If you are going to have a balanced wine range then you need to be listing wines from a wider range of countries, says CGA’s new Emerging Worlds & Global Origins report, the second in a series of four produced in partnership with The Buyer.

“Value, nostalgia, experimentation, and curiosity are all key drivers which can encourage sales.” That’s one of the key conclusions that CGA, the insights company focused on uncovering on-trade trends and statistics, makes when analysing which countries around the world consumers are increasingly turning to – and why.

This is the time to tap into the wanderlust that people will increasingly have in 2021, when the lockdown restrictions are lifted and the opportunity and ability to travel goes up.

Just look what happened last July when we came out of the first national lockdown. Google searches for holidays abroad shot up 750% in the first weeks of July. That nostalgia for holidays, coupled with a desire to broaden our horizons will influence the way consumers choose wine when restaurants, pubs and bars can re-open, says CGA.

These are just two of the findings from CGA’s new ‘Emerging Worlds & Global Origins’, the second in what will be four Wine Insight Reports released by CGA, in partnership with The Buyer during 2021.

The hope is we will once again be able to go and travel to some of our favourite holiday destinations, with half (52%) of wine consumers surveyed for the report saying they like to buy wines from countries they have visited because it reminds them of those places.

Wider choices

Our desire to travel to ever more exotic and undiscovered places has also come at a time when the opportunity and ability to make wine in a much wider number of countries has also increased.

From Slovakia to Slovenia, Vietnam to Mexico, Peru to Chang Mai the countries and regions now making wine is nearly as long as varied as the number of Lonely Planet guides that have been published.

The ability to make good quality wine is no longer just confined to the established, traditional wine producing countries, but is now common in the majority of countries that have a sizeable wine community.

Over half of people (54%) are interested in discovering something new when out drinking in a bar or restaurant, according to the report. With the UK, Hungary and Romania high on the list of countries people are looking to explore.

Hungary is one of the emerging wine countries highlighted by CGA as being on wine drinkers’ radar

The challenge for the on-trade is taking the risk on listing those wines and knowing they are going to sell. The report looks into what steps a restaurant or bar can take to make them feel comfortable trying a wine from a country they have not tasted before – with 51% of these drinkers calling for free tasting samples.

The research also shows a substantial overlap of conservative and experimental drinking behaviour. More than a third (35%) of wine consumers say they find wines from emerging countries appealing, even if they prefer wines from traditional regions (34%).

Younger adults are more likely to choose these wines because of recommendations or to impress others, while older drinkers are more motivated by a desire to broaden their palates and horizons.

Experimental and traditional

Wine drinkers are split between those who want the tried, tested and traditional and those who are happy to explore and discover new countries and regions and their wines

CGA suggests outlets create lists that cater for both traditional (56%) and more experimental drinkers and how you can go about doing that.

“Finding that right mix of wines from traditional and emerging countries is going to be increasingly important,” says Mark Newton, CGA client director and wine category specialist. “People tend to experiment with their wine much more often in the on-trade than they do when drinking at home, and that opens the door for producers and suppliers to push new and emerging options and brands into the mainstream.”

Richard Siddle, editor-in-chief of The Buyer, added: “We have seen throughout 2020 just how well specialist independent wine merchants have done whilst the on-trade has been closed. Those independents have seen a big increase in average spend per bottle, and a willingness from customers, both old and new, to find wines that give them a sense of a treat, that can lift them in their days in lockdown. Providing you have the opportunity to tell the story about those wines, be it in person or online, then people will travel the world with you.”

CGA’s reports how wine drinkers will be looking for “both trusted and more unfamiliar choices when they can drink out again”. It adds: “There will be some great chances to grow sales, improve margins and encourage trade-ups in the post-Covid recovery phase—but only if businesses secure a deeper understanding of people’s needs and wants.”

CGA and The Buyer Reports

There are four reports in the CGA and The Buyer series, each offering insights on different areas of how wine is sold in the on-trade and how to maximise your sales. The four reports are:

The Wine Menu in Focus – out now

This first report examines the role of the wine list and wine menu in how consumers choose which wines to buy. Using sophisticated menu engineering analysis, it shows how businesses can best engage consumers and take advantage of increased use of digital devices at the table and busts some common myths about menus.

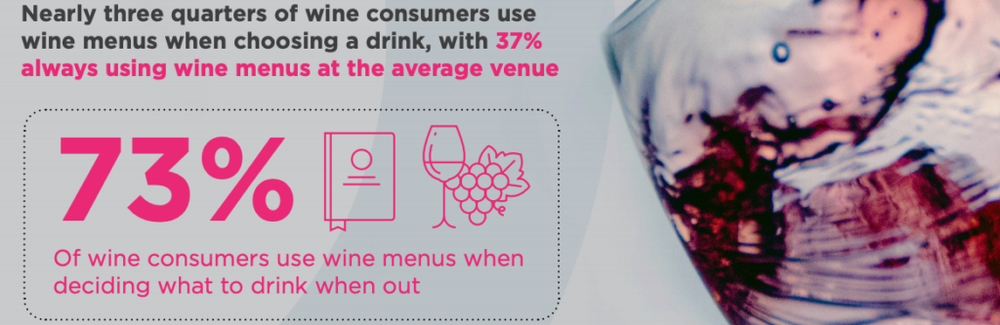

It shows that around three quarters (73%) of wine consumers use menus when deciding what to drink when they are out—and nearly half (44%) always do so. It examines the dynamics of managing a wine list during Covid when operators are limited to table service and have to use apps and online tools to engage with customers. But this new way of working is actually proving beneficial, particularly amongst younger age groups with one in three 18 to 34 year-olds preferring to use an online wine menu.

The report also looks at menu size and how many wines work best in a range – with a selection of 15 wines seen as the optimum number for many venues, with 40% of regular wine drinkers asking for menus with 11 to 20 wines on them.

“Given digital menus are far less structured and can be easily tweaked – now is the time to experiment with the likes of positioning, descriptions and costs,” says the report.

CGA’s Newton says: “It’s clear that menus have never been more crucial to guest engagement, and in 2020 it was often the only way to influence choice. They provide suppliers and operators alike with the chance to educate and entertain guests and inspire them to trade up—but in such a brief window for engagement, menu design and copy has to be spot on. With table service likely to be the norm for some time, it is so important to understand what does and doesn’t work on menus. Investing in menu optimisation now is very likely to pay off when people are able to enjoy drinking wine out of home again.”

The Future of Fizz

This report dives deep into sales and consumer attitude data to provide a detailed understanding of the ever-popular sparkling wine category. It investigates the potential of ‘Pink Prosecco’ and the increasing demand for English sparkling wine and considers what other drinks might shake up the category this year.

The Impact of COVID-19

The final report in the series sets out the huge impacts of the pandemic so far and looks ahead to more change. With valuable insights into consumers’ cautious new attitudes, it shows how to preserve wine sales amid turmoil and highlights opportunities to watch for in a post-COVID world.

- Each individual report is available for £875, and the complete set of four can be bought for £2,600 (excluding VAT). Click here for more information on all four.

- The Emerging Worlds & Global Origins report comes with a comprehensive PowerPoint deck of findings and a concise infographic executive summary. It is available now for £875, or as part of a complete set of four Wine Insight Reports for £2,600 (excluding VAT).

- To learn more about the reports, click here or contact CGA client director Mark Newton at mark.newton@cga.co.uk.