The Chancellor the Exchequer must have something against the wine industry as it was the only drinks category to be hit with a duty rise in his last budget. Here are the facts you need to know about what it will mean for doing business and how we can use this rise to help better inform our customers about the wines they are buying. All figures and analysis are thanks to Gavin Quinney, owner and winemaker at Chateau Bauduc in Bordeaux.

With new duty rates on wine in the UK from 1 February 2019, I’ve updated my statistics and thrilling graphics, and added some new tables for a fairly comprehensive guide to UK wine duty. A rant it may be but, if nothing else, it should help you make better-informed decisions when buying wine in the UK – and on the continent.

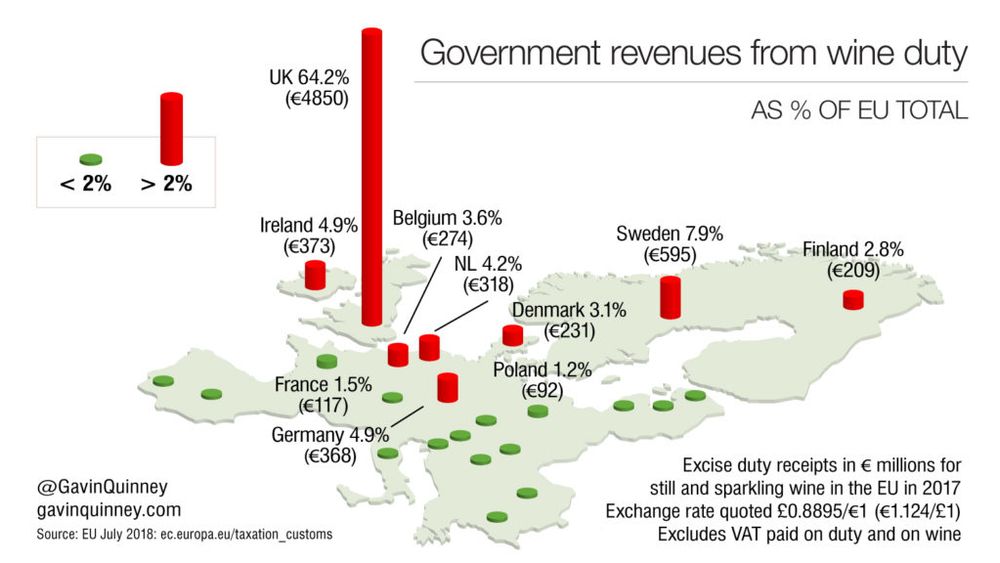

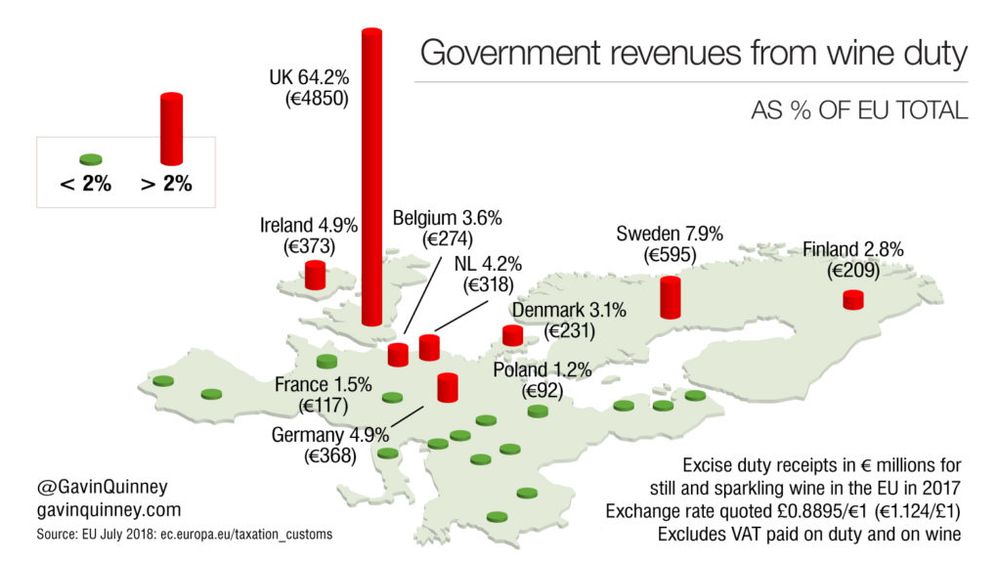

Yes that big red tower is all the duty the UK pays compared to the rest of the EU

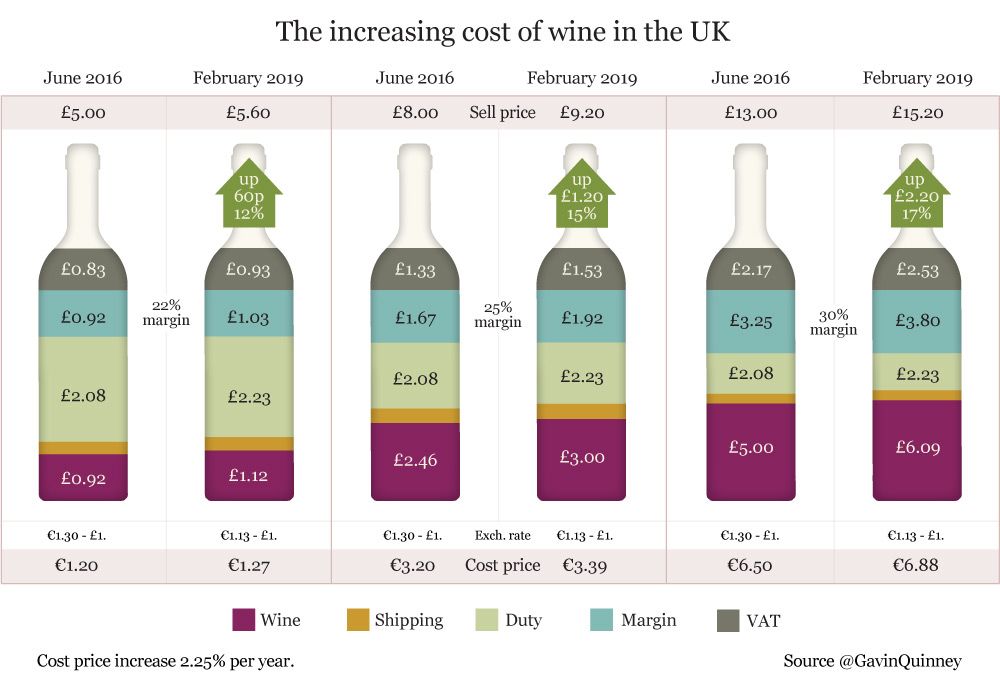

1 . Wine was singled out for a duty increase in the autumn budget, effective February 1, 2019, while excise duties on spirits and beer were frozen.

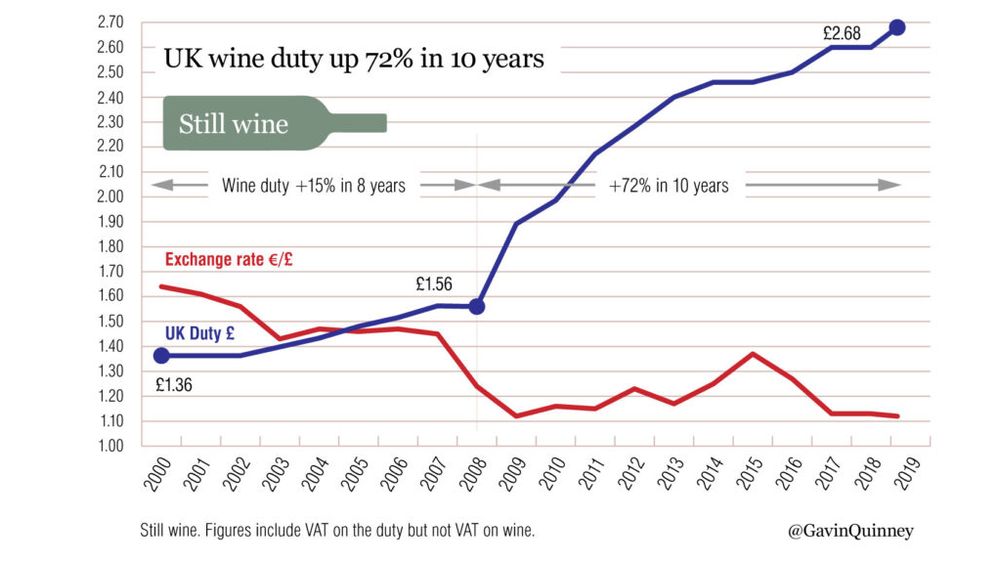

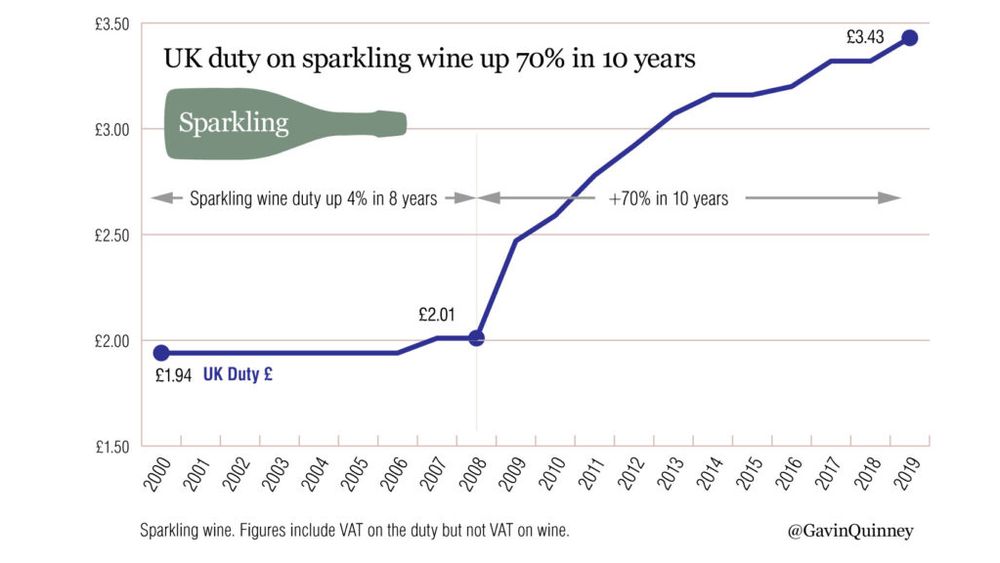

2. The UK duty on still wine is £2.23 a bottle plus VAT (£2.68) from 1/2/19, up from £2.16 (£2.60 inc VAT). Sparkling wine duty is up from £2.77 to £2.86 (£3.43 inc VAT).

3. 61% of a £5 bottle of wine is tax (£2.23 duty plus 83p VAT = £3.06). The average price of a bottle of wine in the UK was last reported by the Wine & Spirit Trade Association (WSTA) (source: Nielsen) in late September 2018 as just £5.68 (56% tax).

4. £6.70 is the price above which you’re paying less in tax than on the wine – which includes all the other elements in the bottle like shipping, packaging and sales margins. When you see a bottle on the shelf for £6.70, equate it – value-wise – to a food product costing £3.35.

5. 58% of a £7 bottle of sparkling wine is tax (£2.86 duty plus £1.17 VAT = £4.03). £8.60 is the price above which you’re paying less in tax than on the wine (and other stuff in the bottle like packaging, shipping and margins).

6. Higher rates of duty have compounded the weaker pound, slightly higher production costs and rising fuel bills. The ‘wine’ element below includes bottling and packaging of 40p-90p, and the producer’s margin.

The key here is the increasing costs year by year

7. Unlike VAT, duty has to be paid once the wine leaves customs or a customs-controlled warehouse. It’s usually treated as part of the upfront cost of the wine, and not only has a huge impact in retail but also in pubs and restaurants, where gross margins have to be far higher.

8. This century, UK wine duty has gone up 72% over the last 10 years, compared to 15% in the eight years before that.

9. UK duty on sparkling wine went up by just 4% in 8 years from 2000, before going up 70% in the last 10.

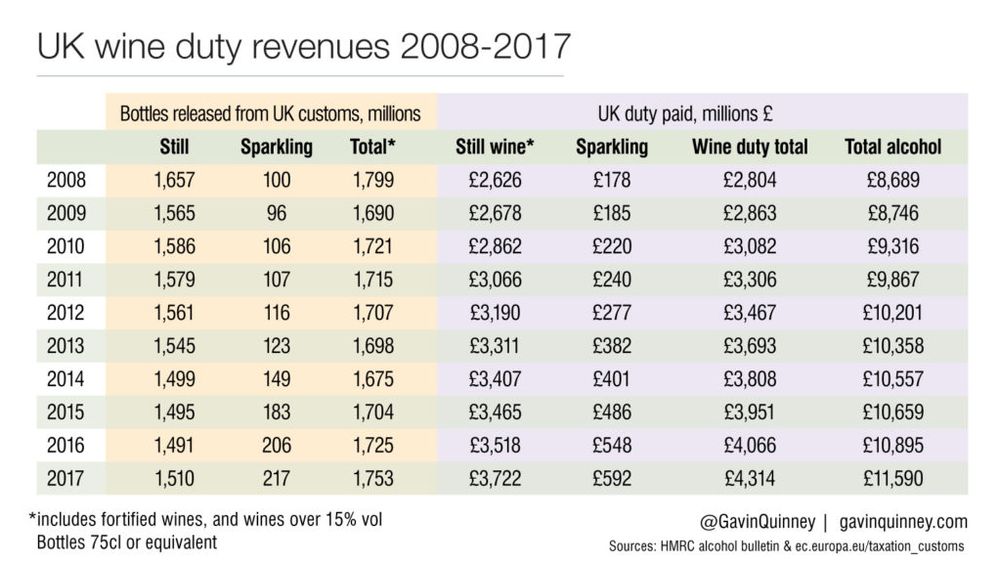

10. For the Treasury, UK wine consumers contribute more than half as much again in duty compared to 10 years ago – for the same amount of wine. Duty receipts have increased year on year while volumes have been remarkably consistent. Sparkling wine duty receipts have tripled in less than 10 years, thanks to the boom in sales since 2011.

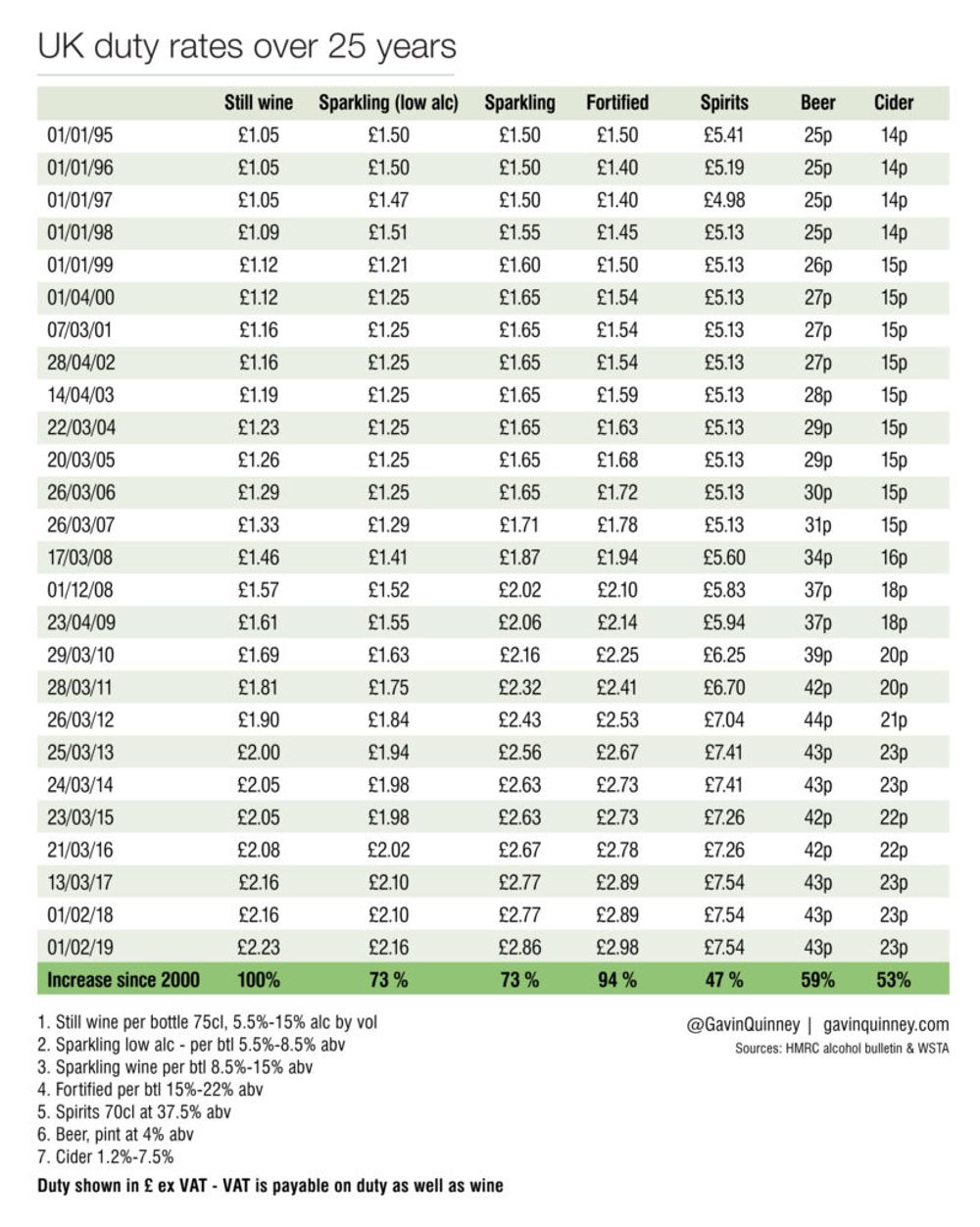

11. This detailed table shows the duty rates on alcohol over the last 25 years, excluding VAT on duty as well as the wine. Since 2000, duty on wine has doubled – still wine up 100% and sparkling wine 73%, whereas spirits duty has gone up 47% and beer 59%.

12. Wine contributes the most UK duty, with £4.3 billion collected out of £11.6 billion in total alcohol duty, ahead of spirits and beer. Wine duty receipts are 54% up in 10 years, in stark contrast to beer on 9.5%.

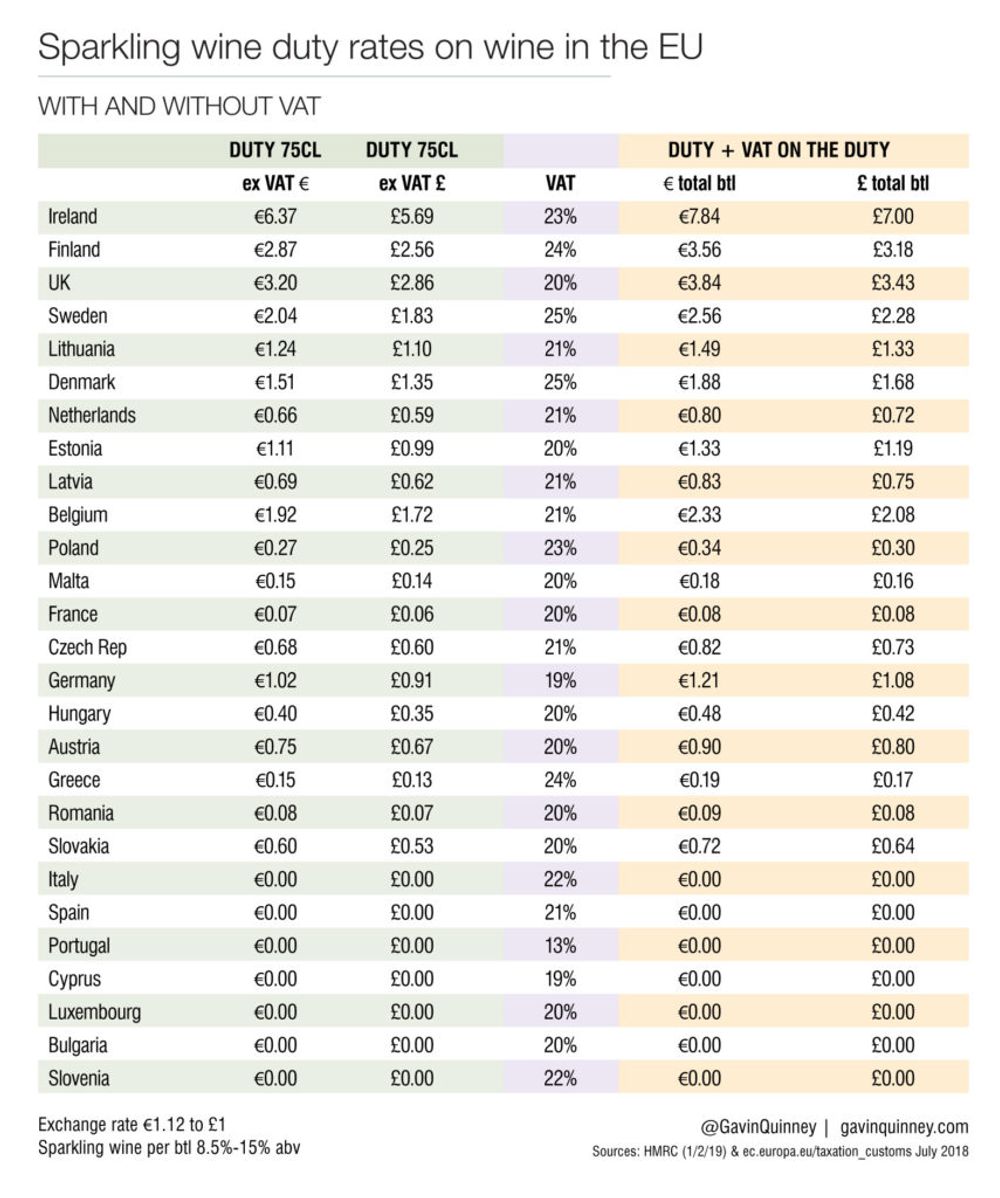

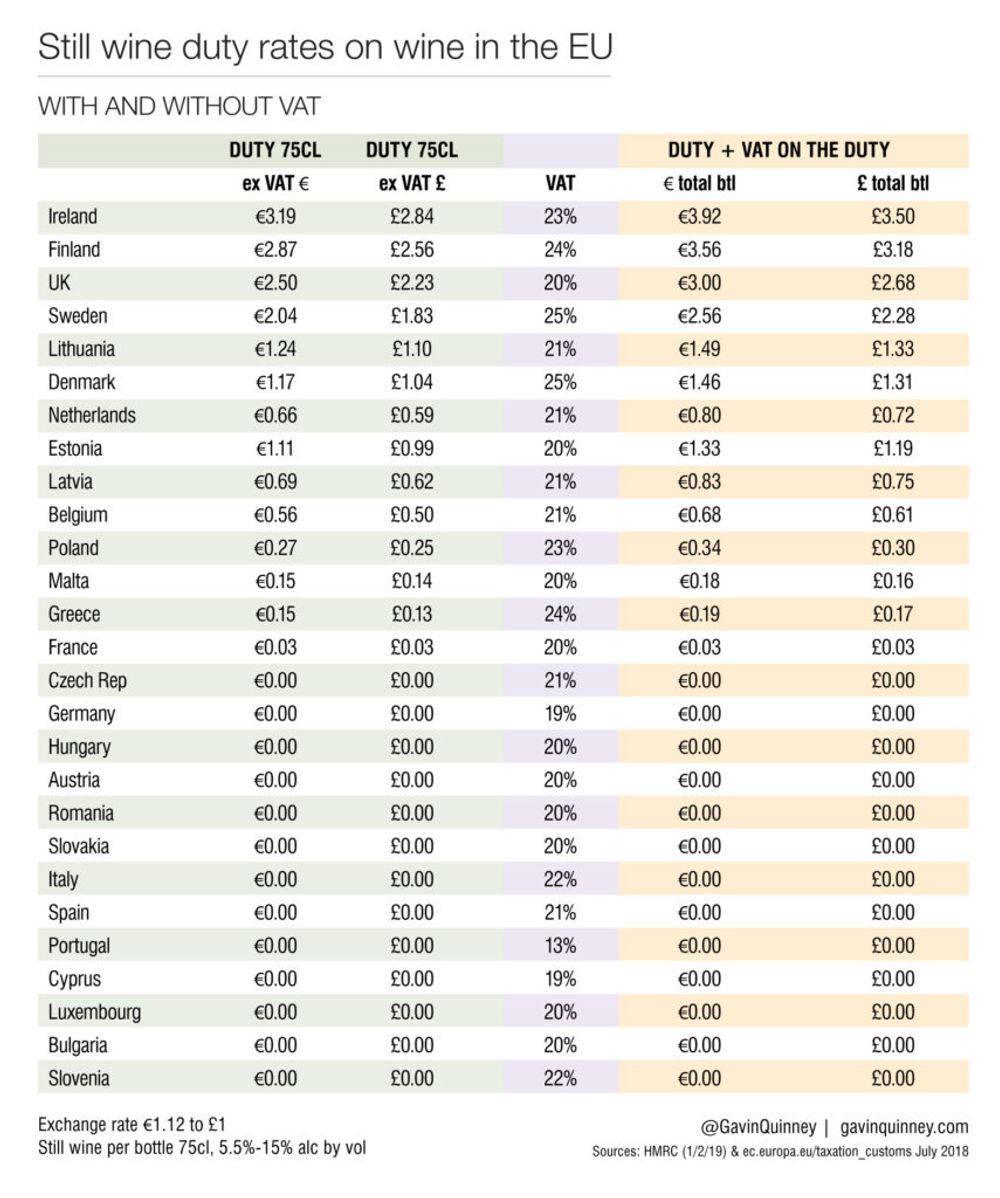

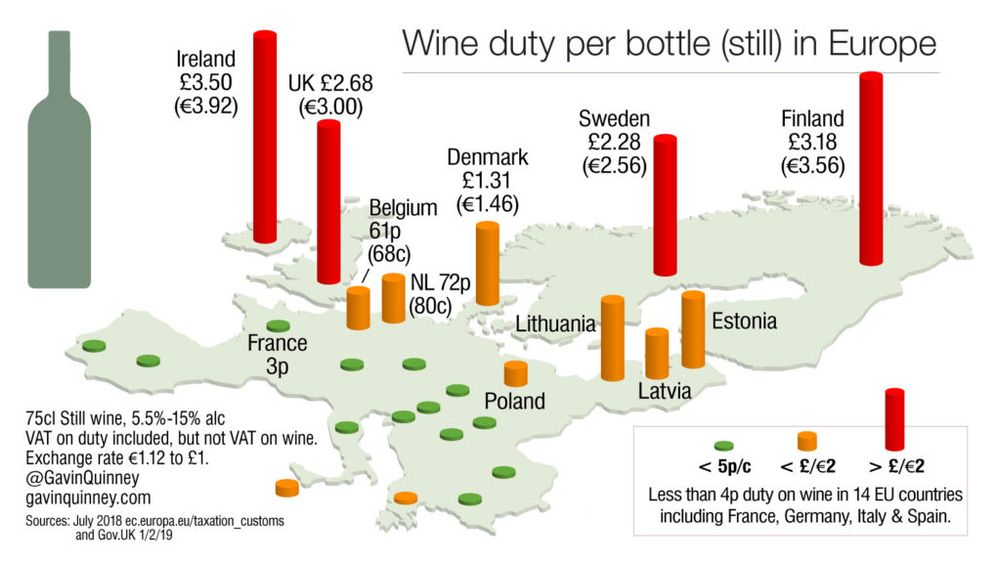

13. Here’s how duty on wine looks across the EU. Each country is free choose to charge what it likes.

14. Most wine-producing countries only tax wine through VAT, though the duty on wine in Belgium (61p inc VAT) and Holland (72p) is around a quarter of the UK rate (£2.68 inc VAT). Sweden and Finland control wine sales through a monopoly of state-owned stores, so consumers there do get something in return.

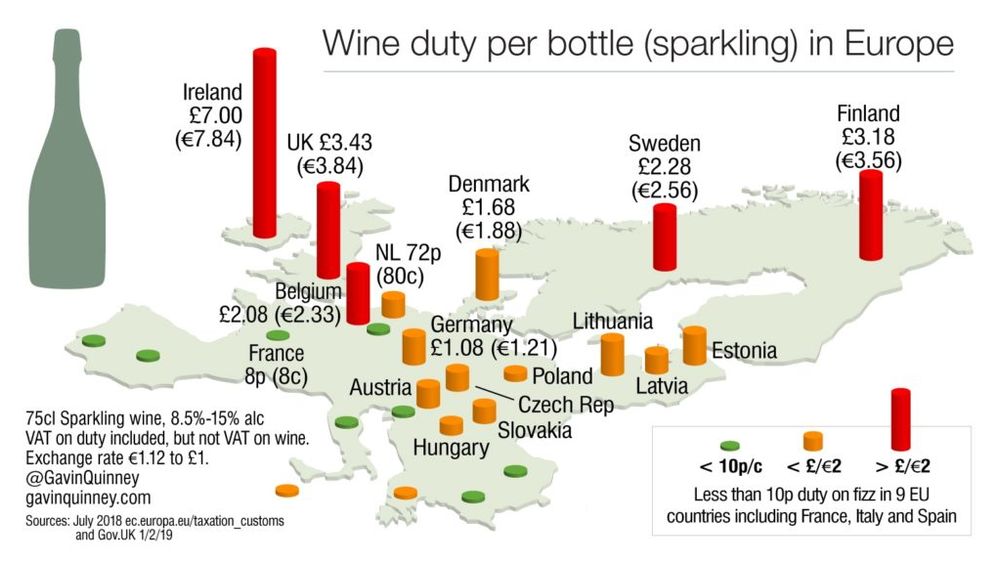

15. Several EU countries charge much higher rates of duty on sparkling wine. At £3.43 a bottle v 8p, duty in the UK is £40 more per dozen than in France.

16. The UK Government takes nearly two thirds – 64% – of all the wine duty collected in the EU. (The UK population is around 13% of the EU.)

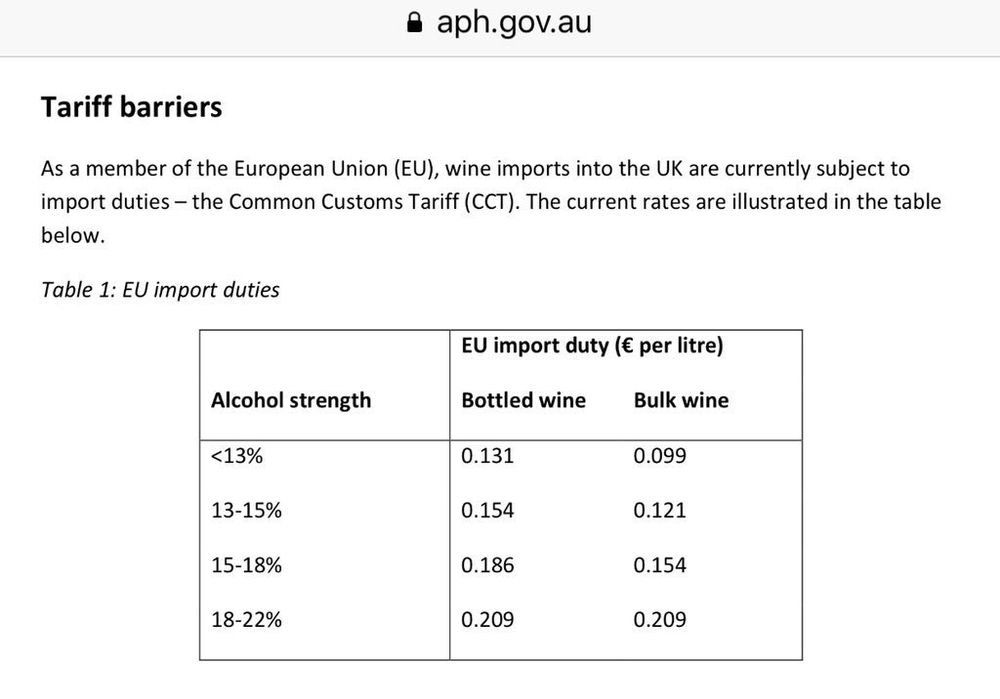

17. 55% of wine consumed in the UK is from the EU, with 45% from outside the EU (source Wine and Spirit Trade Association/WSTA). With all the talk of tariffs, note that EU tariffs on non-EU wine, at 7p to 10p a bottle, are tiny compared to UK duty of £2.23 on still wine and £2.86 on sparkling.

18. There’s no EU tariff on Chilean wine and most South African wine comes in tariff free under a quota system. Free Trade Agreements are being negotiated between the EU with Australia and New Zealand.

Over 80% of Australian wine is shipped to the UK unpackaged (in bulk), then bottled in the UK. At €0.10 & €0.12 a litre for <13% & 13-15% abv, the EU tariff is 7p to 8p a bottle compared to £2.23 UK duty – about 30 times less.

19. Here’s an example of the scale of UK duty on wine. In 2018, 202 million out of 246 million litres of Australian wine (82%) exported to the UK were shipped ‘unpackaged’ – which makes sense – at a value of AUD $1.06 a litre, equivalent to 44p a bottle at today’s rate. The value of that wine was AUD $214 million, or £115 million today. Bottling costs are about the same again. The EU tariff is around £21 million – a lot when considering the sales value of the wine alone, ex Australia.

However, the UK excise duty from 1 Feb 2019 on that wine would be £600 million, plus VAT on the duty and the wine – so, for example, £1 VAT in a £6 bottle would be £270 million. So that’s nearly £900 million in UK tax on wine worth £115 million, excluding shipping and UK bottling. (Source: Wine Australia.)

As one senior executive from a huge Aussie wine company wrote to me this month, the “Government needs to understand that the wine industry in Australia sees the UK as an increasingly hard place to do business – mainly thanks to duty.”

So it’s not just me, then.

The WSTA have a useful Resources page of facts and figures.

Duty rates across the EU – further details.