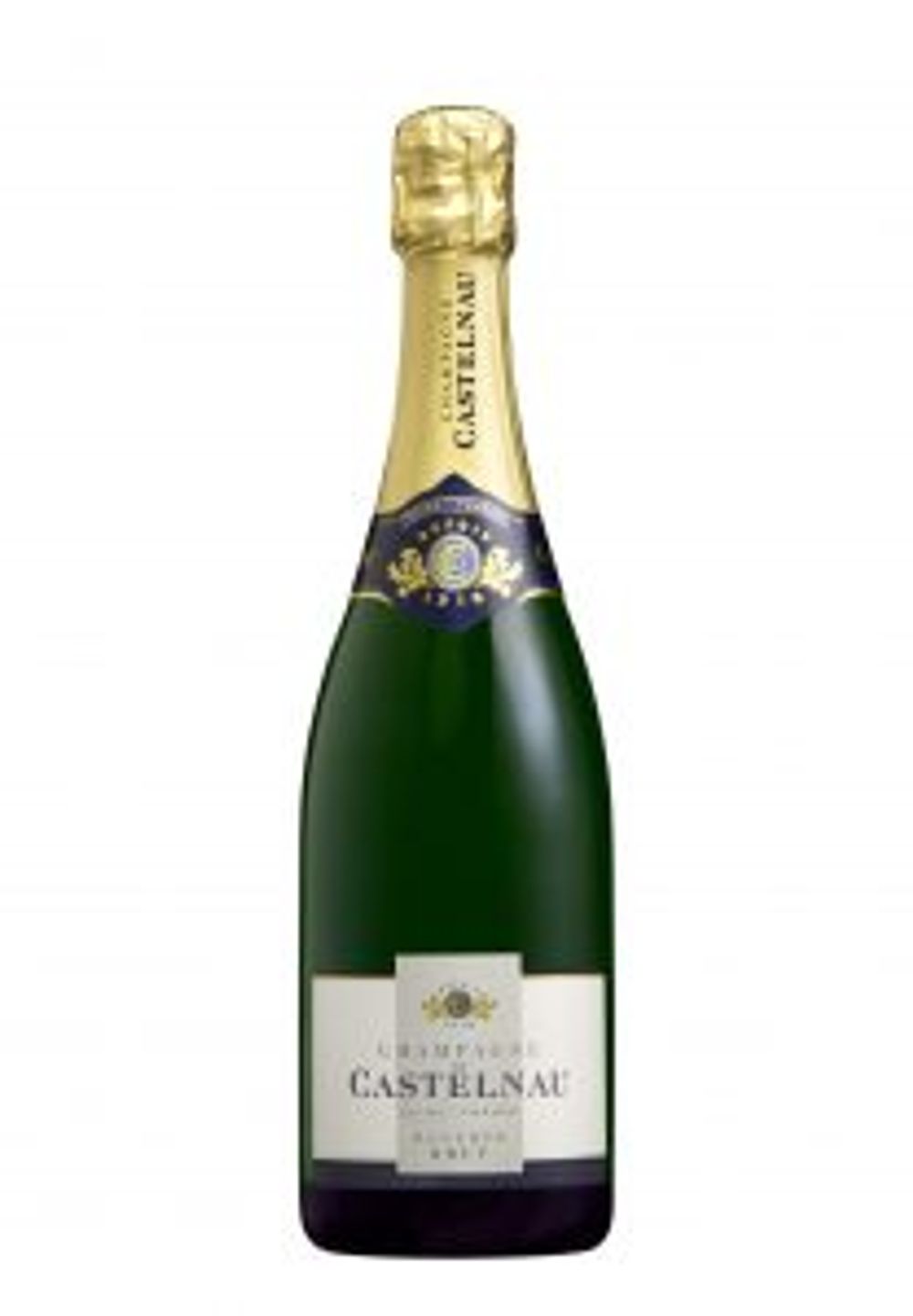

* Champagne de Castelnau Brut Réserve NV, France

* Champagne de Castelnau Vintage 2003, France

* St-Véran 2015, Patriarche Père et Fils, France

* Puligny Montrachet 2011, Patriarche Père & Fils, France

* Gevrey-Chambertin 2014, Patriarche Père & Fils, France

* Eidos de Padriñan Albariño 2015, DO Rias Baixas, Spain

* Xenna Chenin Blanc 2016, Swartland, South Africa

* Oak Valley Sauvignon Blanc 2015, Elgin, South Africa

* Oak Valley Chardonnay 2014, Elgin, South Africa

* La Puerta Alta Malbec 2014, Famatina Valley, Argentina

* Canto de Piedra Carmenère Reserva 2013, Colchagua Valley, Chile

* Siete Fincas Cabernet Franc Reserve 2013, Mendoza

* Aluvios Carmenère Gran Reserva 2014, Colchagua Valley, Chile

* Cycles Gladiator Pinot Noir 2013, California

* Hahn GSM 2014, Central Coast, California

* Hahn SLH Pinot Noir 2014, Santa Lucia Highlands, California

* Lucienne ‘Smith Vineyard’ Pinot Noir 2013, Santa Lucia Highlands, California

* Reata Chardonnay 2014, Los Carneros, Sonoma County

* Double Lariat Cabernet Sauvignon 2014, Napa Valley, California

* Tiki Sauvignon Blanc 2015, Marlborough, New Zealand

The feedback

As part of the feedback process each of the buyers were asked to taste the wines and then answer the following questions:

• What do you think of the wine and the style?

• Is this the kind of wine of you would consider listing (note there is no obligation

to do so if yes)?

• If yes please explain why?

• What do you think of the price point?

• What do you think of the packaging? Any suggested improvements?

• If you did list a wine would you put it on by the glass or the bottle or both?

Which channel of the on-trade do you think this wine is best suited for? Each were then asked to judge the wine and answer the following.

Once again the project showed how complex the premium on-trade sector is and what different demands and needs individual buyers have. But it also proves a fascinating insight in to the different decision making processes that the buyers have and the separate criteria they use to determine whether a wine warrants a listing or further consultation or not.

Matt Harrison, head of London on-trade for Castelnau Wine Agencies described the project as a bit of a “rollercoaster” ride.

“Putting our portfolio out to be dissected has been nerve racking but extremely rewarding. The feedback has been honest and unbiased, some comments have beaten our expectations while others have been surprising but we exist to serve the trade and their customers so who better to assess our relevance in the market? We’ll be building on what the Buyers have said and use the notes as a basis to evolve our portfolio from in the future.”

To find out what those “rewarding” and “surprising” comments from the individual buyers were then click and download the report here.

* If you would like to take part in a similar project then please contact Richard Siddle at editorial@ the-buyer.net