The digitalisation of wine is already transforming the wine industry and how wine is being sold, promoted and moved around the world, whether you realise it or not. Thankfully a panel of digital experts were on hand at the Vinexposium Act For Change Symposium to explain just what is going on online.

If you were doing an old fashioned SWOT analysis of the global wine industry then you might find the discussions around its “weaknesses” and “threats” are a little more prolonged and detailed than they are about its “strengths” and “opportunities”.

Yes, you can point to the fact there has has arguably never been more demand for fine and premium wine wine from around the world and that the boom in e-commerce and new grocery delivery platforms has opened up the retailing of wine like never before. But any new opportunities have to be balanced against the considerable threat of climate change, the economic practicalities of making wine, and the rather uncomfortable truth that an awful lot of people are not drinking wine any more and new drinkers are less likely to do so.

This was the context in which last week’s Vinexposium Act For Change Symposium was set. A two-day event that bought experts together to tackle some of the biggest “threats” and “opportunities” that the industry faces.

How you regard such global issues as climate change, sustainability, winemaking, and the sales, distribution and retailing of wine might depend on which side of the fence you are on, and whether you are see the world through a half full or half empty wine glass.

But even the most optimistic wine professional will be going to bed at the moment with a few gremlins to keep them awake at night.

Christophe Navarre says the wine industry has all the tools to succeed it just needs to get come together more coherently and communicate what it is doing better

Christophe Navarre, chairman of Vinexposium, certainly struck an upbeat note when he brought the two days to a close with a rallying call that as an industry wine, and particularly France, has the styles, the regions, the winemakers, the technology, knowhow and expertise to lead the world and ensure it has a healthy future. But he did so after two days of talks and debates that set out in no uncertain times just what a difficult and dangerous future the wine industry has unless it collectively starts taking action to address some of its major weaknesses.

It was noticeable how little of the conversation actually talked about the consumer and what they are thinking about life in general and wine in particular. But then the wine industry has always lived in a parallel universe to the consumers it is supposed to be serving. That’s its number one weakness right there.

Thankfully there were some e-commerce and digital experts on hand to bring the consumer into the conversation. But then if you are involved in online retailing and not putting the consumer first then you don’t really have a business model at all.

Bigger and better

What the digital experts were able to demonstrate, however, was just how much bigger and better the potential market for wine now is thanks to digitalisation of wine online.

Google’s Cyril Grira said the demand for wine online is shown by the 30% increase in search for wine terms since 2019

Cyril Grira, industry director for retail for Google in France, said there has been a 30% increase in the number of searches for wine on the platform since 2019, with another 6% growth already in 2022. The pandemic saw people turn to Google and search like never before. The challenge for the wine industry is how well prepared is it to know what to do with all these new customers and have websites and search strategies in place that direct those customers to their websites and e-commerce stores. In the world of Google it is all about “awareness, consideration and purchase” and then your “after sales service”. That’s what online players need to be focused on, said Grira.

The key difference, however, between wine and other consumer good sectors is that 88% of search are for generic terms, like a grape variety, a region, or style of wine, it is not about a brand or a retailer like it is in other major consumer industries, added Grira. It means there is a much bigger “funnel” of users all coming online looking to be directed in the right way. The wine industry needs to make sure it knows how to handle and deal with that funnel.

“The wine market requires more expertise to navigate wine online,” he said.

Anthony Maxwell, chief commercial officer at Liv-ex, the fine wine exchange site, said there is now so “much more access and transparency” for consumers to buy wine online thanks to the boom in e-commerce during the pandemic. Liv-ex is now listing and trading over 25,000 fine wines.

What platforms such as Liv-ex have done is to digitise and democratise wines online, he claimed. “It has taken out restrictive elements around stock,” he added, meaning a consumer can carry out their own searches, do their research and then buy the wine they want.

“They don’t have to wait for the merchant to reply. Digitalisation and e-commerce has expanded the market enormously.”

Millesima’s Fabrice Bernard says the pandemic and rise in e-commerce has opened up the fine wine market to a much bigger audience. Picture Philippe Labeguerie

Fabrice Bernard, chairman of Millesima, one of France’s leading fine wine merchants, agreed:“People are searching for a wider range of products and looking for more diverse wines.”

Which, in turn, has opened up online far more to smaller producers to gain their voice and share of the digital market, he added.

It’s a position that Vivino has taken from day one, said Christophe Navarre, a Vivino investor. A platform designed to give smaller producers the chance to sell their wines to a vast audience. Ultimately it is down the consumer whether they buy their wines or not, he stressed.

The cost of entry into wine online has also plummeted, said Roland Peens, fine wine specialist of the Strauss & Co Fine Wine in South Africa. It is now so much more easier for e-commerce players to start up, scrape the internet for content, pull wine ranges together and start trading and competing with traditional online retailers and fine wine merchants who have been online for decades. He agreed with Russell that not having to own and manage your own stock has transformed wine online.

Personalisation of wine

Pam Dillon, co-founder of Preferabli, the new recommendation and personalisation software business for wines, beers and spirits, believes the future of wine online has to be about the personal experience it can offer and get away from it being a convenient, transactional way of buying wine.

It is developing AI driven software to analyse masses of consumer preference data – its database includes 700 different taste preferences gleaned from the experience and research of a team of Master Sommeliers and Masters of Wine – to ensure it is only pushing and promoting wines on a personal basis to consumers be it online or in person.

It’s why personalised emails can be be so powerful that take into account your own shopping history and preferences and “digitise them”. “This is the sort of content that consumers are so thirsty for,” she said.

That’s why the new Pix platform is based on a Netflix-style digital model that serves up recommendations based on your search history and what you look for online, said executive editor, Felicity Carter. It can then take that search experience and apply it to their local market and hopefully find a wine right for them from a local retailer.

Pam Dillon of Preferabli says new digital tools and platforms can offer consumers their own choice of wines based on their personal preferences

She said wine businesses need to work far harder at making sure people can find them and their wines online and then know how to respond when they do. If platforms like Pix are doing the hard work to get people to your site, you need to be able to act like an efficient e-commerce player and serve them when they do.

Grira said Google has free tools for businesses to use to analyse their traffic and personalise what they are offering. If you consider 50% of a website’s traffic on average comes through good SEO then it is vial you are spending the time to invest in an effective search strategy, said Grira. That’s the way you not only build your “audience” but can start using them as “assets” to help drive your business and increase sales.

That’s why so many successful e-commerce players are now looking to marry and blend their online offer with an offline, bricks and mortar, in person experience too, he said.

Dillon said that has to be the future for wine retailing. How do you take the personal experience that makes in-store shopping potentially so enjoyable and memorable and adapt that for online. What dictates how we make decisions in a shop, or a restaurant and how do you replicate that online? AI driven software can help with that decision making, she said.

“When is this industry going to go beyond price and introduce experiences that people are willing to pay for. Like they have for coffee,” says Dillon.

Welcoming influencers

Pam Dillon at Preferabli says the wine industry should welcome new wine influencers with open arms as they are taking wine to a new audience. Picture Philippe Labeguerie

She said the wine sector would do well to look closely at how influencers are shaking up and disrupting the traditional way of talking about products and brands. Wine influencers, for example, are not going to wine producer websites for their inspiration, they are not even that interested in talking to people in the sector, they don’t need to, they are using “digital solutions instead”.

“They don’t want to to talked down to by someone in wine. They find their inspiration in digital.”

What digital tools and social media platforms can they use to “help tell the story of wine?” asked Dillon. Rather than look down on influencers the wine industry should welcome them with open arms as they are the ones who are going to help wine’s story “grow and develop”.

“There is no better story in consumer goods,” she added.

It’s why video and images have now become powerful search tools in their own right, said Grira at Google. It’s also no doubt why YouTube is such an important part of Google’s overall business as it has become a video search platform in its own right. “Image and video as well as words are now key for search,” he explained. “It’s a logical development.”

Digital transformation

Digitising wine is also making it a safer place to trade, argued Maxwell. What digital platforms can now do through blockchains and selling individual secure NFTs is arguably an extension of what Liv-ex first set out to do some 20 years ago. To provide a safe trading environment where people could exchange expensive wines without fear of being ripped off.

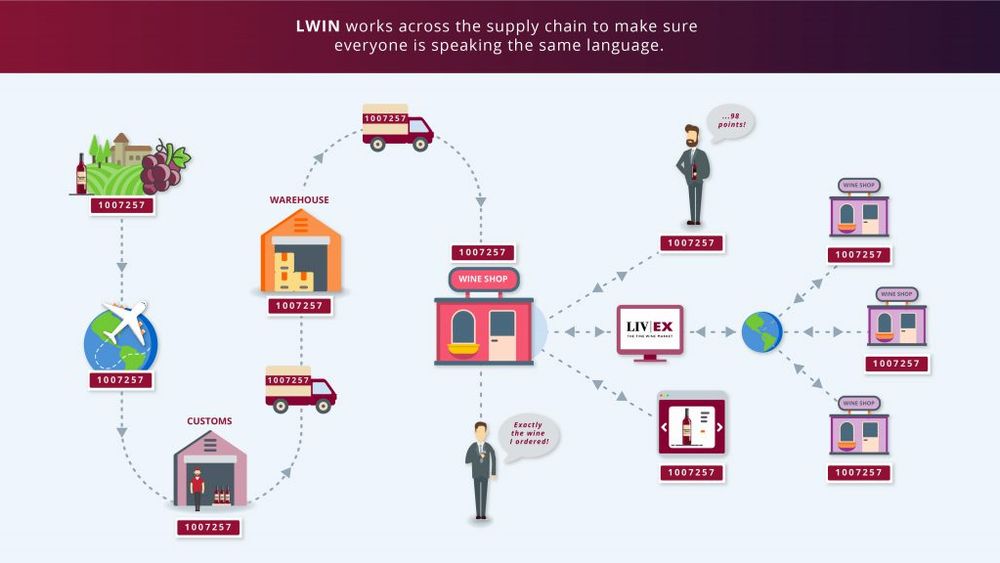

Liv-ex’s LWIN global tracking database is helping to bring the fine wine sector together around the world through technology

That has now gone to the next stage with blockchain technology that is both 100% transparent and safe to boot, for both buyer and seller, producer and consumer. That transparency around price, and independence is what has taken what was a niche fine wine market into the global phenomenon it is now, added Liv-ex’s Maxwell. The global fine wine market has expanded sixth fold and set to be worth $6 billion. “There has been a huge increase in the size, opportunity and breadth of the fine wine market and transparency thanks to the internet has helped all that,” he added.

In fact it has grown so fast that the traditional models of constantly moving wine between owners and traders around the world needs to be ripped, claimed Maxwell. Liv-ex is looking to play its part with its global tracking system, LWIN, that provides a unique code per wine, or spirit that contains all the information you need to know about how it was made, where and what it has been traded for.The equivalent of ISBN for books but for wine.

It means it can “transfer ownership” of a bottle or case of wine by not physically moving it from location to location, because all the data is captured on the LWIN. It has now issued 130,000 LWINS and hopes to get to 200,000 by the end of the year.

“It’s a huge opportunity to immobilise wine and only deliver it when it is going to be drunk,” he explained.

NFTs and blockchains

Similarly Peens said the blockchain and NFTs were now opening up fine wine to a new audience willing to trade large sums of money, through auction businesses like Strauss & Co Fine Wine, and give them access to wines not available anywhere else. Iconic South African wine producers, he said, are now selling limited editions of their wines as NFTs as a new way for collectors and enthusiasts to own their wines.

a

A recent NFT auction of Strauss & Co saw a selection of South African fine wines sold for £175,000. A vertical collection of Klein Constantia’s Vin de Constance from 1986-2027 sold for £63,000 including commissions. Meerlust’s 50-year vertical of their its Rubicon brand sold for £54,000, while Vilafonté Series C 2003-2027 reached £28,000.

“The blockchain is the future for fine wine,” he added imagining a world where people use their NFTs to show off their wine collection rather than take them down to their cellar. “We believe this new technology is the most powerful way of packaging and trading vintage wines, especially when provenance is so vital.”

Maxwell said we are already seeing many major fine wine releases only being offered through NFTs.

Bernard can certainly see the role for NFTs and blockchain in fine wine as it is so transparent and can provide and secure all the information you need about a particular wine which can be shared right down the supply chain from the producer, to the broker, retailer and end customer.

“In the future a winery will be able to know exactly who drank their bottle, when and where,” he said.

The sector also needs to look very closely at how quickly the technology behind the new on demand grocery apps like Gorillas and Getir are transforming the way that wine is being bought, said Pix’s Carter. People are not using these apps to buy a bottle of Yellow Tail, but are looking for Grand Cru Champagnes and the finest of fine wines and are willing to pay through the nose to get it – in the next 10 minutes. Apps that are opening up a whole new marketplace for wine, for those canny enough to recognise it.

All about the consumer

We have chosen to focus on the e-commerce panel first out of all the highly engaging and professional content and debates at Vinexposium for one key reason. It was ultimately all about making wine more relevant to the consumer, now and into the future.

“Digitalisation has removed the barriers and given consumers more informed choice and a better consumption experience,” said Maxwell at Liv-ex. It has simply made wine so much easier to buy, added Peens. “It is now so seamless and easy to do.”

The final word goes to Pam Dillon: “In the past wine retailing was all about the product. But in the future, retail will be all about the consumer.”