There are a handful of national wine and spirits distributors in the UK that really matter to the overall future of the country’s drinks industry and all the venues, operators, bars and restaurants they supply. If anything significant happens to them the ripple effect is felt up and down the country - and to some extent around the world.

Majestic and Enotria&Coe are two of those companies. With a collective turnover of £545m - Majestic reported turnover of £385m in year to April 2024 with Enotria&Coe totalling £160m. Together they employ a combined workforce of over 1,700 people (Majestic 1,400 plus and Enotria 320.)

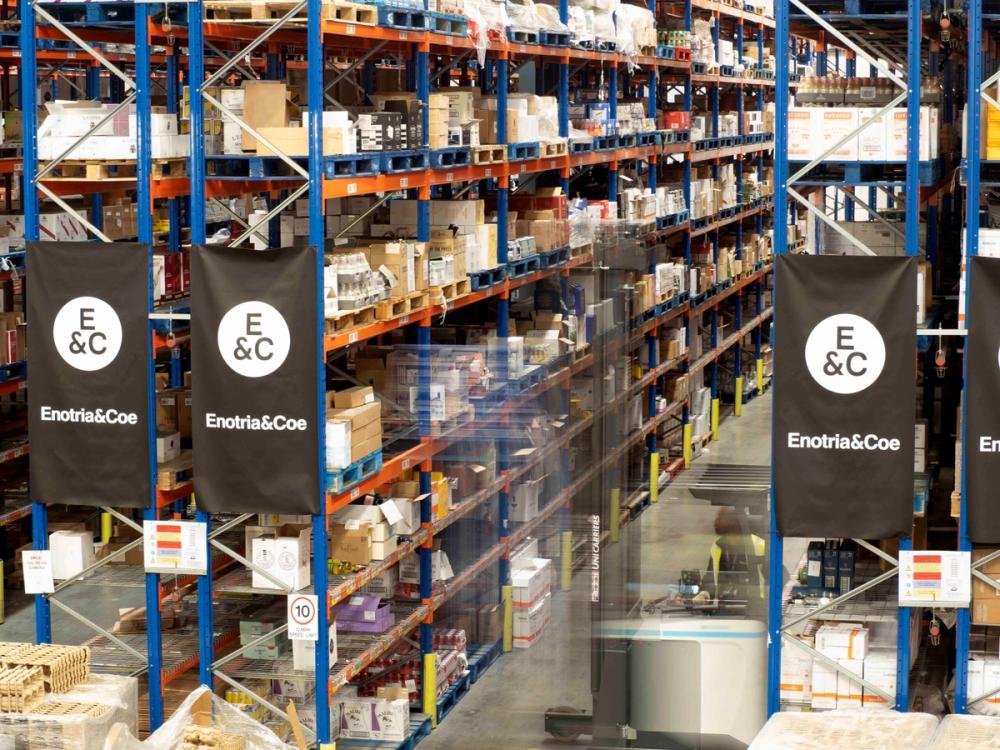

Enotria&Coe is vital to the UK hospitality sector as one of its most important and influential wine and spirit distributors

The combined strength of Majestic and Enotria&Coe would put it behind Matthew Clark and Bibendum (with a turnover of £805m in year to February 2024) and LWC Drinks (£609m turnover in year to September 2023) in terms of importance to the overall UK drinks industry supplying wine and spirits to all corners of the on-trade.

Majestic Commercial might currently on its own not have the clout of those “handful” of major national on-trade distributors, accounting for around 12% of Majestic’s total £385m turnover, but its growth trajectory has been mighty impressive under the leadership of chief executive, John Colley, since it managed to ditch itself of the misguided move in 2016 to give new life to Naked Wines.

Its on-trade division now has 3,250 customers of which 750 were acquired in 2024/25 and over 300 exclusively on-trade wines out of a range of 1,300. Majestic Commercial also saw 29% growth in 2023-2024 with 629 new customers coming on board.

Majestic Commercial has succeeded in taking on 100s of extra customers in the last few years - here it is showing what it can do at a recent customer tasting in Edinburgh

Much of that growth has been down to the security and backing of its private equity owners Fortress Investment Group that took over the business in December 2019 for a reported £95m. A deal that came with a mission statement and a new five year plan “to grow the business and get it back-on-track” by “focusing on people, proposition, product and stores”. In those five years Fortress has, says Majestic, been able to provide “significant investment across the business in new stores, new systems and infrastructure”.

It also happens to open own and invest in an increasingly impressive list of major hospitality operators - including most recently the £345m acquisition of Loungers and its near 300 venues across the UK, which comes on the back of its 2021 deal to take over the 1,300 venues of Punch Pubs - all potential new customers for Majestic and now Enotria&Coe?

A five year plan that has resulted in Majestic making its most ambitious move yet. But what is particularly interesting about the deal to acquire Enotria&Coe is it is being financed, stresses Majestic, by all its own money without any extra funds from Fortress. Its involvement is purely to rubber stamp any deal. Majestic’s last accounts state it had cash reserves of £20m.

Statement of intent

Majestic has enjoyed a strong performance during and coming out of Covid both with its retail business and then in recent years the growth of its on-trade business Majestic Commercial under chief executive John Colley

How much money is involved in the Enotria&Coe deal will no doubt not be revealed, but it is the biggest statement of intent yet by a business that has made its name in retailing but has seen most of its major recent growth coming from the on-trade.

Primarily through the clear and concise strategy the business has put behind Majestic Commercial. It is a far cry from the mid 2010s when Majestic’s on-trade arm seemed to be an unnecessary attachment.

The ink, after all, is still wet from the £6.5m deal to take Vagabond Wines out of administration in April last year moving the business into hospitality for the first time, with its nine bars in London and Birmingham - and all the learnings that have come with that.

Up to now Majestic Commercial has been happy to get on with the job and build up its reputation with a growing base of bars, pubs and restaurants around the country, without shouting about it from the rooftops - or the on-trade’s “best-kept secret” as it has sometimes referred to itself.

Recent major successes have included beating competitors to significant accounts and becoming the official wine supplier to Lord’s Cricket Ground and Macdonald Hotels & Resorts as well as major existing contracts like with Manchester City’s Etihad stadium.

Majestic Commercial is the offical wine supplier to Manchester City

The Enotria&Coe deal changes all that. It has in one move fast tracked itself into the outside lane of the on-trade motorway and will need to be much louder and clearer about how it operates and what working with Majestic Commercial actually means both for its suppliers and its customers.

Challenges and opportunities

There are without doubt major challenges - as well as opportunities - that come with the Enotria&Coe deal.

There are always two sides to any business deal. The company with the money and capability to buy a rival business; and the business that now finds itself in a position that it needs to be bought.

It has been an open secret in the wine industry that Bluegem Capital Partners, the private equity business behind Enotria since 2012, has been looking for an exit strategy for some time, having had to make a series of cash investments into the business over the last 10 years - including a £6m injection in 2020 to help it through Covid.

Enotria&Coe's chief executive Julian Momen had identified 2025 as the year the changes he had brought into the business would bear fruit

A task that some in the City suggest has been high on the agenda of chief executive Julian Momen since he took on the role in 2023.

Momen was refreshingly open to The Buyer in our interview in November 2023 about the need to “reset” Enotria&Coe from the position it was in then and what he described as a “revitalisation of the business”.

In particular he and his leadership team were focused on improving the “fundamental processes” around its “S&OP” – sales and operational planning and expertise. “I would put it right up there at the top in terms of importance,” he said at the time

He likened the task in hand as being similar to the turnaround he achieved at Carlsberg UK between 2016 and 2019.

“We completely reshaped the business and with it a big cultural change. It was a lot of hard work, a lot of change and with it, we had to take a lot of difficult decisions,” he said.

The focus at Enotria&Coe over the last two years has been on running the “business as effectively as we possibly can, securing the best possible information at the right time to make the right business decisions more quickly”.

The ambition then was to get the business in a position where it could really take advantage in 2025 - which, if Momen’s prediction, proves to be right means Majestic could be buying Enotria&Coe at just the right time.

As he told The Buyer in November 2023: “2024 is a critical year, but the bigger opportunity is the year after. In a sense, next year is the turnaround and then it’s about driving the momentum, recovering lost positions and seeking further benefits for all our stakeholders.”

Questions to answer

Many questions need to be answered about how Enotria&Coe and Majestic Commercial are going to be run as separate businesses within the same company

Now that a potential deal has been all but agreed the two sides have to decide just how do they continue to run the companies as two separate businesses?

Do they continue to pitch for the same national contracts?

The two companies P&L lines may operate separately but will there will be synergies across the two teams? There is already talk of how it can streamline and maximise its logistics so that Enotria&Coe can benefit from Majestic’s network of vans where and when needed.

It surely makes sense to buy centrally across the two when it comes to bulk wines and entry level and wines at commercial price points.

That is how we have seen it work in other companies operating two businesses under one corporate umbrella - like Matthew Clark and Bibendum.

Then there are efficiencies to be made around centralising services such as operations, HR, customer services and technology.

Majestic’s statement to announce the deal indicates where areas of synergy might come from as it states: “The combination of assets, highly-qualified colleagues and unique portfolios will create an enlarged, highly competitive on-trade specialist with a best-in-class, differentiated service and product proposition. The acquisition would also allow for greater investment in technology, people and service across the two businesses.”

Investment in technology is particularly interesting as Colley has long been a strong advocate for what good data and intelligence can do to drive a business forward, particularly around using and understanding customer data to create practical and meaningful insights for its sales teams and customers.

Majestic can also now take advantage of the data and insights from the 1000s of customers using its Vagabond bars

The real advantages of AI, for example, come from the amount of information it can work with and clearly the combined data from Majestic and Enotria&Coe would help fuel a powerful AI-driven consumer insights platform. Plus the extra data and purchasing behaviour from its 1,000s of Vagabond customers that will help it build on the already “hyper local insights” it provides for customers with customised, personalised wine lists.

It is one thing having lots of data, however, it is quite another bringing it all together in a way that is meaningful and can be effectively mined for insights and commercial information.

Noticeably John Bovill, a senior data executive from Harrods and Woolworths South Africa, joined the Majestic board in October 2023 as chief transformation and technology officer and works alongside IT director, Nick Workman. Their roles and how they bring the IT capability across both companies together will be vital in the months and years ahead.

On a more structural basis does it look to have preferred partner producers and suppliers who can provide separate labels for both Majestic Commercial and Enotria&Coe? Or pool their existing preferred suppliers to see what synergies and benefits they can bring?

Does Majestic Commecial look to work more as a major regional wholesaler using the van network from its local stores nationwide to service local and regional customers - on the back of its minimum order service of just £87.50. Leaving the national accounts and economies of scale to the bigger Enotria&Coe team?

The exciting aspect to a deal of this size are the potential benefits it can bring to the people involved. There is seriously good talent across the respective teams at Majestic and Enotria&Coe and big opportunities for those best placed to take advantage of them.

But these are also highly sensitive times for both teams and there will be natural uncertainty about what the future looks like. Hence the need for both businesses to be as open and clear about what this deal actually means for its individual employees once all the papers are signed.

Leadership challenge

Majestic's chief executive John Colley has rightly received great praise in how he has turned Majestic around from its ill fated partnership with Naked Wines - but the Enotria&Coe deal is his biggest statement of intent for the Majestic business

The spotlight therefore falls on the two chief executives - Majestic’s John Colley and Enotria&Coe’s Julian Momen - and their respective senior leadership teams. Including Matt Davies who has recently joined Majestic Commercial as its new general manager, with extensive on-trade experience from his time at Coe Vintners, Fields & Morris & Verdin and most recently Sipsmith. Colley will act as group chief executive with Momen reporting into him.

Just how well all their relationships develop under any agreed deal will be essential to its long term success. And just how separate the two teams work in practice.

As ever in the early stages of such an important and complex deal there are far more questions than there are answers. But it is vital for the industry as a whole, and in particular the 1,000s of respective customers and suppliers out there, that the two businesses start answering them. Either as one. Or separately.