“The vision quite simply is different to traditional wine distributors. It’s evolving as we go. There is a strategy that guides our decisions and within this we have the opportunity to be opportunistic when exciting options present themselves .” That’s how Andrew Shaw tries to explain what it is that has made Coterie Holdings the business that not only do leading wine figures like himself want to be part of, but has attracted so much interest from major wine producers all over the world that it is now in the enviable position of turning big name players away

“I saw it as an opportunity to do something in wine distribution that has not been done before.”

He explains: “We are behaving as an entrepreneurial start up with really good mature businesses in Lay & Wheeler and Hallgarten under our belt. But the mindset is of a start-up, the energy, passion, vision to go and do something that is unproven in the market, and the agility to execute quickly.”

Andrew Shaw says Coterie Holdings has the mentality of a start-up

Coterie Holdings’ strategy has been clear from day one. To build a solid, successful UK business, underpinned by the strength and long-standing reputation of Hallgarten & Novum Wines and Lay & Wheeler, and then start to spread its wings to see where best it can take its suite of fine wine buying, storage and supply services.

There is already a particular focus on key cities across Asia - most notably Hong Kong - where its majority shareholder and Canadian businessman Foster Chiang is based - and Singapore, Taipei, and Tokyo.

As its website states: “Coterie Holdings aims to address the gaps in fine wine services in Asia by opening new vaults and offering comprehensive wine solutions…from purchasing fine wine through Lay and Wheeler to storage at Coterie Vaults and financial management via Jera.”

It is the international reach and potential of Coterie Holdings that Shaw believes not only differentiates it from its UK competition but opens up exciting new opportunities for global wine producers looking to find new ways to grow their interests and positions in key markets around the world.

Working for a business with an international perspective is particularly refreshing considering how tough the market conditions are in the UK - and that’s before we know the full impact of the roll out of the new ABV-driven duty system from February 1, warns Shaw.

“All the industry metrics last year were pointing in the wrong direction, never mind what’s in store for us this year,” he says.

He points to 2024 national trading figures across the on-trade where every wine producing country saw a fall in both volume and value sales. Only Italy, France, New Zealand and Portugal saw volume and value increases in the off-trade.

UK first

Coterie Holdings wants to be the leading global player in fine wine with its mix of on and off-trade distribution, fine wine storage, brokerage and direct to consumer services

Despite such depressing figures, Shaw remains particularly bullish and optimistic for the collective parts of the Coterie operation. For a start it is mostly operating in the premium and fine wine end of the market, and he still sees “good opportunities for innovative producers and suppliers” to take market share by “boxing clever”.

It is Coterie’s expertise in technology, fine wine and being able to deliver customers excellent levels of service and make sure they get their wine “when they want it and how they want it” is what Shaw believes gives it the edge.

What’s more it is still very much at the start of its journey and 2025 will be a year when it can really start to “explore the opportunities” that are out there, stresses Shaw.

“We want to create as many opportunities that we can to support our customers and producers,” he adds, through all of Coterie Holdings separate fine wine business divisions.

To do that it needs to be working from solid foundations in the UK, he says, which is why most of 2024 was spent working with the management teams at Lay & Wheeler and Hallgarten & Novum Wines to analyse their business models, identify gaps, build their ranges, and bring in the necessary talent and skills to help develop them.

Shaw says they are clearly fortunate to be working with two already excellently run businesses, with Andrew Bewes and his long-standing management and buying team in charge of Hallgarten & Novum Wines and James Kowszun, chief operating officer of Coterie Holdings, stepping in as managing director of Lay & Wheeler in June 2024.

Why Coterie?

Shaw, himself, is another former Bibendum director who jumped at the opportunity to team up again with Saunders. It is also an opportunity for them to arguably maximise their collective skillsin a trading environment that is far more positive and secure than during their pre and post Conviviality days at Bibendum.

Shaw explains: “It is a chance to be part of such an exciting project right at the beginning. A license from people who you trust to go and deliver and make a difference. An ambition to work for a business that has such an international vision. We are evolving as we go. There is not a ready-made blueprint that we are working towards.”

This is also proving to be very attractive to ambitious wine producers that are keen to work hand-in-hand with the respective Coterie teams to see what part they can play in their combined growth strategy.

Andrew Shaw jumped at the chance to work alongside Coterie's chief executive Michael Saunders where they first met at Bibendum

Which is where Coterie’s separate businesses have a real opportunity to provide the services that producers - and private investors and brokers - did not have before on this scale. From providing a distribution platform to reach any bar, restaurant or fine wine investor in the UK, to supplying and building relationships with the global luxury yacht community, to providing finance for high-net-worth individuals and businesses to grow their fine wine portfolios and manage their fine wine storage needs.

Then there are the strategic businesses that Coterie has acquired small stakes in. Like WineFi, a fine wine investment start-up business that gives Coterie access to potentially a younger fine wine investment community.

Coterie strategy

All of which collectively, and individually, have the capability of growing in their own markets, but also internationally and it will be the Coterie Holdings’ management team responsibility to see “where the synergies” lie in the future, explains Shaw.

“We are not chasing the new and evolving markets, but where we are looking at is where it strategically makes sense for us to partner into countries with high potential, either existing or future potential. That definitely makes sense from a future strategy point of view.”

Which could then see Coterie making long term investments in those places with its own cellar, warehouse and distribution operation.

“If you think where will the business be in five years time, or 10 years time, I am not sure I can give you a specific answer, but it will be in a very interesting and exciting place. It’s not all going to be easy and there are going to be some healthy challenges in our distribution world, but in the UK with Hallgarten and Lay & Wheeler there is the underbelly of a very, very exciting wine platform that covers B2C and B2B.”

The long-standing personal relationships that Saunders and the senior Coterie management team have in the trade means there are lots of discussions taking place, he says, as to where Coterie might go in terms of the “right territories and new export and distribution opportunities that fit the model”.

The acquisition of Global Wine Solutions was not part of Coterie's initial strategy but is the sort of opportunity in fine wine it is keen to maximise

“A lot of that evolves on the job, not before the job,” he adds pointing to the acquisition of Global Wine Solutions which was “not on the cards” when the business first started out but quickly made strong strategic sense for Coterie and the wider group.

“So these opportunities arise and are the benefit of being well connected and we have a long pipeline of opportunities ahead of us.”

For a producer it means a premium player has the opportunity to work with Coterie to sell in the UK through the premium on-trade, premium merchants, independent retailers, off-trade, Lay & Wheeler, Global Wine Solutions, he explains.

A distribution model that works across the traditional on and off-trades but also offers travel and luxury retail opportunities too.

He is also looking to maximise the sales opportunities there are between each of its trading areas so that its customers and suppliers benefit from being part of the Coterie group. It’s also vital for any strong, modern wine distributor to have that close affinity between buying and selling.

“We can offer suppliers into the UK unrivalled access across different channels, particularly at the mid to premium level. It’s fascinating because the premium and fine wine element has not been done before in this way,” he explains, with the potential of “internationalising that in due course”.

Hallgarten’s big step up

Arguably the biggest changes have taken place at Hallgarten & Novum Wines where in the space of a year it has brought in 30 new producers, some 300 wines and expanded the team by around a third - from just under 100 to close to 130 people.

Crucially, though, there has not been any change to its senior management with all the major executive directors and buying team staying in place following the Coterie deal. This has allowed the business to move at almost breakneck speed to fast-track key producers into the business and position Hallgarten very differently to where it was in December 2023.

Hallgarten's recent annual portoflio was its biggest yet with a separate area to accommodate all the producers that have joined the business since the Coterie takeover

So many producers, for example, have come on board in the last quarter that Hallgarten had to print two tasting brochures for last month’s portfolio tasting just to include all the new wineries and their wines.

Some familiar names to join the business include Domaine Lafage in France, Banfi from Italy, Bruce Jack from South Africa, major Champagne house, Nicolas Feuillatte, La Rioja Alta in Spain and Pyramid Valley in New Zealand. Producers and brands that collectively raise Hallgarten’s profile and potential in the national on and off-trade arena considerably.

Shaw could not speak higher of the Hallgarten team and their potential: “I have been unbelievably impressed by the commitment of the Hallgarten team. Jim Wilson, for example, is such a strong individual citizen that works tirelessly for the best interests of the business and nothing else. It is the DNA of the Hallgarten company that it is customer first and the individual second and we have found that across the company.”

He adds: “Jim, Steve (Daniel) and Beverly (Tabbron MW) are the supplier face of Hallgarten and all three are quite complementary to each other’s skills sets and approach things in a different way but they all have a sole focus of customer first. They are very vinous and that has put Hallgarten in a very good stead.”

All of which makes “Hallgarten a beautiful business with such a good base to work with,” he stresses.

Where the opportunity for real growth has come, he says, is signing up more producers on an exclusive agency basis, particularly in key competitive areas such as Champagne, Provence, and English wine.

“We needed to have more influence over our partnerships,” adds Shaw.

Bruce Jack of Bruce Jack Wines in South Africa is one of the high profile producers to join Hallgarten & Novum Wines

But he is also quick to point out that whilst there a large number of producers coming on board, it also did see some players move out and overall they have been “supplementing and complementing our portfolio gaps” particularly in areas such as South Africa which has so much potential. It also came at a good time when there were a lot of good producers looking to change distributors for one reason or another.

“This year there will be a big bedding in process, but with an understanding the market is changing, the demand market is changing,” he adds.

That said it will still look to add to its range in certain countries and build on the momentum of last year and take advantage of “premiumisation” to add more suppliers in some countries. Particularly a bigger “quality player” in Burgundy and Chablis and the chance to work with fewer domaines.

“The fundamental requirement of Hallgarten’s portfolio is in place, the structure is there, we now need to dial in to add in some icing in the right area. But the cake is in a really good place,” he explains.

“Our growth curve is exceptional, and we are in a very optimistic place for this year in terms of growth in all channels and we have got an unprecedentedly good run rate.”

He adds: “We did a lot of those category fixes last year, now we must sell them, seed them in the right places, and introduce a more directive channel strategy in Hallgarten and we know the wines we want to sell in Lay & Wheeler. So, if last year was planning and driving, this year is implementation and selling. We need to lot less sourcing and change the portfolio this year across Hallgarten.”

Driving growth

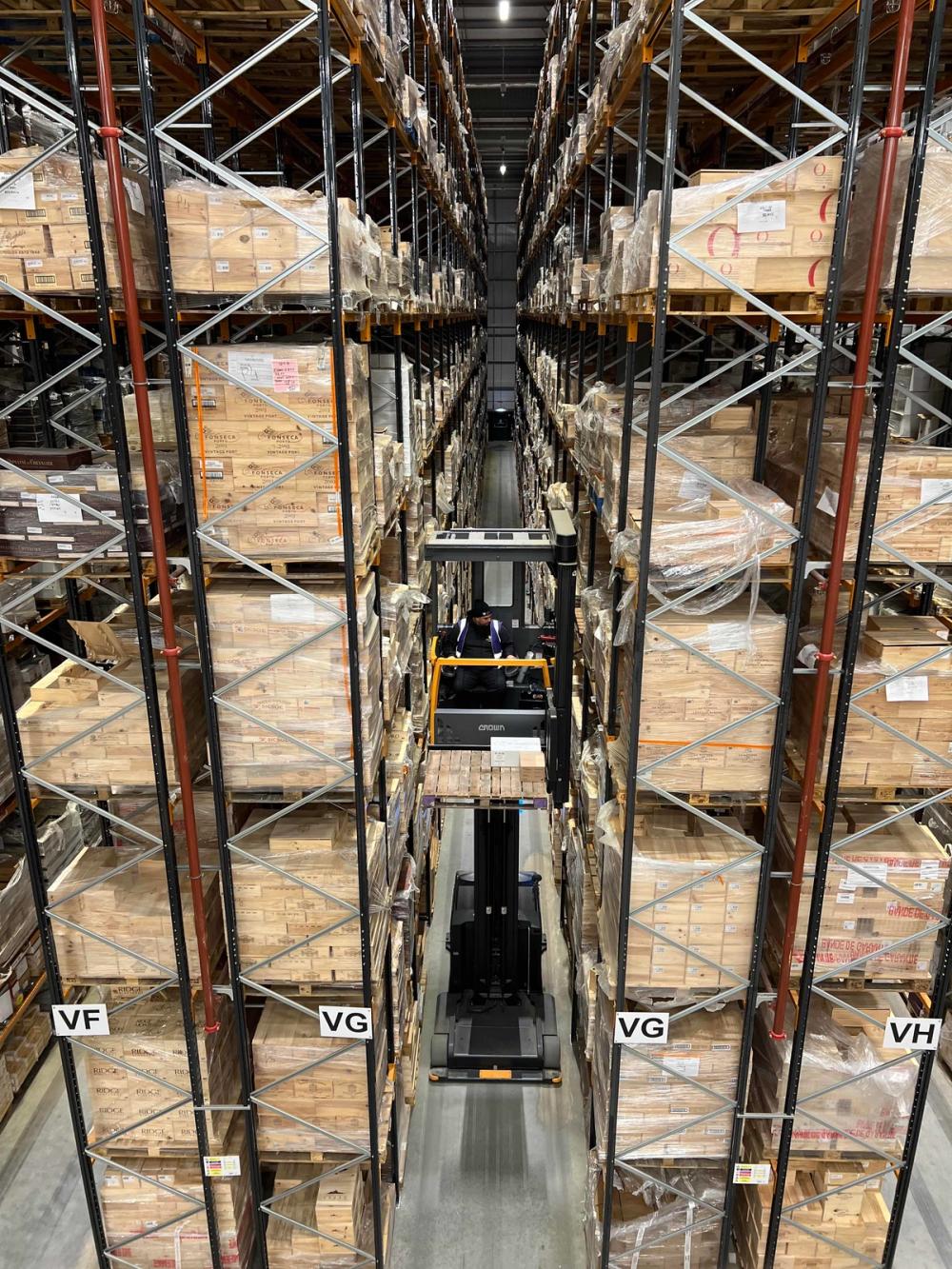

Coterie Vaults offers state-of-the-art fine wine storage in potentiallly different areas of the world

But he also stresses that despite the big step changes that have taken place in the last year in terms of wines, producers and team members coming into Hallgarten the “core culture and DNA of the business is exactly the same as it was” which puts it in a strong position to “maintain service levels” and use “this momentum” to drive further growth.

Hallgarten remains, he stresses, very much in the hands of Andrew Bewes and his management team with “Michael and I supporting where we can”.

Shaw’s role, he says, is to oversee the buying and sales operation for Hallgarten & Lay Wheeler where he can help spot opportunities and steer the team in particular directions - whilst leaving the day- to-day running of the business in the hands of the respective buying, sales and operational teams.

“We have got beautiful momentum, particularly in Hallgarten, in terms of change and positivity and the way to continue to drive that is to put your foot on the accelerator and open as many doors as possible and close the doors that you want to. My role is to steer the wine agenda and portfolio across the Coterie business in whichever territory we are talking about.”

He adds: “Our Hallgarten sales team is fantastic in terms of their appetite to win, their vinosity, their customer service orientation. Then overlay that with LCB doing a very good job in terms of service levels and then the support services across Hallgarten - customer marketing, order processing, and the back office - are all continuing to perform at a market leading level. And then a buying team creates the best portfolio that is clearly communicable to the national sales teams. It’s a relatively simple recipe for the distribution world.”

Shaw says the scene is now set for what he sees as a “fascinating next chapter for Hallgarten” built on the back of its drive into the national on and off-trade, thanks to the arrival of large, scalable wine brands and partners, which is already “revolutionising” the business thanks to “tightening” existing relationships with key customers and winning major new ones, like with the Jockey Club and the Ivy Collection.

Personal experience

Andrew Shaw's wide ranging experience working in senior buying and management roles in the major multiple grocers and national distributors gives him the background to take on his new wine director role at Coterie Holdings

Which brings us to Shaw himself and what he thinks he can bring to a business like Coterie Holdings.

“There is a maturity, value and experience there across retail, on-trade and independent retail (” he says. “UK centric market awareness would be number one and then second would be supplier base. I have been blessed to work for brilliant companies from Waitrose, Bibendum, M&S and now here. I have been lucky to work with great brands, for great companies who had a very good reputation at the time and that has carried me in good stead to open doors.”

A career that has helped him build up “supplier relationships, category awareness, market understanding and a thick enough skin and awareness that not everything can happen overnight”.

Then there is his personal network that means “I normally know someone who knows somebody if I don’t know them myself”.

He also has experienced a lot of what he terms “change culture” in the businesses he has worked for - including hard and difficult times like the collapse of Conviviality at Bibendum.

“That sort of thing creates resilience. Change is something you have to work at, even if you are senior citizens in the trade.”

He also knows what it is like to go from a major supermarket buying role into a major distributor - which he has now done twice, going initially from Waitrose to Bibendum and then now Marks & Spencer to Coterie.

“It weathers you,” he says. “You have to learn how to adapt. To find a middle ground. It forces that sort of teamwork. I have worked very closely with the Hallgarten team all year on categorisation, channel strategy and trying to understand how we implement change across the group to drive efficiencies for the sales team.”

In fact, such has been the speed of change in the first year of Coterie Holdings that Shaw is very aware that a key challenge for the management team this year will be to “manage expectations, both internally and externally”.

He says one of the great benefits of working in the wine industry is how well and quickly new colleagues can get to know each other thanks to long, intensive supplier and producer trips.

“We did a lot of travelling last year to see current suppliers and new ones and built-up strong relationships with good, honest conversations along the way.”

But that is where the strong “moral compass” that he believes sits at the heart of the business, between him, Saunders and the “individuals and businesses that we represent” means “managing expectations is much easier when there is an innate trust with one another”.

It is ultimately that “trust” it can build with its suppliers, producers and customers that will determine the future and potential growth of Coterie Holdings, but it’s crystal clear the foundations are very much in place for Shaw and the rest of the management team to build on.

* You can read more about Coterie Holdings at its website here.