“Most chateaux were not prepared to release full volumes at discounted prices choosing instead to hold stock for a later date. Might this strategy come back to haunt them?” asks the Bordeaux 2019 report.

Prior to this year’s extraordinary Bordeaux 2019 En Primeur campaign, Liv-ex’s view on whether it should go ahead at all during a global pandemic was straightforward enough.

“In a market full of distractions and a changing customer landscape, another “excellent vintage” headline is unlikely to be enough for Bordeaux to grab the market’s attention. Those looking to grow their En Primeur sales might need to consider a more dramatic move this year if they want to give collectors a reason to say ‘yes’. The answer, as ever, will lie in the price.”

One of the key findings of Liv-ex’s latest extended report, Bordeaux 2019: The Magic is Back is that the Bordelais did manage to grab the market’s attention. From the moment Pontet-Canet kicked off the campaign with a release price 31% down on 2018 it was clear that we were witnessing one of those rare events – the Bordelais substantially reducing their prices… by an average of 21% across the board. It may not have been the 60% that recapitalised the market in 2008 with the 2007 vintage but it still showed they were listening.

But although they grabbed the market’s attention the question remains: did the Bordelais grab or miss the opportunity to satisfy and grow “a willing market out there ready for the magic of Bordeaux”?

2019 En Primeur: a campaign like no other. James Suckling tasted over 400 samples in Hong Kong. ©James Suckling

Never mind the width feel the quality

The report starts by listing many of the surprisingly successful aspects of the campaign.

“It ended as quickly and suddenly as it started, critical opinion (when eventually published) placed 2019 as the best vintage of the decade, and the global trade reported higher sales (by volume) than for the 2018 release, itself regarded as a strong campaign.

“Although the quality of the 2019s was judged by many Bordelais to be better than that of the 2018s, the macro-economic climate exerted pressure on producers to release the new vintage at a price the market simply could not refuse. As the recent past has shown, En Primeur returns for “great vintages” have not been attractive enough for collectors. The chateaux had little choice but to listen to the market – and release a good vintage at an acceptable price level. Most, but not all, managed this.”

But as successful as it was, the campaign was not without its challenges. The key challenge was that volumes were reduced by up to 50% in the case of Lafite, 35% by Leoville Las Cases and 30% by Cheval Blanc and Figeac who were ahead of a long list of chateaux all doing the same.

Given the fact that the 2019 vintage was blessed with generous yields as well as quality, this tactic was a source of irritation for merchants and buyers alike. The third most quoted descriptor used for 2019 EP was “frustration” – this was particularly of concern for merchants “who could not develop new clients and were asked to take on all sorts of other, often unrelated, wines in order to meet demand,” according to the report.

“While prices were encouraging, volumes offered were often inadequate, which frustrated merchants and collectors alike. Most chateaux were not prepared to release full volumes at discounted prices choosing instead to hold stock for a later date. Might this strategy come back to haunt them?”

Reducing volumes is “designed to create an illusion of scarcity when Bordeaux is anything but” (Neal Martin)

Neal Martin in his vintage report for Vinous described the withholding of stock as: “designed to create an illusion of scarcity when Bordeaux is anything but. For sure, some properties are sitting on half their production, which they are perfectly entitled to do. I just wish they would be open about it.”

The Liv-ex report questions this rationale – “ignoring the opportunity to sell greater volumes by releasing decent amounts of their production onto a market with “hungry buyers”.

“It seems that there is a continued belief that by squeezing supply, prices will rise. The problem here becomes one of market perception. If the market knows (or simply feels) that the supply exists, but is not being offered, it views it as an overhang. Prices struggle to rise under such conditions.”

One of the reasons this policy of reduced supply stood out this year, in the face of a plentiful vintage, was because chateaux had to release their price “through gritted teeth” before critics had released their scores and the trade had given their impression of the vintage. With the tastings in Bordeaux cancelled and 100s of samples being sent to critics worldwide, the scores and critical reception were not coming in fast enough for prices to be set accordingly.

A campaign for the few and not the many

The Liv-ex report goes into great detail about critics’ evaluation of 2019 compared to 2010 and 2016 particularly, and also how this relates to the Fair Value of the wines. It also shows how the campaign favoured the few big players and was not a campaign for ‘the many.’

Merchants reported contrasting sales figures, with En Primeur regulars reporting sales drops of up to 30% while “part-time players saw an increase in sales”.

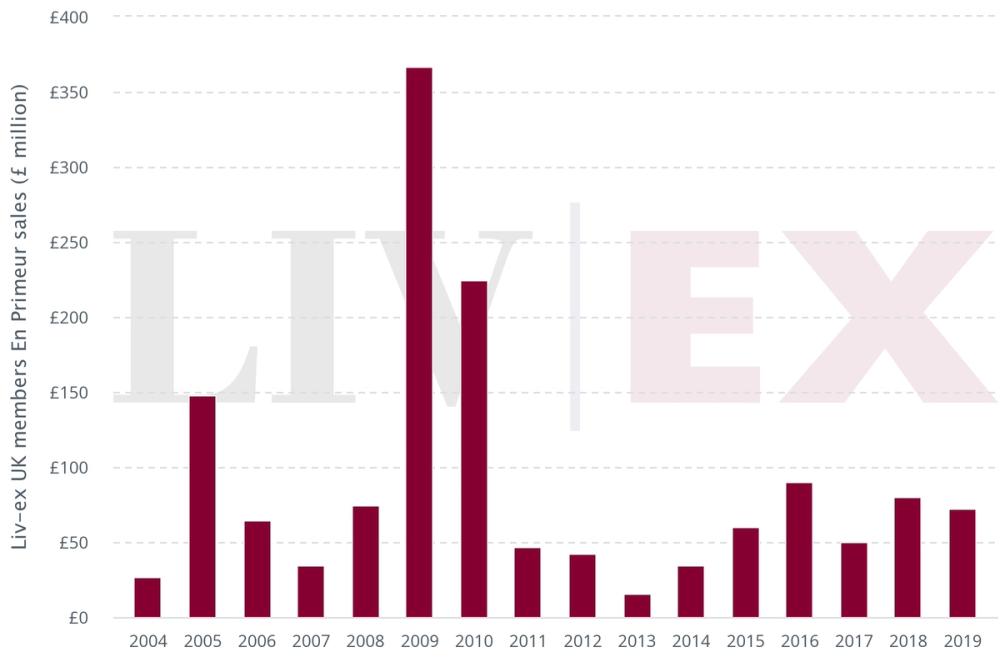

The chart shows the En Primeur sales by value of the top 20 UK merchants, reported to Liv-ex. On average, their sales decreased by 10% on 2018, but surpassed those achieved in 2015 by circa 20%. The lower value figure is due in the most part to lower priced wines and some significant cuts in the volumes released, rather than a lack of demand.

“Those for whom En Primeur is not normally a large part of their year were drawn back into the fold by firm demand from their collector-base. Sales for these more “part time” players were up by both value and volume. But for the regular EP players, this year has seen the value of sales drop by as much as 30% as both price and volume cuts took their toll. The campaign seems to have attracted demand for the big brands, which were far more affordable than in recent years.”

One anomaly with 2019 EP was that it was such a narrow campaign. Normally En Primeur takes place between April to June but with the 2019 EP campaign it was all done and dusted in four weeks meaning that, with 25-30 new releases a day, only the very top wines and chateaux were getting the bandwidth they deserved.

Most of the activity centred around just 30 wines with merchants revealing Pontet Canet, Lynch Bages, Mouton Rothschild, Mission Haut Brion, Pichon Lalande and Clinet were some of the key success stories. Given the decrease in prices and supply collectors are prepared to pay a little more, and an active secondary market developed –often the mark of a well-judged release where all participants benefit – and the first time this has happened for a number of years.

Of course how this affects the larger secondary market for Bordeaux only time will tell. In recent years the trend has been for less consolidation – between 2019 and 2000 for example, the number of Bordeaux wines in the secondary market rose from 5,700 to 7,000.

Another reason the campaign focused on the top classed growths and their Grands Vins is explained by another trend that emerged in the 2019 campaign, says the report – the second and third tier wines had less of a discount and many of the white wines none.

“The big brands, which have greater margins to play with, were often more fairly priced than the second and third tier wines. Conversely, they offered smaller discounts for their second wines. Mouton Rothschild 2019, for instance, was released at 30.8% discount on last year; its second wine, Petit Mouton 2019, was down only 16.9% on its 2018. White wines like Smith Haut Lafitte Blanc and Haut Brion Blanc were also offered at smaller discounts than the reds. The 2019 campaign became a campaign largely for the big brands (and their Grands Vins), with cuts by up to a third grabbing the headlines. Most others were left in the dust.”

Bordeaux as a region has for many years been trying to broaden the market – to educate the consumer about the breadth and depth of quality and value found there – and to bring in a new generation of collectors; it has also been attempting to promote its white wines which will have not have been benefitted by such a narrowly-defined pricing strategy. The reduction in volumes in particular, apart from being a source of frustration for the merchants, also narrowed the opportunity for them to develop a new generation of buyers.

“As to where the buying came from, merchants reported that their client-base mainly consisted of the “usual” customers, with some old hands returning to buy En Primeur for the first time in years attracted by the fair prices. Happily, most merchants did see some first-time buyers emerge – a new generation looking to start a cellar – but the lack of volumes in the desired wines made this more challenging than it might have been. Many felt that it was a missed opportunity.”

Pontet-Canet was first out of the block for the 2019 En Primeur and one of the successes of the campaign

The Bordeaux 2019 EP campaign was remarkable, of course, largely because it took place at all, not only during a global pandemic with all its attendant financial and logistical issues, but also during a time of great uncertainty caused by US tariffs, fluctuating markets, China/Hong Kong and more specifically a waning interest in En Primeur and in Bordeaux generally, following poor overall returns on the 2018 vintage.

The Liv-ex report is clear to hand out bouquets, as well as to challenge the region at the same time – the campaign did “give collectors a reason to say ‘yes’,” but the answer did not lie just with the price, volumes released onto the market needed to go hand-in-hand.

“All things considered, the adaptability and innovation of the Bordelais during this global crisis deserves to be applauded. There is a willing market out there ready for the magic of Bordeaux – the producers simply need to grab the opportunity.”

The full report is available exclusively to members of Liv-ex. Liv-ex membership is open to merchants, wine shops, negociants, producers and wine funds. For more information please click here: https://www.liv-ex.com/pricing/

Liv-ex is the global marketplace for the wine trade, with over 475 members worldwide. Liv-ex offers business services that span trading, data, fulfilment and automation technology to a diverse group of wine businesses – from ambitious start-ups to established merchants. With over £70m opportunities across 16,000 different products, Liv-ex is also the world’s largest marketplace for wine. To find out more, click here.